Introduction

The world of option trading is a dynamic and complex one, offering both immense opportunities and potential risks. Understanding the intricacies of this market can be the key to leveraging your investments and achieving financial success. This comprehensive guide will delve into the world of option trading based on the Relative Strength Index (RSI), providing an in-depth analysis of this technical indicator and its applications in option trading strategies.

Image: www.tradingview.com

What is the Relative Strength Index (RSI)?

Developed by J. Welles Wilder in the 1970s, the Relative Strength Index (RSI) is a technical analysis tool designed to measure the magnitude of recent price changes over a specified period to gauge overbought or oversold conditions in an asset. RSI values range from 0 to 100, with levels above 70 typically indicating overbought conditions and readings below 30 suggesting oversold conditions.

Using RSI in Option Trading

Option traders leverage RSI to identify potential entry and exit points in the market. When the RSI is in overbought territory, it suggests a high probability of a price reversal, creating opportunities for selling (put) options. Conversely, when the RSI is in oversold territory, it indicates a potential for a price rebound, presenting buying (call) options as attractive investments.

Strategies for Option Trading Based on RSI

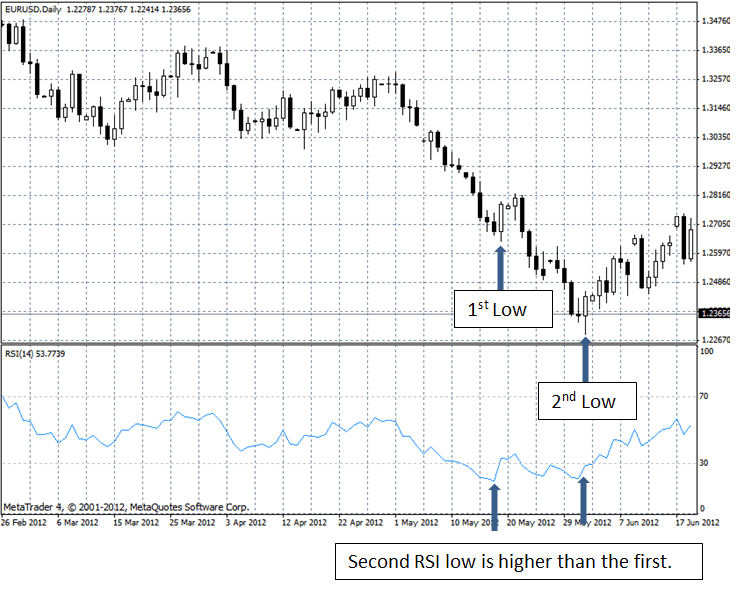

- Divergence Trading: This strategy involves identifying discrepancies between price movements and RSI readings. For instance, if the asset price is rising but the RSI is declining, it could indicate a potential bearish reversal, suggesting a sell (put) option strategy.

- Trend Confirmation: RSI can be used to confirm prevailing market trends. An uptrend is supported by RSI readings above 50, while a downtrend is reinforced by RSI readings below 50. Traders can use this confirmation to strengthen their confidence in their trading decisions.

- Bollinger Band Integration: Combining RSI with Bollinger Bands can enhance trading signals. When the RSI reaches overbought levels and the price is above the Bollinger Band upper threshold, it can suggest a strong selling opportunity. Similarly, when the RSI is oversold and the price is below the Bollinger Band lower boundary, it may indicate a viable buying opportunity.

Image: www.avatrade.es

Expert Insights

“RSI is an indispensable tool for option traders, providing valuable insights into market sentiment and price momentum,” says options market expert Dr. Mark Fisher. “By understanding RSI and implementing it strategically, traders can increase the probability of making profitable trading decisions.”

Actionable Tips

- Choose an appropriate RSI period: Optimal RSI periods vary depending on the asset and market conditions. Experiment with different periods to determine the most effective setting for your trading style.

- Combine with other indicators: RSI alone may not provide a complete picture of the market. Consider using additional indicators like Bollinger Bands, moving averages, or volume analysis to enhance your trading strategies.

- Manage risk: Option trading involves inherent risks. Always define your profit targets and stop-loss levels to limit potential losses.

Option Trading Based On The Rsi

Image: www.forexcrunch.com

Conclusion

Option trading based on the RSI is a powerful technique that can help you identify profitable trading opportunities, navigate market fluctuations, and achieve long-term financial goals. By understanding the principles of RSI, implementing effective strategies, and incorporating expert insights, you can gain a competitive edge in the ever-evolving financial landscape. Remember to approach option trading with a well-defined plan, a thorough understanding of the risks involved, and a willingness to continuously learn and adapt.