Are you ready to unlock the secrets of premarket option trading and gain an edge over other investors? With premarket option trading, you gain the unique advantage of tapping into market movements before the regular trading hours begin, giving you the potential for significant profit.

Image: scuba-dawgs.com

In this comprehensive guide, we will delve into the world of premarket option trading, exploring its foundational concepts, real-world applications, and expert insights. Whether you’re a seasoned trader or just starting out, this guide will equip you with the knowledge and strategies you need to navigate this dynamic and potentially lucrative market.

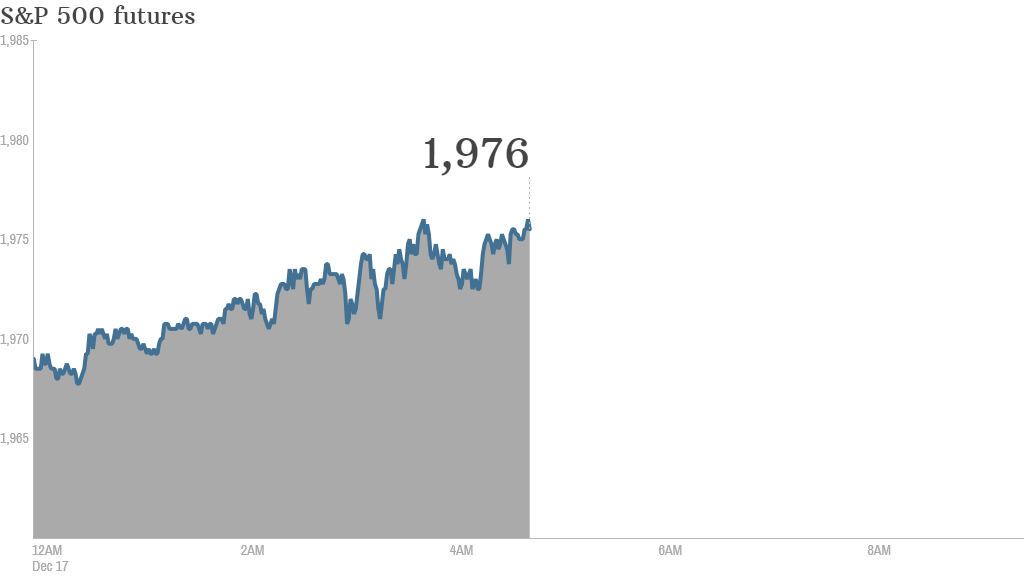

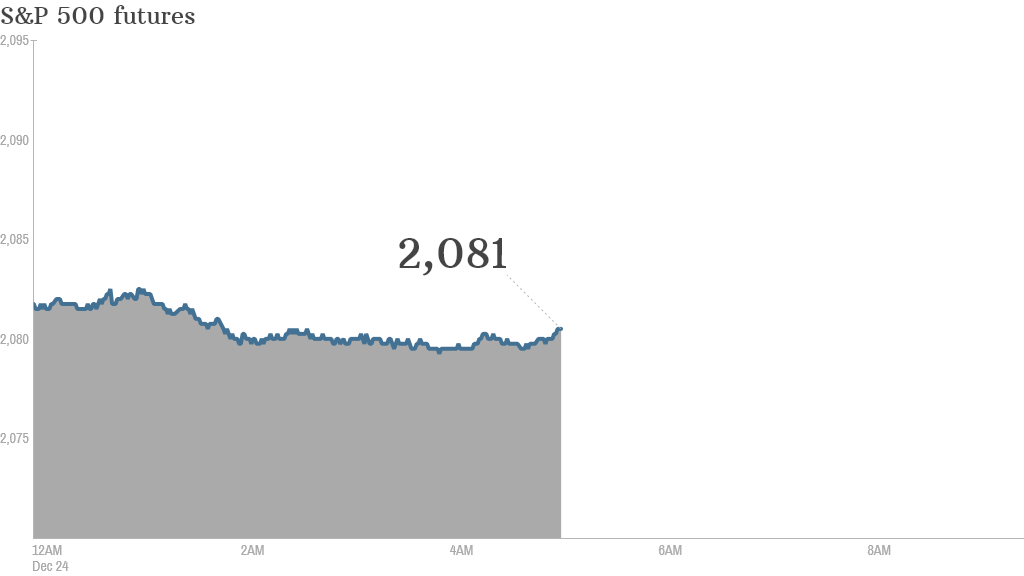

Demystifying Premarket Option Trading: A Window of Opportunity

The premarket trading session, typically taking place from 7:00 AM to 9:30 AM ET, provides an exclusive window of opportunity for savvy traders. It’s a stage where major market participants, such as institutional investors and hedge funds, strategically position themselves before the market opens, often setting the tone for the day’s trading.

By engaging in premarket option trading, you gain privileged access to market movements before they become widely visible. This can be particularly advantageous when reacting to earnings reports, economic data releases, or other market-moving events that occur before the regular trading session begins.

Mastering the Nuances of Premarket Option Trading

As you venture into the realm of premarket option trading, it’s crucial to grasp the fundamental concepts that underpin this unique market. Understanding option contracts, their types, and how to price and value them is paramount to making informed trading decisions.

Once you’re well-versed in the basics, delve into advanced strategies that can amplify your profit potential. Explore vertical spreads, calendar spreads, and other complex tactics employed by experienced traders to maximize returns.

Bridging the Gap Between Theory and Practice: Real-World Applications

Theoretical knowledge is indispensable, but it requires practical application to yield tangible results. Discover real-life examples of premarket option trading strategies that have consistently outperformed the market. Learn how professional traders identify opportunities, analyze market conditions, and execute trades that generate substantial profits.

Beyond the technicalities, embrace the psychological aspects of trading. Understand the emotional roller coaster that comes with financial risk and develop the mental fortitude to stay disciplined and make sound decisions even amidst market volatility.

Image: money.cnn.com

Harnessing the Wisdom of Experts: Insights from Industry Leaders

To become a successful premarket option trader, it’s essential to seek guidance from those who have mastered this craft. In this guide, we’ve assembled insights from seasoned experts, renowned traders, and financial analysts.

They generously share their hard-earned wisdom, unveiling their winning strategies, risk management techniques, and secrets to staying ahead of the curve. By absorbing their collective knowledge, you’ll increase your chances of becoming a formidable force in the premarket option trading arena.

Premarket Option Trading

Image: money.cnn.com

Call to Action: Embark on Your Premarket Option Trading Journey

Now that you’ve gained a comprehensive understanding of premarket option trading, it’s time to take that leap of faith and start reaping the rewards. Begin by opening a trading account with a reputable broker that offers access to premarket trading.

Set aside a portion of your investment portfolio specifically for premarket option trading, and start practicing with smaller trades until you gain confidence. Remember, consistency and discipline are key to success in this or any other financial endeavor.

The world of premarket option trading awaits your participation. Armed with the knowledge and strategies outlined in this guide, you’re poised to unlock the hidden opportunities this market offers, potentially transforming your financial future.