In the fast-paced world of investing, having a solid understanding of different trading strategies is crucial for success. Among the many options available, the strangle option trading strategy stands out as an effective method for navigating market volatility and generating potential returns.

Image: www.ispag.org

This article will delve into the intricacies of the strangle option trading strategy, providing a comprehensive overview of its definition, mechanics, and implementation. We’ll explore the latest trends and developments in this dynamic trading arena, offering valuable insights and expert advice to empower traders of all experience levels.

Understanding the Strangle Option Trading Strategy

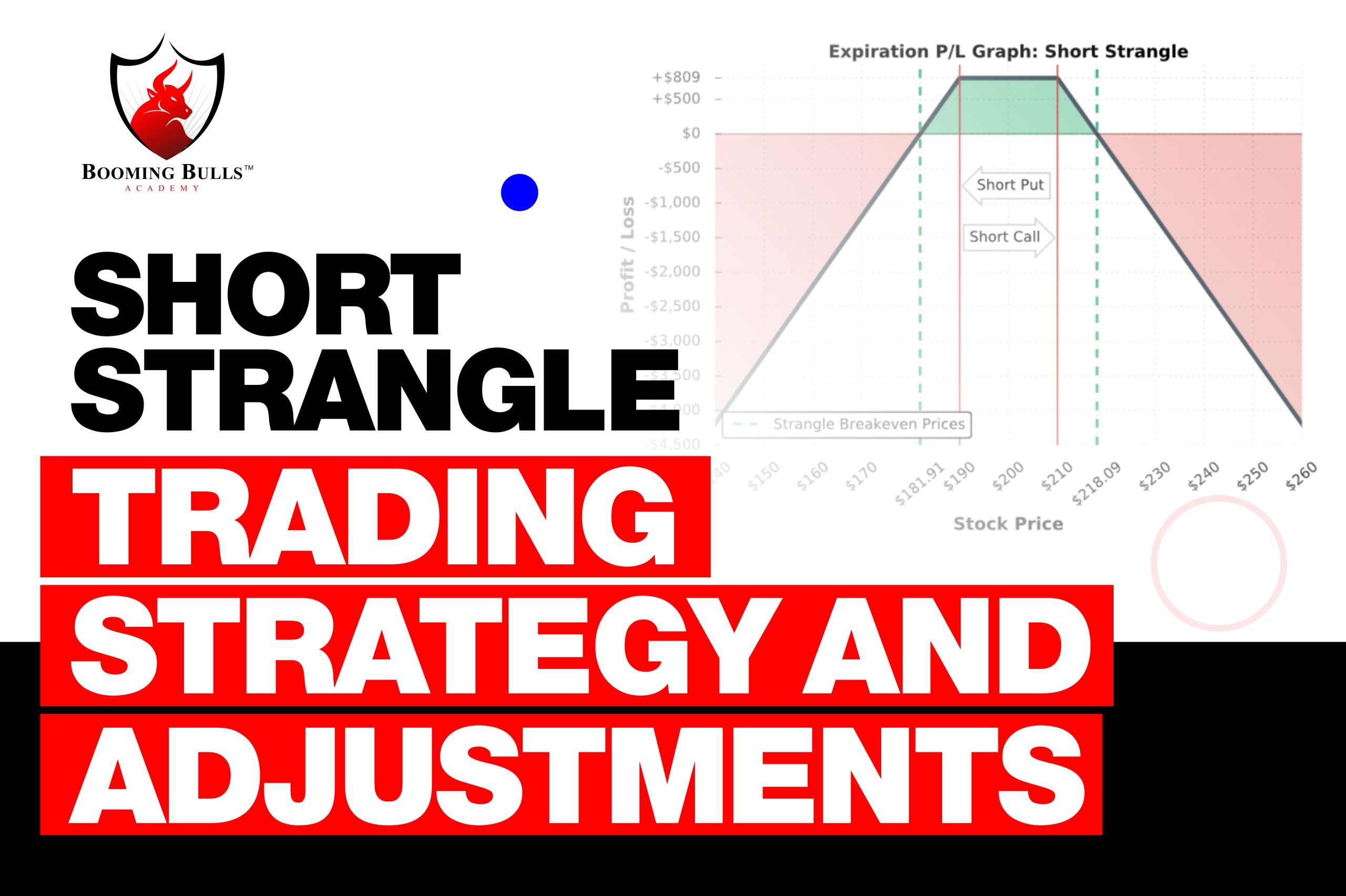

A strangle option trading strategy involves the simultaneous purchase of both a call option and a put option with the same expiration date but different strike prices. The call option grants the holder the right but not the obligation to buy the underlying asset at a specified strike price on or before the expiration date. Conversely, the put option grants the right but not the obligation to sell the underlying asset at a specified strike price on or before the expiration date.

The strike prices for the call and put options in a strangle strategy are typically set above and below the current price of the underlying asset, respectively, creating a range within which the trader expects the asset’s price to fluctuate.

Benefits and Risks of Strangle Option Trading

Strangle option trading strategies offer several potential benefits, including:

- Profit potential in both rising and falling markets: Since a strangle strategy involves holding both a call and a put option, traders can potentially profit from upward or downward price movements.

- Defined risk: The maximum loss in a strangle strategy is limited to the premium paid for both the call and put options.

However, it’s important to note that strangle option trading also carries certain risks:

- Time decay: The value of both the call and put options decays over time, which can erode potential profits if the underlying asset’s price remains within a narrow range.

- Implied volatility: The implied volatility of the underlying asset affects the price of the options. If implied volatility decreases, the value of the options will decline, potentially reducing potential profits.

Implementation and Execution

To implement a strangle option trading strategy, follow these steps:

- Determine the underlying asset you want to trade.

- Select the expiration date for your options.

- Set the strike prices for the call and put options, ensuring they are above and below the current asset price, respectively.

- Calculate the cost of the strategy by adding the premiums for both the call and put options.

- Place your order to purchase both the call and put options simultaneously.

Image: boomingbulls.com

Expert Advice for Successful Strangle Option Trading

- Proper risk management: Always trade with capital you can afford to lose, and carefully consider the potential risks involved in any strangle option trading strategy.

- Understand implied volatility: Implied volatility plays a crucial role in strangle option pricing. Monitor it closely and adjust your strategy accordingly.

- Consider using delta-neutral strategies: By adjusting the strike prices of the call and put options, you can potentially reduce your overall delta exposure and enhance the risk-reward profile of your strategy.

By following these tips and conducting thorough research, you can increase your chances of success when implementing a strangle option trading strategy.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about strangle option trading strategies:

Q: What is the difference between a strangle and a straddle?

A: A strangle involves purchasing a call option and a put option with different strike prices, while a straddle involves purchasing a call option and a put option with the same strike price.

Q: When is it best to use a strangle strategy?

A: Strangle strategies are typically used when traders expect high volatility in the underlying asset’s price, but are unsure of the direction of that movement.

Q: How long should I hold a strangle option trade?

A: The holding period for a strangle option trade varies depending on the trader’s strategy. Some traders may hold their positions for a few weeks, while others may hold them for several months.

Q: What are the different types of strangle option strategies?

A: There are various types of strangle option strategies, including bull-call strangles, bear-put strangles, and butterfly spreads.

Strangle Option Trading Strategy

Conclusion

The strangle option trading strategy is a versatile and potentially lucrative approach to capitalize on market volatility. By understanding the mechanics, benefits, risks, and implementation principles of this strategy, traders can navigate market uncertainties and enhance their potential for success.

Remember that all trading involves risk, and it’s crucial to conduct thorough research, manage your risk exposure effectively, and consider seeking professional advice when necessary. We encourage you to explore the world of strangle option trading further, empowering yourself with the knowledge and skills to make informed decisions and maximize your trading potential. Are you ready to conquer the challenges of the market with a strangle option trading strategy?