Introduction

In today’s fast-paced financial world, options trading has emerged as a powerful tool for investors seeking to enhance their portfolio. With an option trading platform, you gain access to a vast array of financial instruments that allow you to manage risk, speculate on market movements, and potentially generate significant profits. If you’re based in Europe, choosing the right trading platform is crucial, and this article aims to provide comprehensive guidance on the best European option trading platforms.

Image: www.publicfinanceinternational.org

European Option Trading: An Overview

Option trading involves buying or selling contracts that give you the right but not the obligation to buy (call option) or sell (put option) a specific underlying asset at a predefined price on a specified date. The flexibility offered by options allows you to tailor your trades to your risk appetite and investment objectives. European options, specifically, can only be exercised on their expiration date, providing a unique risk-reward profile compared to their American counterparts.

History and Significance

Option trading has its roots in the 17th century, with the first recorded options contracts traded in Amsterdam. Over the centuries, options have evolved into sophisticated financial instruments used by both retail investors and institutional traders. Today, European option trading platforms provide a modern and efficient way to access global options markets, offering a wide range of underlying assets, such as stocks, indices, commodities, and currencies.

Understanding Key Terms

To navigate the world of option trading effectively, it’s essential to understand some key terms:

- Premium: The price you pay to buy an option contract.

- Strike Price: The specified price at which you can exercise your option.

- Expiration Date: The final day on which you can exercise your option for European options.

Image: www.publicfinanceinternational.org

Choosing the Best European Option Trading Platform

With numerous platforms available, selecting the right one for your needs is crucial. Consider the following factors:

Regulation and Security

Ensuring your funds and personal information are protected is paramount. Choose platforms regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK or the CySEC in Cyprus.

Account Types and Fees

Different platforms offer various account types tailored to different experience levels and trading strategies. Compare fees, including commissions, spreads, and margin rates, to optimize your profitability.

Trading Interface and Functionality

A user-friendly trading interface and advanced charting tools enhance your trading experience. Look for platforms that provide a seamless workflow, real-time data, and customizable options.

Asset Selection and Liquidity

Access to a wide range of underlying assets ensures you can diversify your portfolio and capitalize on various market trends. Platforms with high liquidity ensure smooth trade execution and minimize slippage.

Customer Support and Education

Responsive customer support can assist you with any queries or issues. Platforms that offer educational resources, such as webinars and tutorials, empower you to expand your knowledge and improve your trading strategies.

Tips and Expert Advice

To thrive in European option trading, consider the following tips:

- Educate yourself: Understand the complexities of options trading before investing real money.

- Start small: Begin with small trades to minimize risk and develop your confidence.

- Define your risk appetite: Determine how much risk you’re willing to take and trade accordingly.

- Diversify your portfolio: Spread your investments across different options and underlying assets to mitigate risks.

- Monitor the market: Stay informed about economic news and market trends that can impact option prices.

Frequently Asked Questions

Q: What is the main difference between European and American options?

A: European options can only be exercised on their expiration date, while American options can be exercised at any time before expiration.

Q: How do I choose the right strike price for an option?

A: Consider the underlying asset’s price, market sentiment, and your trading objectives when selecting a strike price.

Q: Is option trading suitable for beginners?

A: While option trading offers great potential rewards, it can be complex and risky. Beginners should approach it with caution and educate themselves thoroughly.

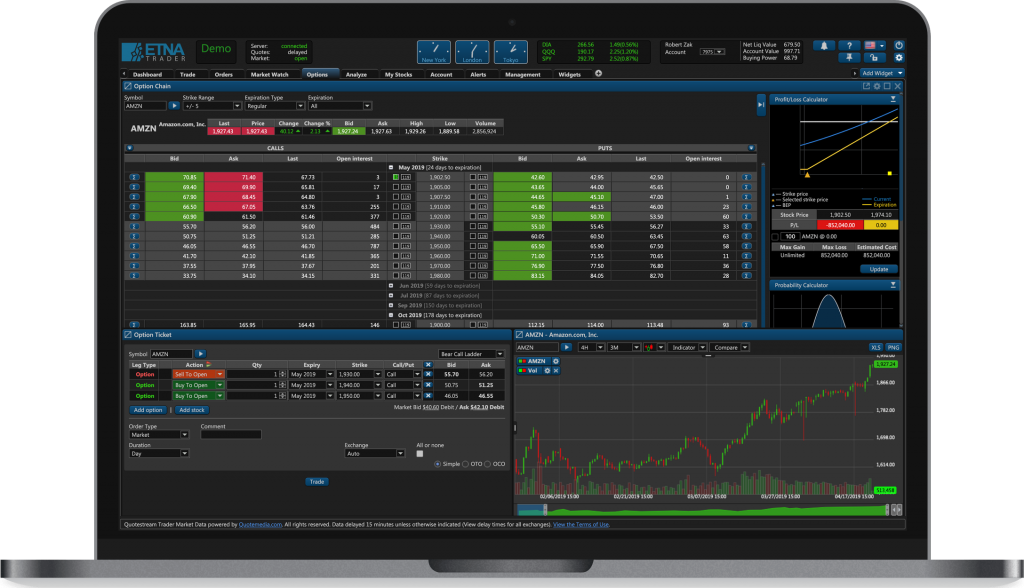

Option Trading Platform Europe

Image: www.etnasoft.com

Conclusion

Mastering European option trading through the right platform can empower you to navigate market fluctuations and pursue financial opportunities. By choosing a reputable platform, implementing proven strategies, and expanding your knowledge, you can optimize your trades, mitigate risks, and potentially achieve your investment goals. Are you ready to explore the world of European option trading and unlock its potential?