In the captivating world of options trading, where skilled strategists navigate the intricate dance between risk and reward, the strangle emerges as a powerful tool capable of delivering substantial premiums. Whether you’re a seasoned options veteran or a novice seeking to expand your trading repertoire, this comprehensive guide will equip you with the knowledge and techniques you need to harness the potential of strangle strategies.

Image: blog.dhan.co

A Tale of Two Strikes: Understanding the Strangle Strategy

Imagine yourself standing at the helm of an options contract, with the vast ocean of market volatility stretching out before you. A strangle strategy involves simultaneously purchasing both a call option and a put option with different strike prices but the same expiration date. The call option grants you the right to buy an asset at a specified “strike price” on or before the expiration date, while the put option gives you the right to sell an asset at a specific strike price.

Exploring the Strangle’s Rewards and Risks

By simultaneously owning both a call and a put option, you effectively establish a wider range of potential profit opportunities. This approach seeks to profit from market volatility, generating gains if the underlying asset’s price moves significantly in either direction. Think of the strangle as casting a wide net, hoping to capture profits as the market fluctuates within a specific range.

However, remember that options are double-edged swords. The potential for rewards comes hand in hand with the risk of losses. If the underlying asset’s price stays within a narrow range, your strangle options may lose value. It’s crucial to carefully weigh the potential rewards against the risks before embarking on any options strategy.

Navigating the Strangle’s Parameters: Strike Prices and Expiration Dates

-

Selecting Strike Prices: Choose strike prices that are significantly different from the current underlying asset price. Aim for options that are “out-of-the-money,” where the strike price is above the current price for the call option and below the current price for the put option.

-

Determining Expiration Dates: Consider expiration dates that align with your anticipated market volatility. Shorter-term expirations increase the potential for higher premiums, but they also amplify the risk of losses. Longer-term expirations offer more time for market swings but may result in lower premiums.

Image: optionalpha.com

Maximizing Strangle Profits: Expert Insights and Actionable Tips

-

Seek Market Volatility: Strangle strategies thrive in volatile markets, where the underlying asset’s price fluctuates frequently. Identify stocks or commodities with a history of volatility to increase your chances of profiting.

-

Monitor Market Conditions: Keep a close eye on market events, economic indicators, and industry-specific news. Monitor the underlying asset’s price to assess whether the chosen strike prices remain appropriate.

-

Manage Your Risk: Strangle strategies can amplify both profits and losses. Limit your risk by allocating a small percentage of your portfolio to each trade. Consider employing stop-loss orders to mitigate potential losses.

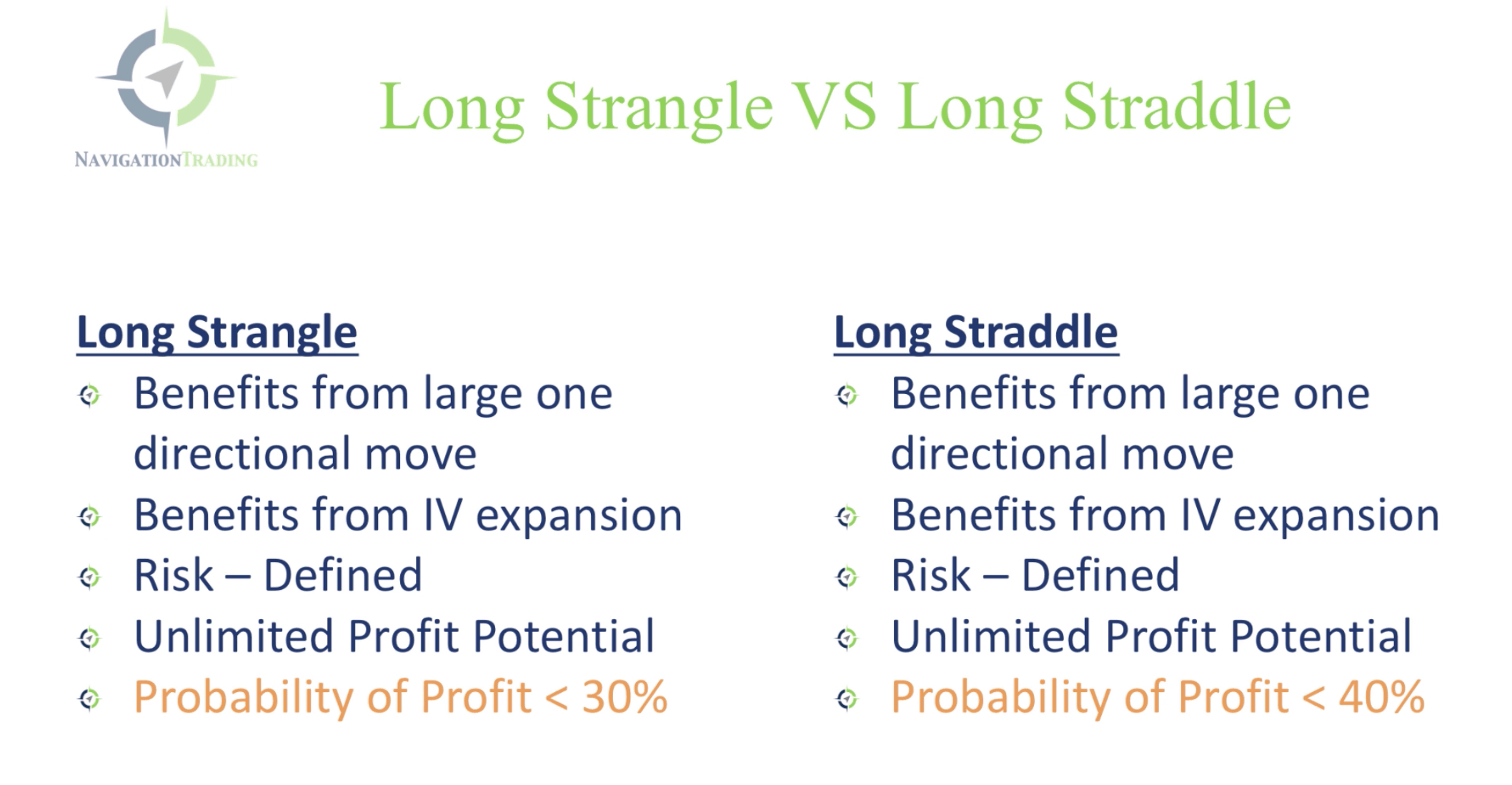

Option Trading Strategies Strangle

Image: navigationtrading.com

Conclusion: Unleashing the Strangle’s Power

By understanding the nuances of strangle options and applying the insights shared in this guide, you can unlock the potential for substantial premium profits. Remember that options trading, while potentially rewarding, carries inherent risks. Thorough due diligence, proper risk management, and a keen understanding of market dynamics are paramount to maximizing your chances of success. May your strangle options sail smoothly through the market’s storms, delivering the profits you seek in this realm of financial adventure.