Unveiling the Costs Involved in Options Transactions

Option trading, with its potential for substantial returns, has captivated the interest of investors seeking to amplify their profits. However, it’s crucial to recognize that executing option trades incurs certain charges that can impact your overall profitability. Understanding these charges is paramount in making informed trading decisions. In this comprehensive guide, we will delve into the realm of option trading charges imposed by Motilal Oswal, a leading financial services provider in India.

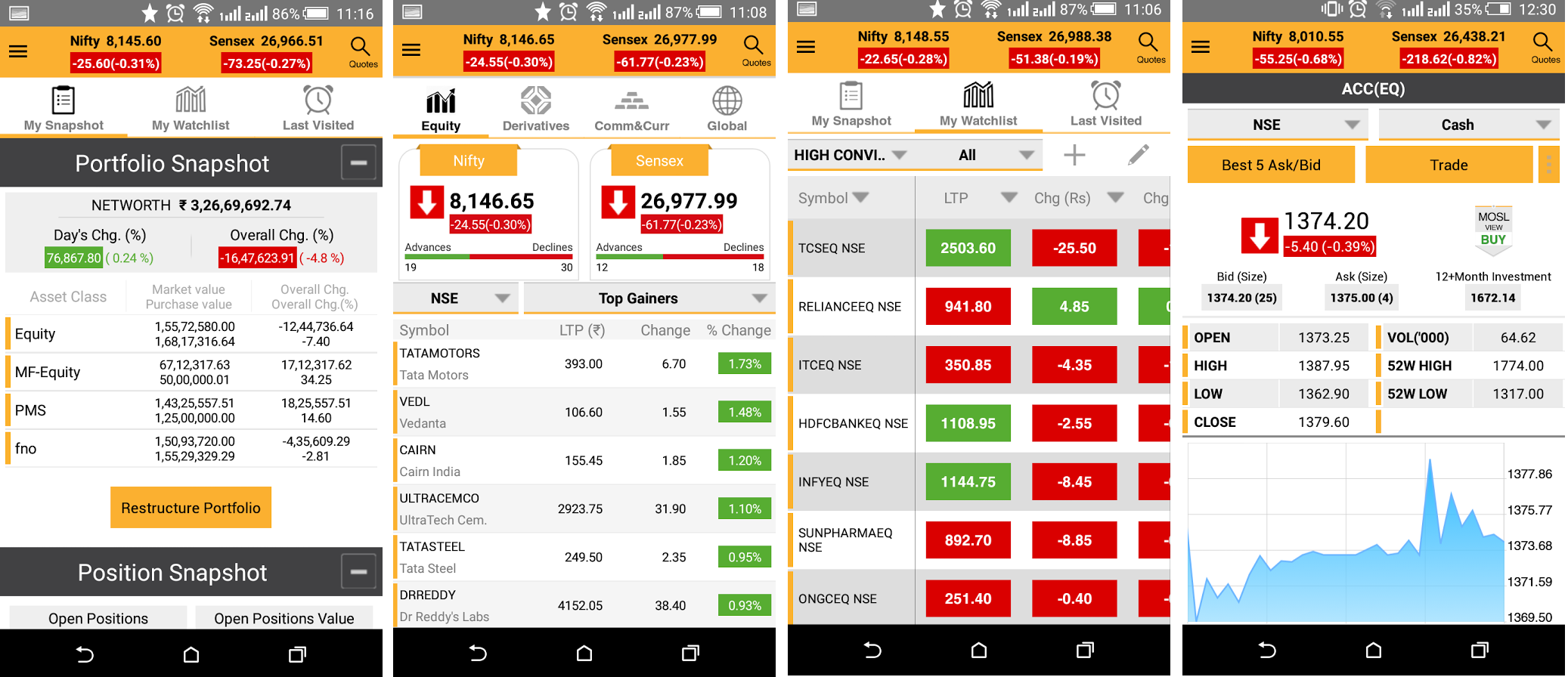

Image: www.paisowala.com

Exploring the Brokerage Ecosystem

Before delving into specific charges, it’s essential to comprehend the role of brokers in option trading. Motilal Oswal, acting as a broker, facilitates the buy and sell orders of traders, enabling them to participate in the options market. In return for their services, brokers charge fees, including brokerage, exchange fees, and other ancillary charges.

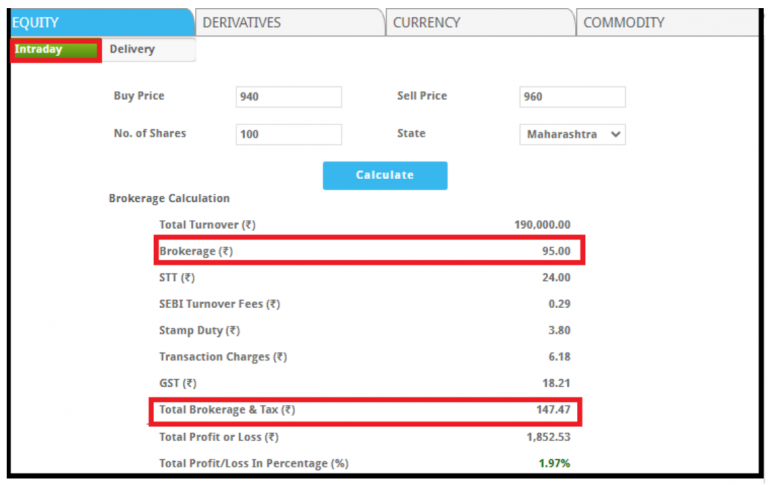

Brokerage Charges: The Trading Commission

Brokerage charges, also known as transaction fees, constitute a significant portion of option trading expenses. These fees are levied every time a trader buys or sells an option contract. Motilal Oswal’s brokerage charges vary based on the value of the contract traded. Traders can opt for either a fixed brokerage rate or a percentage-based rate, depending on their trading volume and preferences.

Exchange Fees: A Market Infrastructure Levy

Exchanges, such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), where option contracts are traded, impose certain fees on each transaction. These fees, known as exchange fees, contribute to the maintenance and operational costs of the exchanges. Motilal Oswal, as a member of these exchanges, passes on these charges to its clients.

Image: thewaverlyfl.com

Stamp Duty: A Government Imposition

Stamp duty, a tax levied by the government on financial transactions, is applicable to option trades as well. The rate of stamp duty varies across states in India. Motilal Oswal, as mandated by law, collects and remits stamp duty on behalf of its clients.

STT: A Tax on Transactions

Securities Transaction Tax (STT) is another tax imposed by the government on the purchase and sale of securities, including options contracts. The STT rate is a flat percentage of the transaction value. Motilal Oswal, acting as a collecting agent, deducts STT from the client’s account before executing the trade.

GST: A Comprehensive Tax

Goods and Services Tax (GST), a comprehensive indirect tax levied on the supply of goods and services, is also applicable to option trading charges. Motilal Oswal incorporates GST into its brokerage charges, ensuring compliance with tax regulations.

Additional Charges: Enhancing Trading Experience

Apart from the aforementioned charges, Motilal Oswal may levy additional charges to enhance the trading experience of its clients. These charges may include platform fees, software usage charges, and data dissemination fees, among others. Traders should carefully evaluate these additional charges and consider them when calculating the overall cost of option trading.

Option Trading Charges In Motilal Oswal

Image: www.adigitalblogger.com

Conclusion: Informed Trading Decisions

Navigating the world of option trading charges can be a complex endeavor, but armed with the knowledge provided in this guide, you can make informed trading decisions. Understanding the charges levied by Motilal Oswal, including brokerage charges, exchange fees, stamp duty, STT, GST, and additional charges, allows traders to effectively manage their trading expenses. By carefully considering these charges in their trading strategy, they can maximize their profit potential and mitigate any financial surprises.