Navigating the intricacies of options trading, I’ve often marveled at the vital role played by options trading clearing houses. They stand as the silent guardians of every transaction, ensuring the seamless execution and safeguarding the interests of all parties involved. This article delves into the multifaceted world of options trading clearing houses, exploring their history, significance, and the indispensable services they provide.

Image: goldenpi.com

Clearing Houses: The Unsung Heroes of Options Trading

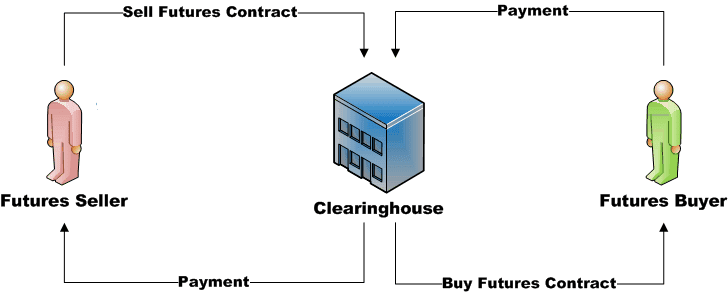

Options trading clearing houses are financial institutions that serve as intermediaries in options transactions, acting as the central counterparty between buyers and sellers. They assume the risk associated with each transaction, freeing up trading firms from taking on excessive risk. By doing so, they create a stable trading environment and give investors confidence in the integrity of the market.

The Mechanics of a Clearing House

When an options contract is executed, the buyer and seller enter into a binding agreement to complete the transaction at a predetermined time and price. However, the exchange of cash and settlement of obligations might not occur immediately. Here’s where clearing houses come in:

- They take over the responsibility for the contract from both parties.

- They become the buyer to every seller and the seller to every buyer.

- They ensure that all obligations are met, regardless of whether one party defaults or not.

By assuming the counterparty risk, clearing houses provide unparalleled stability to the options market. Traders can confidently engage in transactions knowing that their contractual obligations will be honored, fostering trust and smooth market operation.

Evolution and Growth of Clearing Houses

The concept of options trading clearing houses has evolved over time, adapting to meet the changing needs of the financial landscape. Initially, clearing houses relied heavily on manual processes and recorded transactions in physical ledgers. As technology advanced, clearing houses embraced automation and electronic trading systems, significantly enhancing operational efficiency.

Today, options trading clearing houses leverage advanced technology to manage the complexities of high-volume and fast-paced trading environments. They employ sophisticated algorithms and risk management systems to mitigate systemic risks and ensure market stability.

Image: www.financial-planning.com

The Importance of Clearing Houses for Market Integrity

Options trading clearing houses don’t just facilitate transactions—they play a crucial role in maintaining market integrity. They provide transparency by maintaining a centralized record of all transactions, ensuring that market participants have access to real-time information.

Moreover, clearing houses enforce rigorous standards and regulations, protecting investors from fraud and abuse. They monitor market activities for any irregular trading patterns or manipulation attempts, safeguarding the fairness and credibility of the options market.

Benefits of Using Clearing Houses

- Risk Management: Clearing houses assume the counterparty risk, reducing exposure for trading firms and investors.

- Market Stability: By guaranteeing the completion of contracts, clearing houses promote stability and confidence in the options trading market.

- Transparency: Centralized record-keeping ensures visibility of trading activities and enhances market integrity.

- Regulatory Compliance: Clearing houses enforce regulations, safeguarding investors and maintaining market fairness.

The Future of Options Trading Clearing Houses

As the world of finance continues to evolve, options trading clearing houses will play an increasingly critical role. The growing popularity of electronic trading and the advent of new financial instruments will require clearing houses to adapt and innovate.

One anticipated trend is the increased use of distributed ledger technology (DLT). DLT has the potential to enhance the efficiency of clearing and settlement processes, adding further security and resilience to the options market.

Expert Tips for Engaging with Clearing Houses

To make the most of your interactions with options trading clearing houses, consider these expert tips:

- Due Diligence: Thoroughly research and select a clearing house that aligns with your trading needs and risk profile.

- Understanding Contracts: Familiarize yourself with the clearing house’s rules, regulations, and contract terms to avoid any surprises or penalties.

- Margin Requirements: Be aware of margin requirements and maintain adequate collateral to cover potential losses.

- Transaction Monitoring: Regularly monitor your transactions and confirm that settlement instructions are accurate and timely.

- Open Communication: Maintain open communication with the clearing house to address any queries or concerns promptly.

Navigating Options Trading with Confidence

By following these expert tips, you can navigate the options trading landscape with increased confidence, leveraging the benefits of options trading clearing houses. These institutions are indispensable players in the financial markets, ensuring the integrity, stability, and efficiency of options trading while safeguarding the interests of all participants.

Frequently Asked Questions about Options Trading Clearing Houses

- Q: Why are clearing houses necessary in options trading?

A: Clearing houses assume counterparty risk, reduce systemic risk, enhance market stability, ensure transparent trading, and promote regulatory compliance.

- Q: How do clearing houses manage risk?

A: Clearing houses employ sophisticated risk management systems, including stress testing, margin requirements, and daily settlement processes, to mitigate systemic risks.

- Q: What is the role of technology in the operations of clearing houses?

A: Technology plays a vital role in clearing houses’ automation, record keeping, and risk management processes. Advanced systems ensure efficient and secure transaction processing.

Options Trading Clearing House

Image: gkandbanking.blogspot.com

Conclusion

Options trading clearing houses are the cornerstone of the options trading ecosystem, providing an indispensable platform for efficient and secure transactions. Their role in risk management, market stability, and regulatory compliance makes them essential for the healthy functioning of financial markets. By understanding the mechanics, importance, and future trends of clearing houses, you can confidently navigate the options trading landscape and leverage its opportunities.

Are you interested in diving deeper into the fascinating world of options trading clearing houses? Leave a comment below or reach out to us for further insights and guidance.