In the fast-paced and dynamic world of financial markets, investors are constantly seeking strategies to gain an edge and maximize their returns. Among these strategies, relative strength index (RSI) option trading has emerged as a powerful tool for identifying and capitalizing on market momentum. This detailed guide will delve into the intricacies of RSI option trading, providing you with the knowledge and insights to master this technique and harness its full potential.

Image: forextraininggroup.com

What is Relative Strength Index (RSI) Option Trading?

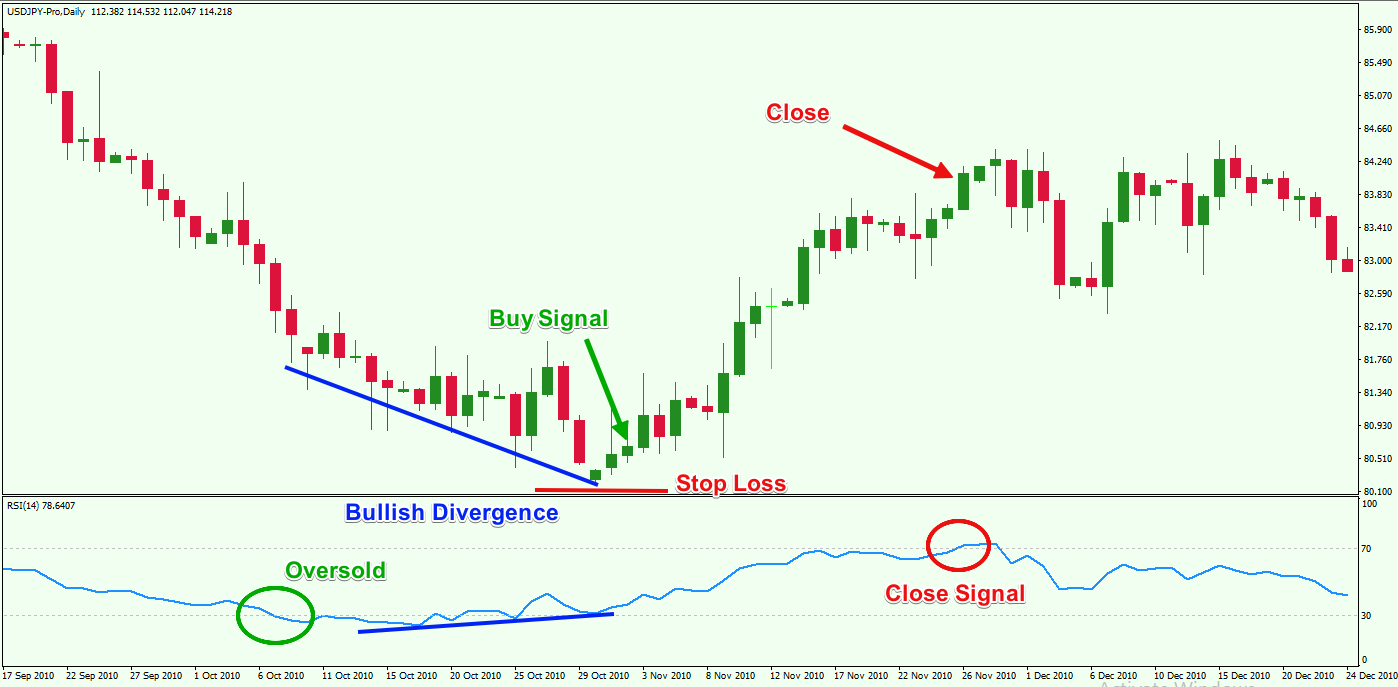

Relative Strength Index (RSI) is a technical analysis indicator that measures the magnitude of recent price changes to gauge the overbought or oversold conditions of an asset. It oscillates between 0 and 100, with values above 70 indicating overbought territory and values below 30 suggesting oversold conditions.

RSI option trading involves using the RSI indicator to identify potential trading opportunities and select appropriate option strategies. By analyzing the RSI chart patterns and identifying divergence between RSI and price action, traders can anticipate market reversals and position themselves to profit from momentum shifts.

Applications of RSI Option Trading

The versatility of RSI option trading extends to various market conditions and financial instruments. Here are some of the most common applications:

- Trend Identification: RSI can help traders identify the main trend of an asset by observing the general direction of its movement.

- Overbought/Oversold Conditions: Divergence between RSI and price action can indicate potential overbought or oversold conditions, providing clues for potential market reversals.

- Support and Resistance Levels: RSI can serve as an additional signal to validate or invalidate support and resistance levels, enhancing the reliability of trading decisions.

- Options Selection: RSI can aid in selecting appropriate option strategies, such as bullish or bearish options, based on the market momentum and potential reversal points.

Expert Insights and Actionable Tips

To maximize the effectiveness of your RSI option trading, consider incorporating the insights of renowned experts in the field. These insights can provide valuable guidance and practical strategies:

- Uwe Keller: Emphasizes the importance of combining RSI with other technical indicators, such as moving averages, to confirm trading signals.

- Clem Chambers: Advocates for using RSI to identify overbought and oversold extremes and, subsequently, adopting a contrarian trading approach.

- Peter Steidlmayer: Suggests usingRSI to identify potential reversal points and recommends entering trades when RSI oscillates near its extreme levels (above 80 or below 20).

Harnessing these insights can empower you to refine your RSI option trading strategies and seize more favorable opportunities.

Image: blog.elearnmarkets.com

Rsi Option Trading

Image: bloghowtotrade.blogspot.com

Conclusion

RSI option trading offers a powerful tool for investors seeking to tap into market momentum and potentially enhance their returns. By understanding the principles, applications, and expert insights detailed in this comprehensive guide, you can equip yourself with the knowledge and skills necessary to master this technique. As with any investment strategy, thorough research, prudent risk management, and a disciplined approach are crucial for sustainable success in RSI option trading.