Introduction

In the vibrant realm of stock market investing, options trading has emerged as a sophisticated and potentially lucrative strategy. TD Ameritrade, a renowned financial services provider, offers a comprehensive platform for savvy traders to navigate the intricacies of premarket option trading. By understanding the unique mechanics, strategies, and pitfalls involved, investors can harness the power of premarket trading to optimize their returns.

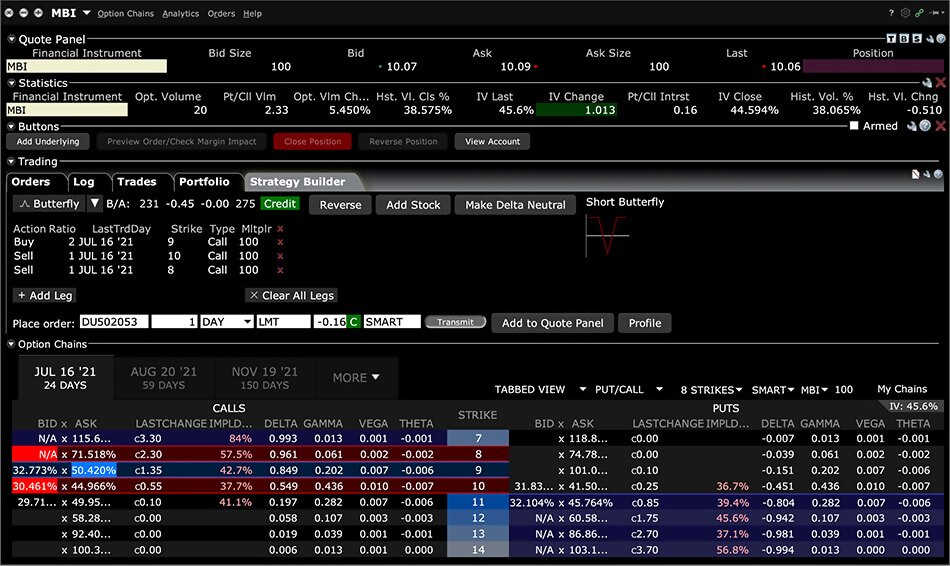

Image: www.interactivebrokers.com

Premarket trading sessions precede the regular market hours, offering traders an exclusive window of opportunity to place and execute trades before the market opens. This early access provides several advantages, including the ability to capitalize on price discrepancies, reduce order execution time, and manage risk more effectively. TD Ameritrade’s user-friendly interface and advanced trading tools empower investors to seize these benefits seamlessly.

Premarket Trading with TD Ameritrade: A Comprehensive Overview

TD Ameritrade’s premarket trading platform allows investors to trade options contracts from 7:00 AM EST to 9:30 AM EST. During this extended trading period, traders can evaluate market conditions, research potential trades, and submit orders. The platform’s intuitive design simplifies order placement, enabling investors to specify contract details, strike prices, and order types with precision.

Premarket trading with TD Ameritrade offers several distinct advantages. Firstly, it provides traders with an opportunity to react swiftly to overnight news and economic events that may impact the market’s opening price. This early insight allows investors to adjust their positions accordingly, potentially mitigating potential losses or capturing unforeseen gains.

Secondly, premarket trading reduces order execution time. By placing orders before the market opens, investors can minimize the risk of slippage, which occurs when the executed price differs from the intended price due to rapid market movements. TD Ameritrade’s robust trading infrastructure ensures that orders are executed efficiently, optimizing trade execution accuracy.

Moreover, premarket trading facilitates effective risk management by enabling traders to establish and adjust their positions based on premarket price action. By monitoring order flow and price fluctuations, investors can make informed decisions to protect their capital or enhance their profit potential before the market opens.

Strategies for Successful Premarket Option Trading

To maximize the potential of TD Ameritrade’s premarket option trading platform, investors should adopt a strategic approach. One effective strategy involves identifying stocks or sectors that have experienced significant overnight price movements or news events. By analyzing premarket order flow and market sentiment, traders can assess potential trading opportunities and develop informed decisions.

Another strategy is to employ technical analysis to identify potential price breakouts or reversals. By studying premarket charts and indicators, investors can anticipate market trends and position themselves accordingly. Additionally, utilizing fundamental analysis to evaluate company earnings reports or economic data releases can provide insights into potential market movements.

Potential Pitfalls and Risk Management

While premarket option trading with TD Ameritrade offers numerous benefits, it is crucial to acknowledge potential pitfalls. Increased volatility and lower liquidity during premarket hours can magnify both gains and losses. Therefore, proper risk management techniques are essential to mitigate potential setbacks.

One prudent measure is to limit trading volume during premarket hours, especially for less experienced traders. Moreover, employing stop-loss orders or other risk management tools can safeguard capital against unexpected price swings. It is also advisable to monitor market conditions closely and adjust trading plans as needed.

Image: www.youtube.com

Option Trading Premarket Tdemeritrade

Image: www.angelone.in

Conclusion

Premarket option trading with TD Ameritrade empowers investors with exclusive opportunities to maximize returns and manage risk. By leveraging the platform’s advanced trading tools and capitalizing on the advantages of extended trading hours, traders can navigate the market’s complexities with greater precision and efficiency. However, it is imperative to recognize potential pitfalls and implement sound risk management strategies to harness the full potential of premarket trading.

For novice investors, it is recommended to approach premarket trading with caution, begin with smaller trade sizes, and prioritize education. As experience and knowledge grow, traders can progressively increase their involvement in premarket trading. Remember, the stock market remains an ever-evolving landscape, and ongoing research, practice, and adaptation are key to achieving success.