Have you ever wondered how the stock market’s biggest players make their millions? A significant part of their success lies in the ability to analyze and trade options. Options trading is a powerful tool that can amplify profits and provide investors with various strategies to navigate market volatility.

Image: www.pinterest.ph

If you’re new to the world of options, it’s essential to understand that they’re financial instruments that give the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or commodity, at a predetermined price on or before a specific date. By trading options, investors can speculate on the future price direction of the underlying assets, hedge against market fluctuations, or generate income through premium collection.

Decoding Options Terminology

Call Option

A call option entitles the holder to buy a specific number of shares of an underlying asset at a set price (strike price) on or before a set date (expiration date). If the market price of the underlying asset rises above the strike price, the holder can exercise the right to purchase the asset at the lower strike price, creating a potential for profit.

Put Option

A put option gives the holder the right to sell a specific number of shares of an underlying asset at a predetermined price on or before a specific date. If the market price of the underlying asset falls below the strike price, the holder can exercise the right to sell the asset at the higher strike price, again creating a possible gain.

Image: tikloenglish.weebly.com

Understanding the Key Metric: Implied Volatility

Implied volatility (IV) is a crucial factor to consider when analyzing options. It represents market participants’ expectations of future price fluctuations in the underlying asset. High IV indicates that the market anticipates significant price movement, either upward or downward. This volatility level can impact the premium (price) of options contracts.

Benefits of Options Trading

- Potential for amplified profits: Options have leverage, meaning they allow investors to control large positions with a smaller capital outlay.

- Hedging against market downturns: Put options provide a buffer against potential losses in underlying asset values.

- Flexibility and versatility: Options can be used for various strategies, from speculative trading to income generation.

Navigating the Options Trading Process

Analyzing Options Contracts

When evaluating options contracts, consider factors such as the strike price, expiration date, implied volatility, and Greeks (parameters that measure sensitivity to various factors). These elements provide insights into the potential risk and reward profile of options trading.

Developing Trading Strategies

Effective options trading involves developing tailored strategies based on market conditions and risk appetite. Common strategies include buying calls for potential gains on rising markets, selling puts for premium income generation, and using spreads to manage risk and enhance returns.

Expert Advice on Maximizing Returns

Tips for Minimizing Risk

- Understanding the Risks: Before venturing into options trading, comprehend the potential risks and pitfalls.

- Proper Bankroll Management: Allocate only a portion of your investment capital to options trading to minimize potential losses.

- Risk Management Strategies: Use hedging strategies like protective puts or stop-loss orders to limit potential losses.

Tips for Maximizing Gains

- Advanced Technical Analysis: Utilize technical indicators and chart patterns to identify potential market trends and inflection points.

- Understanding Order Types: Choose the appropriate order types to execute trades effectively, considering market conditions and objectives.

- Staying Informed: Regularly monitor market news and economic data to stay abreast of current events that may impact options prices.

FAQs About Options Trading

Q: Is options trading suitable for all investors?

A: No, options trading is not appropriate for all investors. It requires a moderate to high level of financial knowledge, risk tolerance, and trading experience.

Q: How much capital do I need to start options trading?

A: The minimum capital required for options trading depends on the strategies employed and risk tolerance. However, it’s generally recommended to start with a substantial capital base to minimize potential losses.

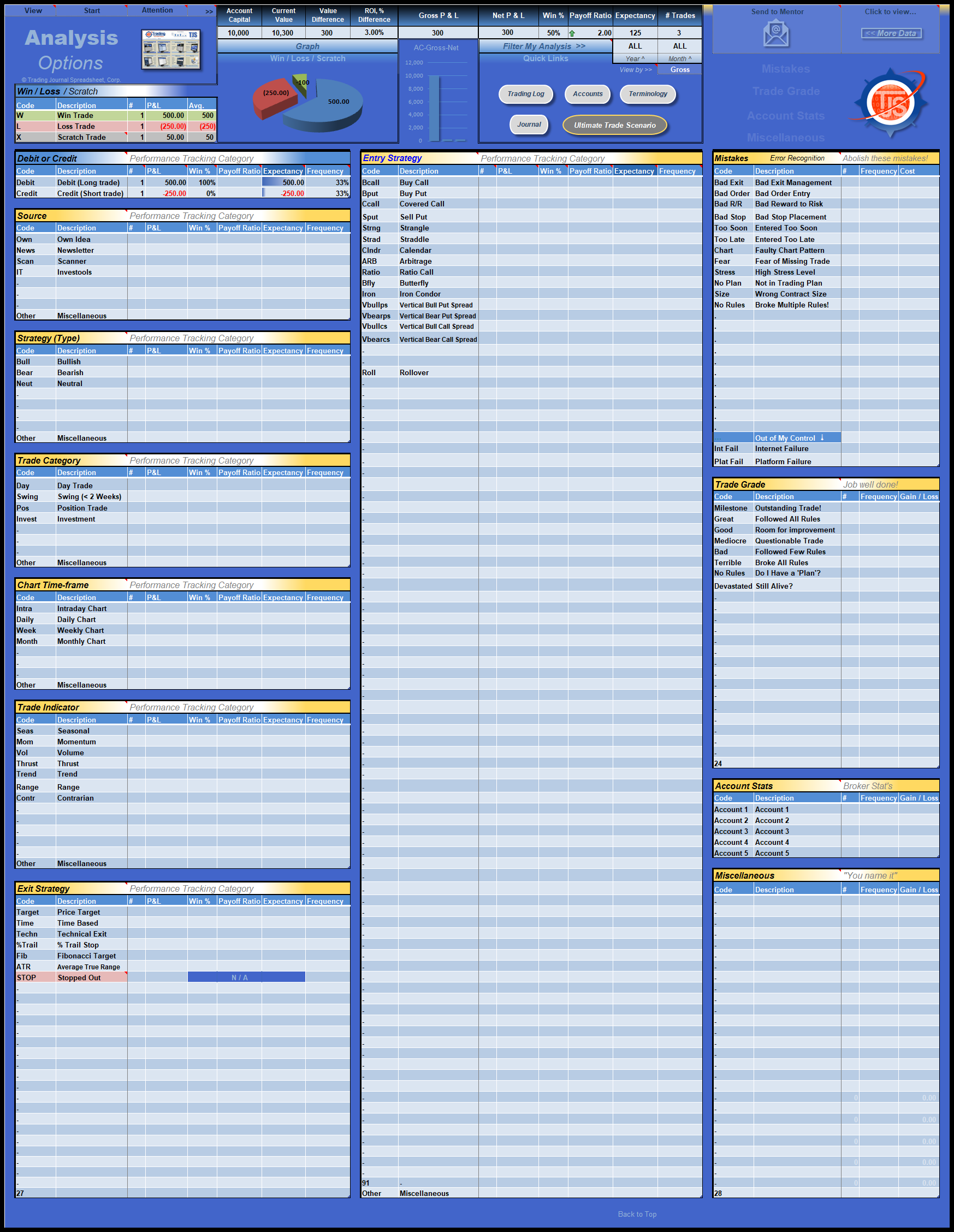

Trading Options Analysis

Image: seskaydip.blogspot.com

Conclusion

Trading options can be a highly rewarding endeavor, but it also requires a comprehensive understanding of the financial markets and options products. By meticulously analyzing options contracts, implementing sound trading strategies, and adhering to risk management principles, investors can leverage the power of options to maximize profitability while minimizing risk exposure.

If you’re intrigued by the world of options trading and eager to explore its possibilities, consider seeking guidance from reputable resources, brokers, or experienced professionals. With dedicated knowledge acquisition and prudent execution, you can unlock the potential of options trading and embark on a successful financial journey.