The Power of Financial Markets: A Path to Prosperity

Investing in financial markets has become an integral part of modern-day wealth creation. Amidst the plethora of investment avenues available, the choice between trading options and stocks often perplexes investors. Both instruments offer distinct advantages, catering to different investment goals and risk appetites.

Image: dorinbrynja.blogspot.com

Delving into the Realm of Options Trading

Options are derivative contracts that grant the holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (the strike price) on or before a specified date (the expiration date). This flexibility offers traders unique strategies for managing risk and enhancing return potential.

Benefits of Options Trading:

-

Leverage: Options provide significant leverage, allowing traders to control a larger position with less capital compared to buying the underlying asset directly.

-

Risk Management: Traders can use options to hedge against potential losses or speculate on market movements without exposing themselves to the full risk of owning the underlying asset.

-

Income Generation: Selling (or writing) options can generate income if the underlying asset’s price moves within a certain range.

Exploring the World of Stocks

Stocks represent ownership in a publicly traded company. By buying a share of stock, investors become partial owners of the company and are entitled to a portion of its profits through dividends and potential share price appreciation. Stocks offer a direct stake in corporate growth and dividends.

Benefits of Stock Ownership:

-

Long-Term Capital Appreciation: Historically, stocks have outperformed other asset classes in the long run, offering the potential for significant wealth accumulation.

-

Dividends: Many companies pay dividends to their shareholders, providing a regular stream of income.

-

Ownership and Voting Rights: Shareholders have the right to vote on corporate matters and influence the company’s direction.

Choosing the Right Investment Path

The choice between trading options and stocks depends on individual investment objectives and risk tolerance.

-

Low Risk, Low Return: For those seeking capital preservation and modest returns, stocks with a solid track record of dividend payments may be a suitable option.

-

Moderate Risk, Moderate Return: Investors willing to assume some risk can explore options to enhance their returns or hedge against market downturns.

-

High Risk, High Reward: Traders with a high risk appetite and substantial investment experience may find lucrative opportunities in options trading.

![Stock Options Trading 101 [The ULTIMATE Beginner's Guide] ⋆ ...](https://tradingforexguide.com/wp-content/uploads/_stock-options-trading-101-the-ultimate-beginners-guide.jpg)

Image: tradingforexguide.com

Trading Options Vs Stock

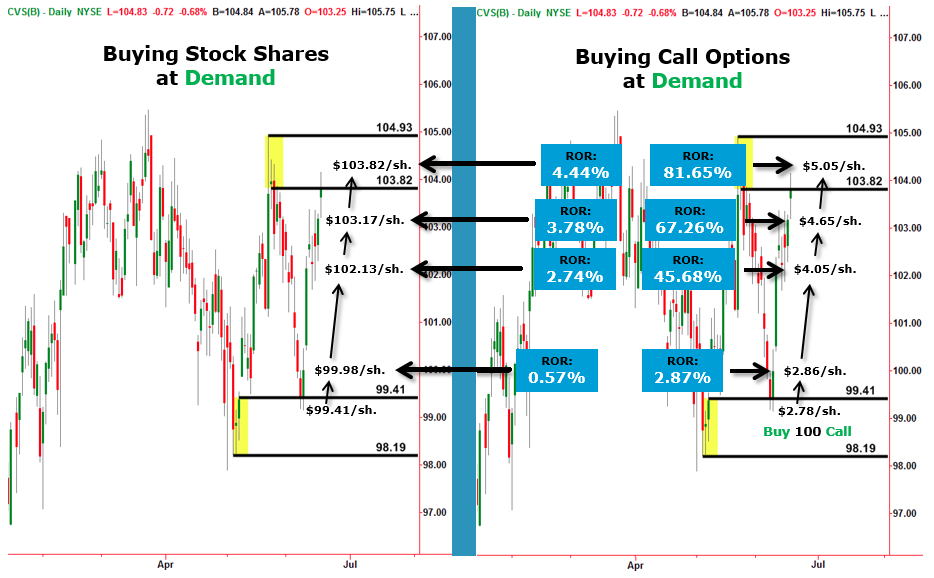

Image: www.tradingacademy.com

Seeking Expert Guidance

Navigating the complex world of financial markets requires prudence and professional advice. Consult a licensed investment advisor to understand the nuances of options and stock trading, select the strategies that align with your goals, and develop a personalized investment plan that aligns with your risk tolerance.

Remember, investing involves inherent risks. Educate yourself thoroughly, seek professional guidance, and approach the markets with a calculated strategy. By understanding the intricacies of options and stocks, you can unlock the potential for a prosperous financial future.