A Journey Through the Labyrinth of Financial Options

Avago’s stock options, a doorway to the world of financial alchemy, offer immense opportunities to savvy investors. Join me as we navigate this complex terrain, unraveling its intricacies and unlocking its transformative potential.

Image: www.tradingview.com

Delving into Stock Options: A Primer

Stock options, at their core, are contracts that bestow upon the holder the right but not the obligation to buy (in the case of a call option) or sell (in the case of a put option) a specified number of shares of a particular stock at a set price (strike price) on or before a specific date (expiration date). Options trading empowers investors with the flexibility to speculate on future stock price movements, hedge against potential losses, and enhance portfolio returns.

Avago: A Colossus in the Semiconductor Landscape

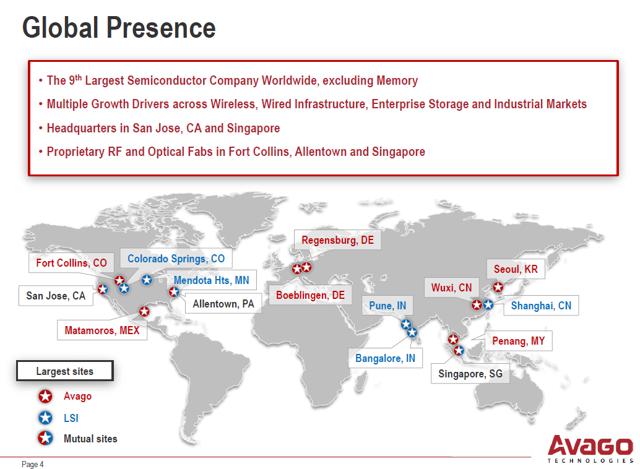

Avago Technologies, now part of Broadcom, is a global semiconductor giant renowned for its prowess in analog and mixed-signal solutions. Its diverse product portfolio spans communication infrastructure, consumer electronics, industrial automation, and automotive applications. Given its pivotal role in shaping technological advancements, Avago’s stock has consistently attracted the attention of investors seeking exposure to the semiconductor industry’s growth trajectory.

Navigating the Nuances of Avago’s Stock Options

As with any financial instrument, mastering Avago stock options trading demands a thorough understanding of its inherent nuances. The strike price, time to expiration, and volatility are critical factors that influence the premium of an option contract. Premium is the price paid to acquire the option, thus understanding its determinants is crucial for informed decision-making.

The strike price represents the price at which the underlying stock can be bought or sold upon exercising the option. Options with strike prices close to the current stock price typically command a higher premium than those with distant strike prices.

Time to expiration, as the name suggests, refers to the duration of the option contract. Options with longer durations offer greater flexibility to ride out short-term market fluctuations, resulting in a higher premium. Conversely, options nearing expiration hold a diminished premium as the likelihood of their exercise diminishes.

Volatility, a measure of the stock’s price movements, plays a significant role in option pricing. Options on stocks with high volatility, implying greater price fluctuations, carry a higher premium compared to options on stocks with low volatility.

Image: seekingalpha.com

Expert Insights and Strategies for Success

Seasoned traders have an arsenal of strategies to maximize returns and mitigate risks in Avago stock options trading. Covered calls involve selling call options against shares one owns to generate income and reduce portfolio volatility. Straddles involve purchasing both call and put options with the same strike price and expiration date, enabling profit from significant price movements in either direction. Iron condors, more complex strategies, involve selling an out-of-the-money call option and put option along with buying two at-the-money options.

Frequently Asked Questions: Demystifying Avago Stock Options

Q: What are the benefits of trading Avago stock options?

A: Options provide leverage, allowing for significant returns with a small capital outlay. They offer flexibility in tailoring strategies to suit risk appetite and investment goals.

Q: What are the risks associated with Avago stock options trading?

A: As with any investment, options trading involves inherent risks. Options can expire worthless, resulting in the loss of the premium paid. Understanding market dynamics and exercising caution are crucial.

Q: Is Avago stock options trading suitable for everyone?

A: Options trading requires a sophisticated understanding of financial instruments and market dynamics. It is not advisable for novice investors without a firm grasp of the underlying concepts.

Avago Stock Options Trading

Conclusion: Embracing the Power of Options

Avago stock options trading presents an alluring pathway towards financial growth and diversification for astute investors. By embracing the principles of options trading and honing your analytical skills, you can leverage the transformative power of these financial instruments. Whether you are a seasoned pro or a curious beginner, delve into the captivating world of Avago stock options and ignite your financial journey.

Ask yourself: Are you ready to embrace the alluring possibilities that Avago stock options trading holds? Join the ranks of savvy investors who have harnessed its potential to unlock financial freedom and achieve their investment dreams.