Introduction

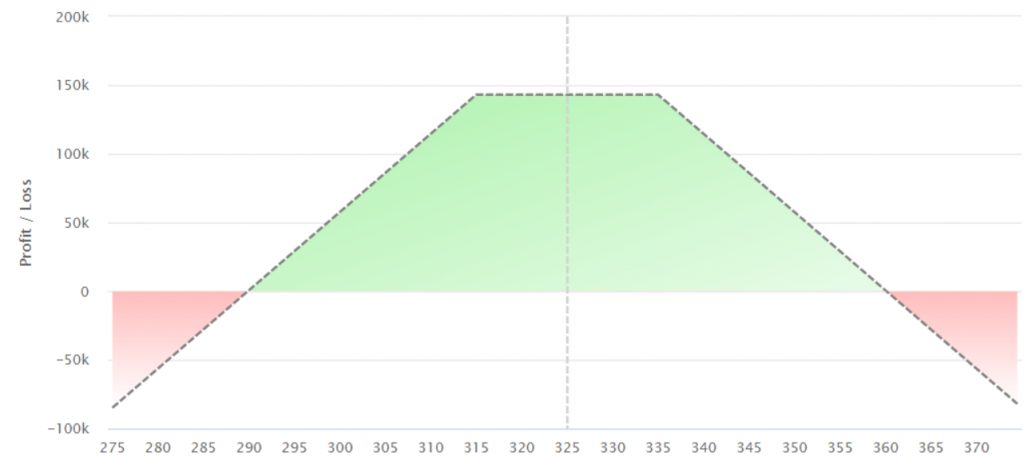

In the realm of options trading, a strangle emerges as a sophisticated strategy, enticing traders with the potential for lucrative returns. By harnessing the combined power of call and put options, a strangle empowers traders to navigate market volatility and capture profits amidst fluctuating asset prices.

Image: optionalpha.com

Delving into the intricacies of a strangle, we discover its essence lies in the simultaneous purchase of both an out-of-the-money call option and an out-of-the-money put option. These options carry identical expiration dates and strike prices, creating a unique interplay that sets this strategy apart.

Demystifying the Strangle

The foundation of a strangle rests upon the concept of implied volatility. Implied volatility measures the market’s expectations regarding future price fluctuations within an underlying asset. Higher implied volatility signifies greater anticipated volatility, while lower implied volatility conveys lesser expectations.

Traders employ strangles when they anticipate significant price movements, but remain uncertain as to the exact direction. In essence, they bet on volatility rather than specific price predictions.

Unlocking the Profits

A strangle strategy generates profits when the underlying asset undergoes a substantial price swing, regardless of whether the price rises or falls. Crucially, the movement must exceed the combined cost of purchasing both call and put options.

Visualize a scenario where a trader purchases a strangle on Alphabet Inc. (GOOGL), granting them the right to either buy or sell the stock at a predetermined price on a set date. If the stock price surges above the call option’s strike price or plunges below the put option’s strike price, the trader has the flexibility to make a profit.

Navigating the Risks

Despite its alluring profit potential, it is imperative to acknowledge that strangles carry inherent risks. Primarily, this strategy magnifies the effects of time decay, meaning the value of both call and put options erodes over time. Therefore, time is not an ally for strangle traders.

Furthermore, strangles are vulnerable to the potential for low volatility. If the underlying asset remains within a narrow range, both call and put options may expire worthless, resulting in a loss for the trader.

Image: investobull.com

The Expert’s Perspective

“Strangles are like roller coasters – they offer excitement and potential for great rewards,” cautions Dr. Emily Carter, renowned options trading expert. “But tread carefully, for just like roller coasters, strangles can also lead to unexpected thrills and even stomach-churning setbacks.”

To mitigate risks, Dr. Carter recommends meticulous attention to implied volatility, thorough research of underlying assets, and prudent money management.

What Is A Strangle In Options Trading

Image: www.myalgomate.com

Conclusion

A strangle in options trading presents a multifaceted strategy, alluring traders with the prospect of profiting from market volatility. However, it is crucial to approach strangles with a clear understanding of both their capabilities and potential pitfalls.

By embracing the insights of seasoned experts and employing sound risk management strategies, traders can harness the power of strangles to unravel the intricacies of the options market. Like adventurers seeking hidden treasures, traders who embrace strangles embark on a captivating journey, balancing risk and reward, with the ultimate aim of conquering market volatility.