In the realm of financial markets, options trading plays a pivotal role in risk management and speculative strategies. However, behind the scenes of every options transaction lies a crucial entity: an options clearing corporation (OCC). Understanding the role of OCCs is essential for navigating the intricacies of options trading and mitigating potential risks.

Image: www.youtube.com

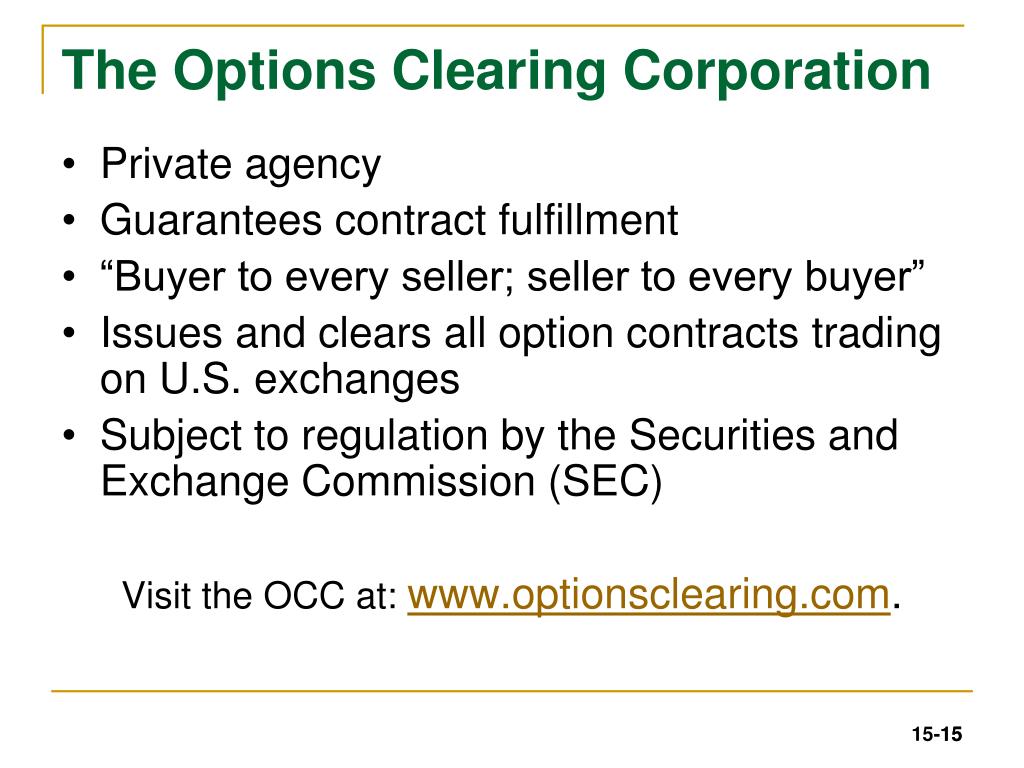

An options clearing corporation serves as a central counterparty to every options contract traded on an exchange. When an options buyer and seller enter into a contract, the OCC steps in between them, assuming the role of the counterparty to both parties. This eliminates the need for direct interaction between the buyer and seller, providing a secure and transparent platform for options trading.

The History of OCCs

The options clearing concept originated in the United States in 1973 with the establishment of the Options Clearing Corporation (OCC) as a non-profit organization. Its creation aimed to reduce systemic risk in the options market and provide a centralized point of clearing and settlement for all options transactions. By assuming the role of a counterparty, OCC became responsible for ensuring the fulfillment of obligations under each options contract, effectively guaranteeing performance.

The Role of OCCs in Options Trading

The central role of OCCs in options trading extends far beyond mere counterparty functions. OCCs perform a myriad of essential tasks that contribute to market stability and efficiency. These include:

- Central Counterparty: As mentioned earlier, OCCs act as the counterparty to every options contract traded on an exchange. This eliminates the potential risks associated with direct buyer-seller interactions, such as default or insolvency of one party.

- Clearing and Settlement: OCCs facilitate the clearing and settlement of options contracts, ensuring the timely and accurate transfer of funds and underlying assets between buyers and sellers. They establish standard procedures for settlement, reducing operational risks and enhancing market confidence.

- Risk Management: OCCs play a critical role in managing systemic risk in the options market. By analyzing market data and calculating margin requirements, OCCs monitor potential risks and take proactive steps to mitigate them. They also engage in stress testing and contingency planning to ensure the resilience of the options market in challenging scenarios.

- Market Surveillance: OCCs continuously monitor trading activity to detect and deter manipulative or unethical practices. They enforce market rules and regulations, ensuring that all participants operate within ethical boundaries and that market integrity is maintained.

The Importance of OCCs for Traders

For options traders, the presence of OCCs provides several key benefits:

- Reduced Risk: OCCs reduce the risk of potential counterparty defaults or market disruptions. By centralizing clearing and settlement functions, OCCs enhance the reliability and stability of the options market.

- Increased Liquidity: OCCs enable efficient trading operations by providing a centralized pool of liquidity. Market participants can access a wider range of options contracts and trade more confidently, knowing that counterparty risk is minimized.

- Clearance and Speedy Settlement: OCCs facilitate seamless clearing and settlement processes, ensuring timely delivery of funds and underlying assets. This reduces operational risks and delays, allowing traders to quickly realize profits or losses from their options positions.

- Regulatory Compliance: OCCs help ensure regulatory compliance by enforcing market rules and regulations. They work closely with regulatory authorities to maintain the integrity and fairness of the options market.

Image: simplykesil.weebly.com

Options Trading Options Clearing Corporation

Image: www.slideserve.com

Conclusion

Options clearing corporations (OCCs) play a vital role in the options trading ecosystem. By assuming the role of central counterparty, facilitating clearing and settlement, managing risk, and monitoring market activities, OCCs enhance the stability and integrity of the options market. For traders, OCCs provide reduced risk, increased liquidity, speedy settlement, and regulatory compliance, contributing to a more efficient and secure trading environment.