In the realm of options trading, one of the most pivotal factors to master is implied volatility (IV). IV, a measure of market expectations for future price fluctuations, presents a fertile ground for astute traders to devise strategic plays that can amplify their profit potential.

Image: www.cameyeam.com

Embarking on a journey to unravel the intricacies of the implied volatility option trading strategy, we unveil an approach that empowers traders to capitalize on IV’s ebbs and flows, setting the stage for lucrative returns.

Understanding Implied Volatility

At the heart of IV lies its role as a beacon of market sentiment. It encapsulates the market’s perception of an underlying asset’s future price volatility, distilled from option pricing models.

High IV denotes elevated market anticipation of significant price swings, while low IV signals expectations of a calmer trading landscape. Comprehending these market sentiments is crucial for crafting options strategies that align with prevailing market conditions.

Harnessing IV for Strategic Gains

The judicious application of IV analysis unveils a treasure trove of opportunities for skilled traders. When IV is elevated, options premiums tend to be inflated, offering an entry point to capitalize on anticipated price volatility.

Conversely, when IV contracts, options premiums deflate, presenting an opportune moment to exit positions or acquire new ones at favorable prices. Navigating the ebb and flow of IV allows traders to position themselves strategically, enhancing their chances of realizing substantial gains.

Recent Trends and Developments

The realm of options trading continues to evolve at a rapid pace, with IV playing a central role in shaping market dynamics. Recent advancements in options pricing models have refined IV calculations, leading to more precise market sentiment assessments.

Additionally, the advent of sophisticated trading platforms has democratized access to advanced IV analysis tools, empowering individual traders with institutional-grade insights. These enhancements have paved the way for more informed and profitable trading decisions.

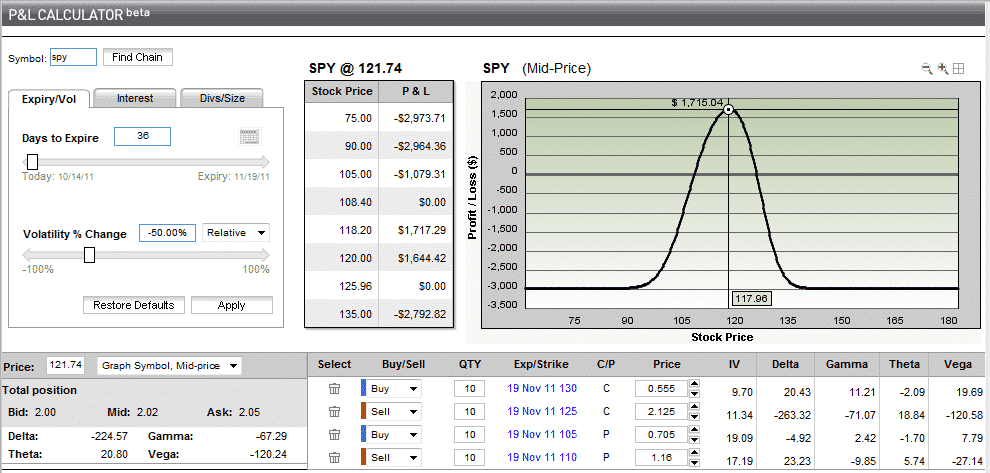

Image: www.optionstradingiq.com

Expert Tips for Maximizing Returns

To maximize their returns through the implied volatility option trading strategy, traders can benefit from heeding the wisdom of seasoned experts. Here are key insights:

- Monitor IV closely: Track IV levels diligently to gauge market sentiment and identify potential trading opportunities.

- Consider historical IV trends: Analyzing historical IV patterns can provide valuable context for understanding current market conditions.

- Employ IV-based indicators: Utilize technical indicators specifically designed to measure IV to enhance your trading strategy.

- Manage risk effectively: Implementing robust risk management strategies is paramount to safeguarding your capital in the face of market volatility.

- Stay informed: Keep abreast of the latest market news and events that can impact IV and overall market conditions.

Incorporating these expert tips into your trading strategy will refine your decision-making, increasing the probability of seizing lucrative trading opportunities.

FAQs on Implied Volatility Option Trading

To further clarify the intricacies of implied volatility option trading, here are answers to some frequently asked questions:

- What is the difference between IV and historical volatility? IV is a forward-looking measure of expected volatility, while historical volatility gauges past price fluctuations.

- How does IV impact option premiums? Higher IV leads to higher option premiums, while lower IV results in lower premiums.

- What are some popular IV-based strategies? Common strategies include selling options when IV is high (IV crush strategy) and buying options when IV is low.

- How can I track IV? Various platforms and data providers offer real-time IV data.

- Is IV trading suitable for all traders? IV trading requires a solid understanding of options and a moderate risk tolerance.

Implied Volatility Option Trading Strategy

Image: aaaquants.com

Conclusion

Mastering the art of implied volatility option trading empowers traders to navigate market volatility with greater confidence and precision. By leveraging IV analysis, traders can identify lucrative trading opportunities and maximize their returns.

Whether you are an experienced options trader or embarking on this exciting journey, we encourage you to delve into the world of implied volatility. Its rich tapestry of insights and potential rewards awaits your exploration.

Is implied volatility option trading a topic that resonates with you? Share your thoughts and experiences in the comments section below.