Understanding Stocks

Stock trading involves buying and selling shares of companies listed on stock exchanges. When you purchase a share, you become a part-owner of that company. Your potential returns come from two primary sources: appreciation (increase in the share price) and dividends (profits shared with shareholders).

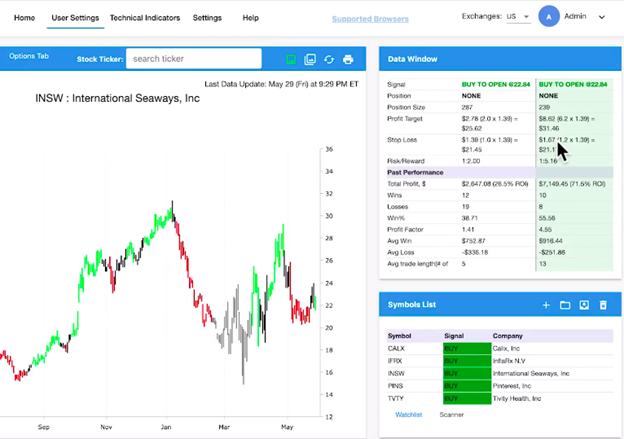

Image: www.moneyshow.com

Benefits and Risks

Benefits:

- Potential for high returns

- Diversification of portfolio

- Long-term wealth creation

Risks:

- Volatility in stock prices

- Loss of capital

- Market fluctuations

Key Concepts

Understanding these key concepts is crucial for stock trading:

- Securities: A financial instrument representing ownership in a company.

- Stock Exchange: A platform where stocks are bought and sold.

- Equity: The value of a company represented by its stock.

- Dividend: A portion of a الشركة’s profits paid out to shareholders.

- Capital Gains: Profit from selling a stock at a higher price than the purchase price.

Getting Started with Stock Trading

- Open a brokerage account: A platform through which you can buy and sell stocks.

- Research: Analyze companies and gather information to make informed investment decisions.

- Set investment goals: Determine your return expectations and risk tolerance.

- Diversify: Invest in a mix of industries and companies to reduce risk.

Image: www.pinterest.com

Options Trading: A Sophisticated Investment Strategy

Introducing Options

Options contracts give the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (typically a stock) at a specific price (strike price) on or before a specific date (expiration date).

Benefits and Risks

Benefits:

- Flexible strategies for various market conditions

- Potential for high leverage

- Speculation and hedging opportunities

Risks:

- Loss of investment

- Complex trading strategies

- Time decay

Key Concepts

These concepts are fundamental to understanding options trading:

- Call Option: Gives the holder the right to buy an asset.

- Put Option: Gives the holder the right to sell an asset.

- Premium: The price paid for an options contract.

- Strike Price: The price at which the asset can be bought/sold.

- Expiration Date: The date when the option contract expires.

Using Options Strategies

Options can be used for various trading strategies, such as:

- Covered Call: Sell a call option against underlying shares owned.

- Cash-Covered Put: Sell a put option with enough cash to purchase the asset if exercised.

- Iron Condor: A combination of two call options and two put options.

Comparing Stock Trading vs. Options Trading

| Feature | Stock Trading | Options Trading |

|---|---|---|

| Ownership | Part-owner of a company | Right to buy/sell an underlying asset |

| Risk | Moderate | High |

| Volatility | Moderate | High |

| Potential returns | High | Unlimited potential, also potential loss |

| Complexity | Simpler | Complex |

| Time commitment | Less time-consuming | More time-consuming |

| Fees | Lower brokerage fees | Higher option premiums |

Stock Trading Vs Options Trading

Image: www.stockpathshala.com

Conclusion

Both stock trading and options trading offer distinct opportunities and risks for investors. Stock trading provides a straightforward approach with moderate risk and return potential. Options trading, on the other hand, offers sophisticated strategies but comes with a higher level of risk and complexity. The best choice depends on an investor’s individual goals, risk tolerance, and knowledge.