Introduction:

Image: www.myalgomate.com

Are you a seasoned options trader seeking to elevate your strategies? Or perhaps an inquisitive beginner eager to explore the realm of options trading? In either case, the strangle options trading strategy is one that deserves your attention. This dynamic technique offers a versatile approach to capitalizing on market volatility while managing risk effectively. In this comprehensive guide, we will delve into the intricacies of the strangle options trading strategy, empowering you with the knowledge and insights to leverage its potential for success.

What is a Strangle Options Trading Strategy?

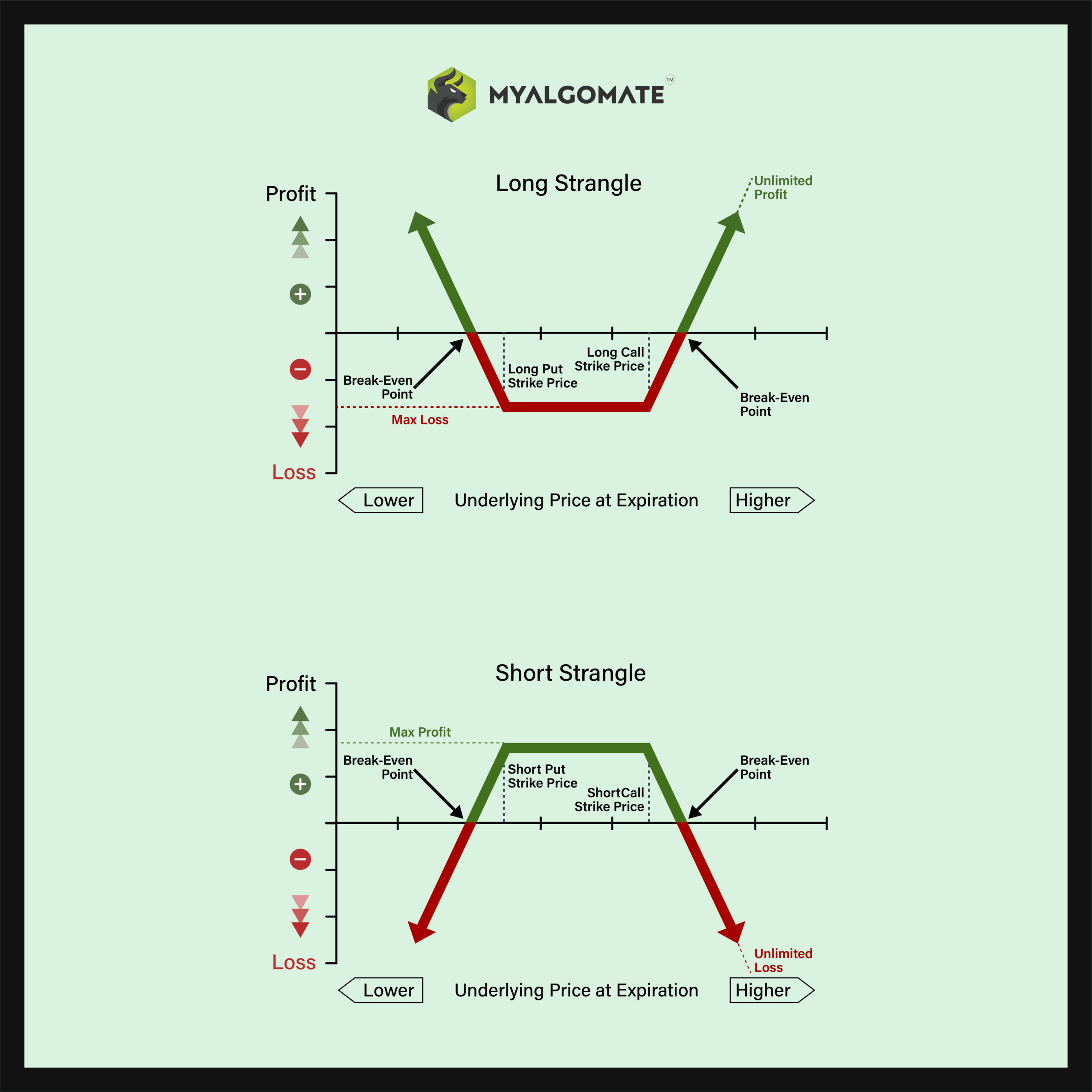

A strangle options trading strategy involves the simultaneous purchase of both a call option and a put option with different strike prices on the same underlying asset, such as a stock, index, or commodity. The call option conveys the right (but not the obligation) to buy the underlying asset at a predetermined price, while the put option provides the right to sell. The strike prices of the options are typically selected to be out-of-the-money (OTM), meaning they are above the current market price for a call option or below the current market price for a put option.

Mechanics of a Strangle Options Trading Strategy

The key to executing a strangle options trading strategy lies in selecting the appropriate strike prices for the call and put options. As mentioned earlier, these strike prices are typically set OTM. The distance between the strike prices and the underlying asset’s current market price determines the potential profit and loss. The wider the spread between the strike prices, the higher the potential profit, but also the higher the risk involved.

Once the strike prices are selected, the trader purchases both the call and put options. The premium paid for these options represents the trader’s investment. The profit potential arises when the underlying asset’s price moves significantly in either direction, causing either the call or the put option to become ITM.

Risk Management in a Strangle Options Trading Strategy

While the strangle options trading strategy offers the potential for high returns, it is crucial to understand and manage the associated risks effectively. One of the primary risks is that the purchased options may expire worthless. This can occur if the underlying asset’s price remains within the range defined by the strike prices.

To mitigate this risk, traders should select strike prices judiciously and consider the historical volatility of the underlying asset. Additionally, employing proper position sizing is essential. The trader’s overall risk should be in line with their risk tolerance and financial capabilities.

Benefits and Drawbacks of a Strangle Options Trading Strategy

Benefits:

- Potential for high returns: If the underlying asset’s price moves significantly in either direction, the strangle options trading strategy can generate substantial profits.

- Reduced market direction risk: Unlike directional strategies, a strangle options trading strategy does not rely on predicting the precise direction of the underlying asset’s price movement. It benefits from volatility regardless of the direction.

- Flexibility: Strangle options trading can be applied to various underlying assets, offering traders a broad range of opportunities.

Drawbacks:

- Limited profit potential: The profit potential of a strangle options trading strategy is capped by the difference between the strike prices plus the net premium paid for the options.

- High risk: Strangle options trading can be risky, especially if the underlying asset’s price remains stagnant or moves within a narrow range.

- Initial capital requirement: Purchasing both a call and a put option requires a substantial initial investment, which may not be suitable for all traders.

Conclusion:

The strangle options trading strategy is a powerful tool that can enhance the returns of experienced options traders and introduce new opportunities for beginners alike. However, it is essential to approach this strategy with a solid understanding of the risks involved and employ effective risk management techniques. By carefully selecting strike prices, considering historical volatility, and maintaining proper position sizing, traders can harness the potential of the strangle options trading strategy while preserving their capital.

Image: top10stockbroker.com

Strangle Options Trading Strategy

Image: www.youtube.com