The financial markets have undergone a revolutionary shift, empowering individuals to participate in complex trading strategies once reserved solely for seasoned professionals. Amidst this transformative landscape, AvaTrade has emerged as a beacon of accessibility and opportunity, offering a comprehensive suite of trading tools tailored specifically for retail traders. In this in-depth guide, we delve into the realm of CDF option trading with AvaTrade, providing a comprehensive understanding to equip you with the knowledge and confidence to navigate this dynamic and potentially lucrative market.

Image: www.forexcrunch.com

At its core, CDF option trading involves predicting the future price of an underlying asset, such as stocks, commodities, or indices. Unlike traditional stock trading, where you purchase a direct stake in the underlying asset, CDF options provide the flexibility to speculate on price movements without taking ownership. The ability to speculate on both rising and falling prices opens up a world of possibilities for savvy traders.

AvaTrade: A Trusted Gateway to CDF Option Trading

Partnering with AvaTrade for your CDF option trading endeavors is a decision that rests on a solid foundation of trust and dependability. As a globally renowned broker, AvaTrade has consistently garnered recognition for its transparent practices, stringent regulatory compliance, and unwavering commitment to client satisfaction. With AvaTrade, you can trade with confidence, knowing that your interests are always prioritized.

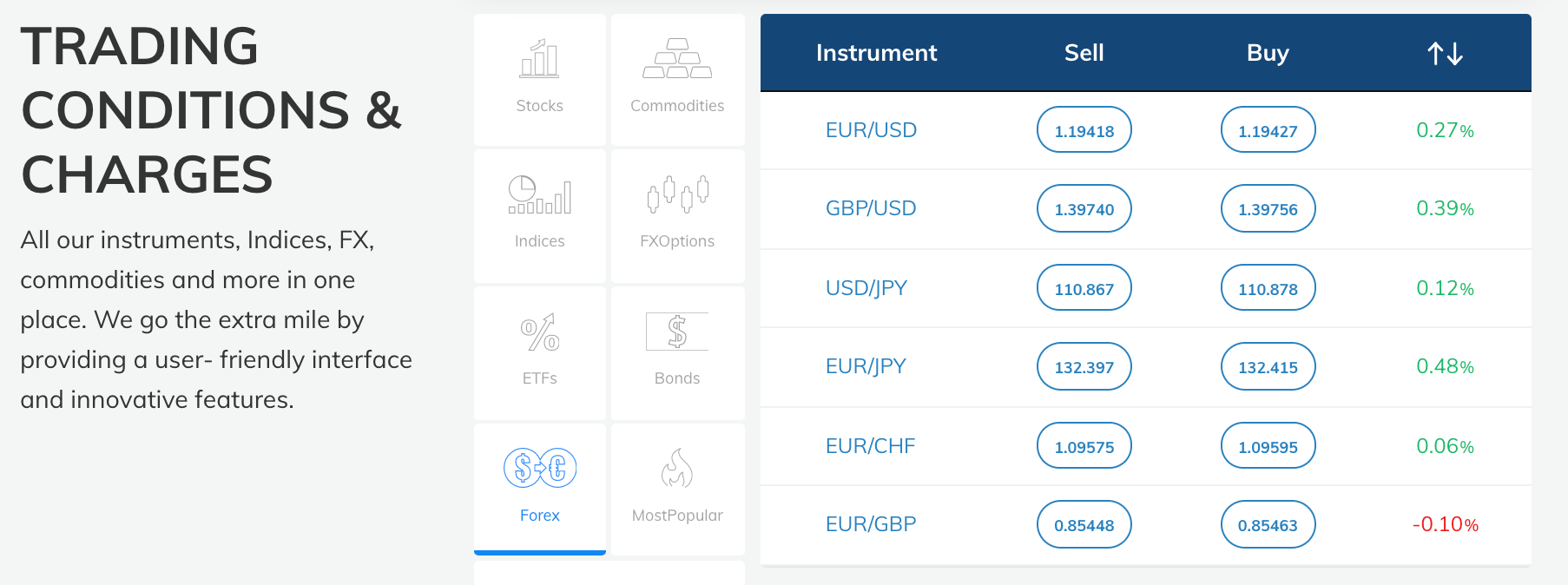

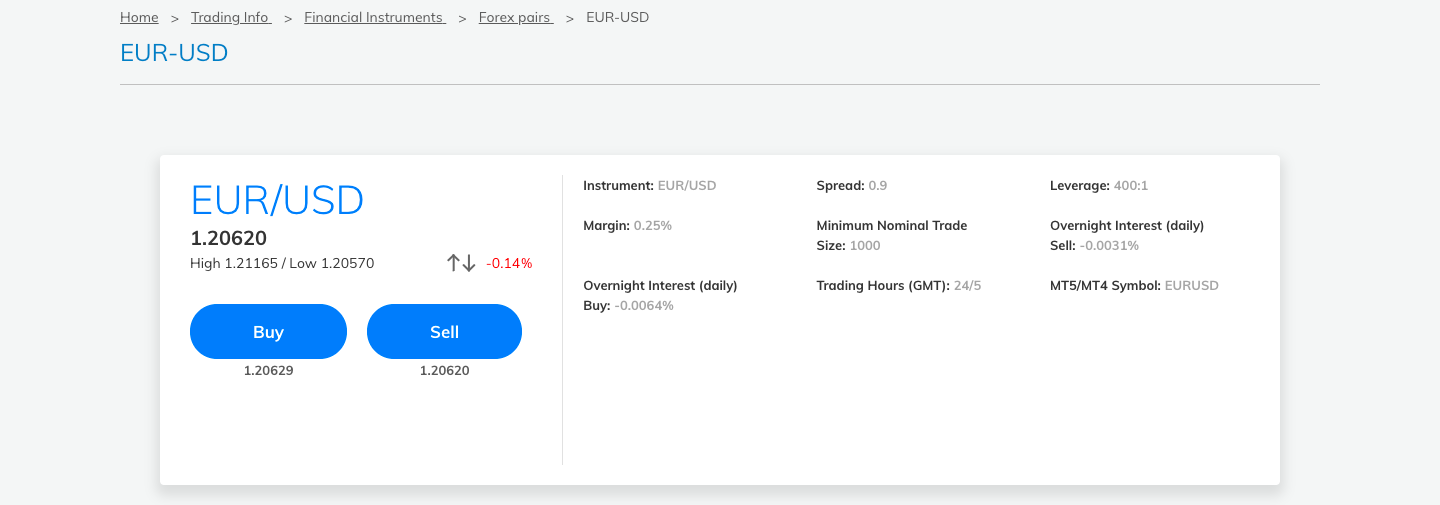

Empowering Traders with an Arsenal of Advanced Trading Tools

AvaTrade’s meticulously curated platform is a testament to their commitment to providing traders with the tools they need to excel. The intuitive and user-friendly interface empowers both novice and experienced traders alike, enabling them to execute trades seamlessly and efficiently. At your fingertips, you’ll have access to real-time market data, advanced charting capabilities, and customizable trading parameters that cater to your unique needs.

Unlocking the Secrets of CDF Option Trading

Now, let’s embark on an exploration of the intricacies of CDF option trading, starting with the basics. Options, in essence, are contracts that grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. This flexibility provides you with a wide range of potential trading strategies.

Call Options: Betting on Growth

Imagine you believe the price of a particular stock is poised for a steady climb. In this scenario, you can purchase a call option, granting you the right to buy the stock at a predetermined price in the future. If your prediction holds true and the stock price rises, you can exercise your option and purchase the stock at a lower price than its current market value, securing a potential profit.

Put Options: Capitalizing on Declines

Conversely, if you anticipate a decline in the price of an asset, you can opt for a put option. This gives you the right to sell the underlying asset at a predetermined price in the future. If the market takes a downturn as expected, you can exercise the option and sell the asset at a higher price than its current market value, generating a tidy profit.

Expert Insights: Unlocking the Secrets of Successful Trading

As you delve deeper into the world of CDF option trading, it’s invaluable to glean insights from seasoned experts who have navigated the markets with both success and lessons learned. Here are some invaluable tips from industry veterans:

-

Understand Risk Management: Embarking on any trading journey requires a keen understanding of risk management principles. CDF options come with inherent risks, so it’s paramount to carefully assess your risk tolerance and implement appropriate risk management strategies.

-

Thorough Market Research: Successful trading hinges on in-depth market research. Before executing any trades, take the time to thoroughly analyze historical data, industry trends, and geopolitical events that may influence market movements.

-

Calculated Trading Decisions: Avoid impulsive trades driven by emotions. Instead, rely on a well-thought-out trading plan that incorporates sound market analysis and aligns with your risk tolerance.

Conclusion: Embracing the Opportunities of CDF Option Trading

CDF option trading with AvaTrade empowers you to unlock a world of financial opportunities, providing the flexibility to speculate on both rising and falling markets. Backed by the reliability of AvaTrade and armed with the insights shared in this comprehensive guide, you can confidently navigate the exciting world of CDF options and potentially reap substantial rewards. Remember, knowledge is power, and by continuously refining your understanding and leveraging the right tools, you can increase your chances of success in this dynamic and potentially lucrative market.

Image: www.forexnewsnow.com

Avatrade Cdf Option Trading