In the realm of financial markets, options trading offers an intriguing opportunity to leverage market movements and potentially enhance returns. However, navigating the complexities of options requires an understanding of the “Greeks,” a set of metrics that measure the sensitivity of an option’s price to changes in underlying variables. Enter this comprehensive guide, where we’ll delve into the enigmatic world of the Greeks, empowering you with indispensable knowledge for informed decision-making in options trading.

Image: optionsinplainenglish.com

Defining the Greeks: The Pillars of Options Analysis

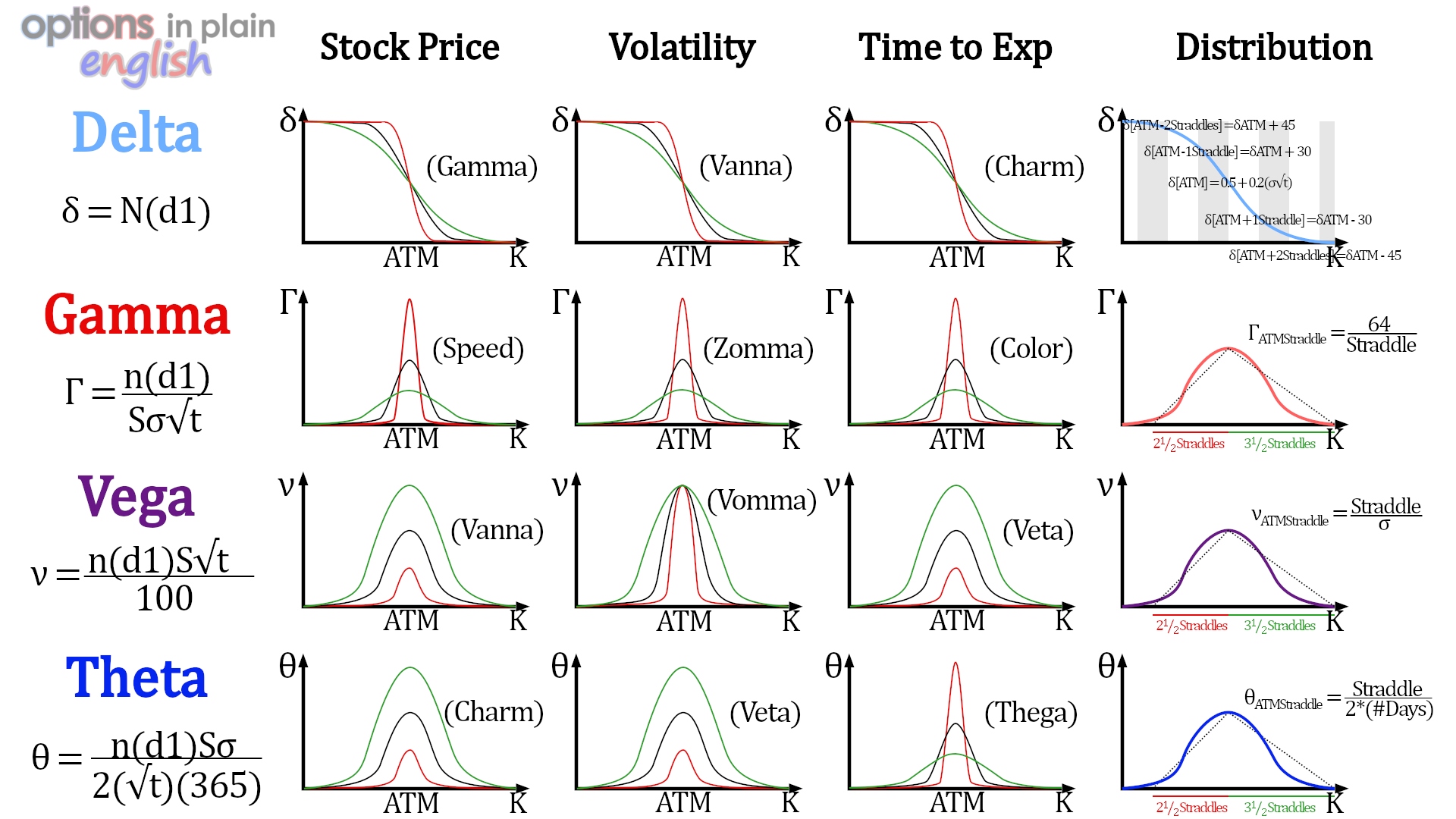

The Greeks, named after Greek letters, are mathematical metrics that quantify the impact of various factors on the price of an option contract. These factors include:

- The underlying asset price

- The time to expiration

- The volatility of the underlying asset

- The risk-free interest rate

Understanding these metrics is crucial for assessing the potential risks and rewards associated with options trading and making calculated decisions.

Delta: Tracking the Heartbeat of the Underlying

Delta measures the rate of change in an option’s price relative to the change in the underlying asset’s price. It gauges how much the option’s price will move for every unit change in the underlying asset.

- Positive Delta (0-1): As the underlying asset’s price increases, the option’s price will follow suit, mimicking its movement proportionally.

- Negative Delta (-1 to 0): Conversely, when the underlying asset’s price declines, the option’s price will decrease in a proportional manner.

Gamma: The Acceleration of Delta

Gamma indicates how the Delta of an option changes as the underlying asset’s price fluctuates. It measures the rate of change in Delta.

- Positive Gamma (+): If the underlying asset’s price is volatile (i.e., exhibiting significant fluctuations), the option’s Delta will also change at a faster rate, making the option more sensitive to price movements.

- Negative Gamma (-): With decreasing volatility, the Delta of the option becomes less responsive, resulting in a lower sensitivity to price movements.

Image: globaltradingsoftware.com

Theta: The Time Phantom

Theta tracks the decay in an option’s value as time passes, known as time decay. This factor is particularly relevant for short-term options, where time value erosion can be substantial.

- Positive Theta (+): As time elapses, the option’s price will generally decline, especially if the option is out of the money (OTM). This is because OTM options have less time to realize any potential gains from price fluctuations.

- Negative Theta (-): ITM (in the money) options may hold their value better or even increase in price as time approaches expiration, offsetting the impact of time decay.

Vega: Volatility’s Shadow

Vega gauges the sensitivity of an option’s price to changes in the volatility of the underlying asset. Volatility can significantly influence the value of options, particularly options with longer expiration dates.

- Positive Vega (+): If market volatility increases, the price of the option will typically rise, as volatility can lead to larger price swings in the underlying asset.

- Negative Vega (-): Conversely, as market volatility subsides, option prices may decline as the potential for significant price movements diminishes.

Rho: Interest Rate’s Subtle Sway

Rho quantifies the impact of changes in the risk-free interest rate on the price of an option. This factor is especially important for long-term options.

- Positive Rho (+): If interest rates rise, the price of call options generally increases, as higher interest rates make borrowing more expensive, favoring long positions.

- Negative Rho (-): With decreasing interest rates, call option prices tend to fall, while put option prices may rise due to the reduced cost of borrowing.

Harnessing the Power of the Greeks

By comprehending the concepts behind the Greeks, options traders can:

-

Assess risk exposure and make informed trading decisions: The Greeks provide valuable insights into the potential risks and rewards associated with specific options strategies.

-

Identify potential trading opportunities: Analyzing the Greeks can help traders identify options with favorable risk-to-reward ratios, maximizing profit potential.

-

Fine-tune option strategies: By understanding how the Greeks interact, traders can tailor their strategies to align with their specific objectives and market conditions.

-

Manage the impact of external factors: The Greeks enable traders to quantify the potential impact of changing market conditions on their options positions, allowing for proactive risk management.

Expert Insights and Actionable Tips

“The Greeks are the compass for navigating the options market,” says Peter, a seasoned options trader. “By understanding how they interact, you can plot a course through market volatility and increase your chances of success.”

“Pay attention to Delta and Vega when selecting options,” advises Sarah, a financial analyst. “Delta indicates the option’s movement relative to the underlying asset, while Vega gauges its sensitivity to volatility. Understanding these key Greeks can help you choose options that align with your risk tolerance and trading goals.”

“Don’t forget about Rho, especially with long-term options,” emphasizes James, a portfolio manager. “Changes in interest rates can significantly impact option prices, so factoring in Rho is crucial for making informed decisions.”

Options Trading Thre Greeks

Image: www.youtube.com

Embracing the Complexity

While the Greeks can seem daunting at first, their significance in options trading cannot be overstated. By unraveling their complexities and applying them strategically, traders can unlock the full potential of this fascinating financial arena. Remember, the path to mastery begins with a single step. Embrace the challenge, delve into the depths of the Greeks, and watch your options trading journey soar.