Navigating the Labyrinth of Fees Associated with Options Trading

Options trading, with its allure of potentially lucrative returns, attracts many investors seeking financial growth. However, embarking on this journey requires a comprehensive understanding of the associated charges that can significantly impact your trading strategy. Understanding these fees is paramount to making informed decisions and achieving optimal profitability.

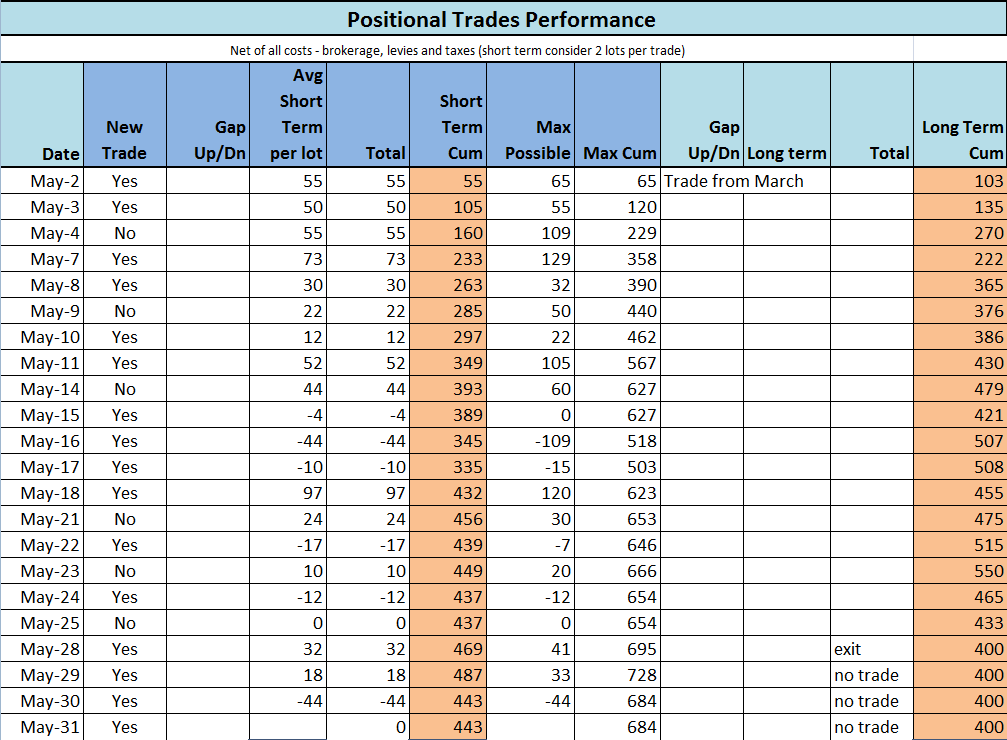

Image: bitsofjarvis.com

Unveiling the Cost of Options Trading

Initiating an options trade incurs a multitude of charges, akin to fees levied on stock transactions. These charges vary depending on the trading platform, the type of contract, and the underlying asset. Major exchanges like Cboe, CME Group, and Nasdaq impose varying fees for their trading services.

1. Transaction Fees:

Transaction fees, the fundamental cost of executing an options trade, are levied by the exchange where the trade is executed. These fees typically range from $0.50 to $1.00 per contract for retail traders, with institutions often enjoying lower rates. The fee is applied to both the purchase and sale of the option.

2. Exchange Fees:

In addition to transaction fees, exchanges impose exchange fees to facilitate the trading process. These fees cover market data, order routing, and clearing and settlement services. Exchange fees vary based on the exchange and the level of services provided.

Image: www.pinterest.co.uk

3. Clearing Fees:

Clearing organizations, responsible for ensuring the smooth execution of options trades, charge clearing fees to guarantee the settlement of contracts. These fees are generally small and applicable to each leg of the trade.

4. Brokerage Commissions:

Trading options through a brokerage incurs brokerage commissions, which compensate the broker for their services. Commissions vary widely between brokers and can be based on factors such as volume, account type, and contract type. Some brokers offer competitive commission rates or commission-free trading options.

5. Regulatory Fees:

Options trading is subject to regulatory fees, including the Securities and Exchange Commission (SEC) fee, the Financial Industry Regulatory Authority (FINRA) fee, and the Depository Trust & Clearing Corporation (DTCC) fee.

These fees are designed to cover regulatory and oversight activities and contribute to the stability and integrity of the options market.

Tips and Expert Advice for Navigating Options Trading Charges

Navigating the maze of options trading charges requires a strategic approach and careful consideration. Implementing the following tips can help you minimize expenses and optimize your trading strategy:

-

Choose the Right Broker: Compare commission structures and associated fees among different brokers to find the most cost-effective option.

-

Negotiate Commissions: If you have a significant trading volume, consider negotiating lower commission rates with your broker. Some brokers may be willing to offer discounts for high-volume traders.

-

Understand Your Contract Fees: Each options contract has inherent fees associated with its type, expiration date, and underlying asset. Research and comprehend these fees to make informed trading decisions.

-

Utilize Limit Orders: Placing limit orders to buy or sell options can help control your costs by executing trades at a specific price or better.

-

Consider Spread Trading: Spread trading involves buying and selling options simultaneously, which can reduce transaction fees and potentially lower your overall trading costs.

Frequently Asked Questions (FAQs) About Options Trading Charges

1. Can I avoid transaction fees?

No, transaction fees are an unavoidable cost associated with options trading. However, comparing brokers and choosing the one with the most competitive fees can minimize your expenses.

2. What is the difference between exchange fees and clearing fees?

Exchange fees cover the services provided by the exchange where the trade is executed, such as market data and order routing. Clearing fees are levied by clearing organizations to ensure the settlement of contracts.

3. Do all brokers charge the same commission rates?

No, commission rates vary among brokers. Factors such as volume, account type, and contract type can influence the commission structure.

4. What is the benefit of using limit orders?

Limit orders allow you to specify the desired price for your trade. This control can prevent slippage, which occurs when the execution price differs significantly from the intended price.

5. Can I trade options without using a broker?

While it is technically possible to trade options directly with another party, most individual traders use a broker for convenience and regulatory compliance. Brokers provide access to trading platforms, facilitate trade execution, and handle clearing and settlement processes.

Options Trading Charges

Image: emugepavo.web.fc2.com

Conclusion

Options trading charges are an integral part of the trading process, but understanding and managing these fees effectively can significantly enhance your trading strategy. By thoughtfully considering the various charges, negotiating commission rates, and implementing tips from experts, you can minimize expenses and maximize your profitability in the labyrinth of options trading.

Are you curious about delving deeper into the intricacies of options trading charges? Share your thoughts and questions in the comments section below, and let’s embark on a collaborative journey to unravel the secrets of successful options trading.