In the fast-paced and ever-evolving world of finance, technical analysis has emerged as an indispensable tool for traders seeking to predict market movements and maximize profits. Technical analysis of option trading, in particular, allows investors to delve into the intricacies of option pricing and identify potential trading opportunities with greater precision.

Image: hitandruncandlesticks.com

In essence, technical analysis of option trading involves studying historical price data and market activity to identify patterns and trends that may provide insights into future price movements. By examining factors such as volume, volatility, open interest, and the underlying’s price action, technical analysts aim to uncover actionable trading opportunities and mitigate risks.

The Importance of Technical Analysis in Option Trading

Technical analysis plays a critical role in option trading for several reasons. Firstly, it helps traders gain a deeper understanding of the market, its dynamics, and the factors that influence option prices. This knowledge empowers traders to make informed decisions and allocate their capital strategically.

Furthermore, technical analysis provides objective and data-driven insights that can help traders overcome the biases and emotional influences that often cloud their judgment. By relying on charts and mathematical indicators, technical analysts seek to remove the subjectivity from trading and make rational decisions based on historical patterns.

Chart Patterns in Option Trading

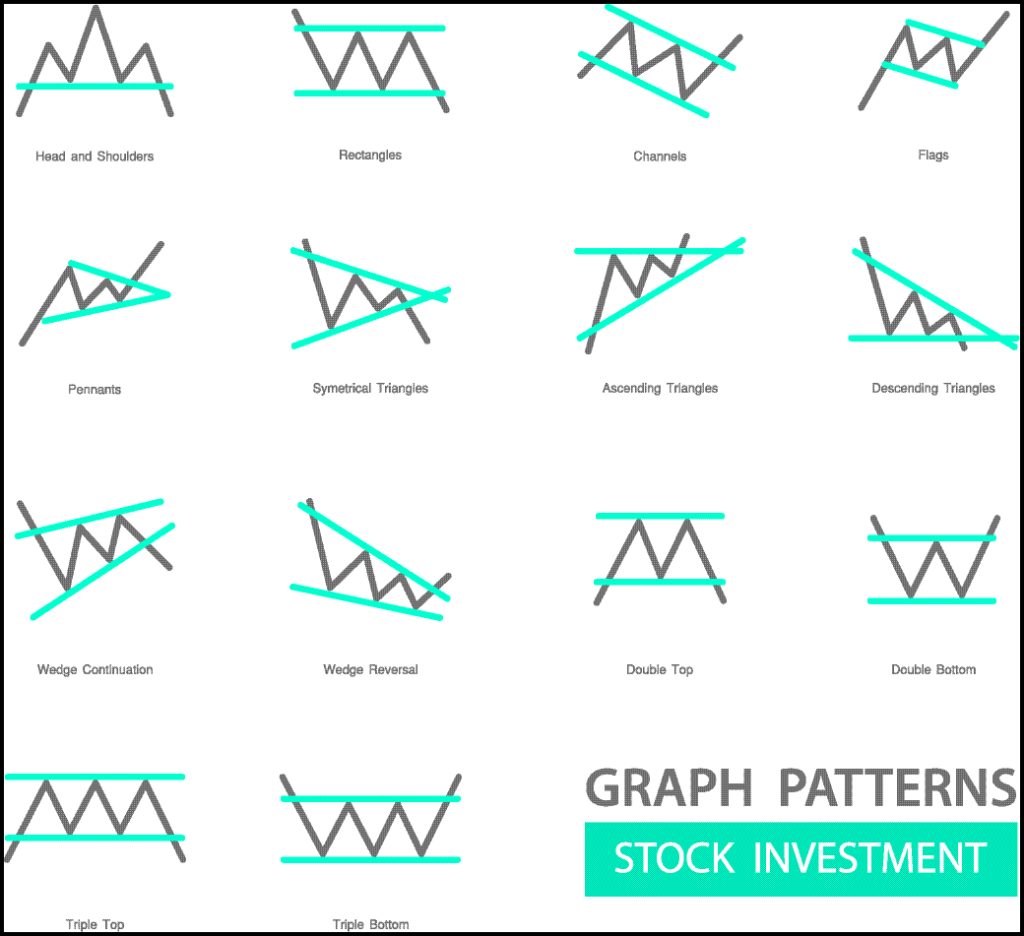

Chart patterns are one of the fundamental building blocks of technical analysis. They represent recognizable formations on price charts that can indicate potential trading opportunities. Some of the most common chart patterns include:

- Double-Bottom: This bullish pattern forms when the price falls to a support level, rallies, falls back to the same support level, and then rebounds strongly.

- Head-and-Shoulders: This bearish pattern forms when the price makes three peaks, with the middle peak being the highest. The neckline is drawn connecting the two lows formed between the peaks.

- Breakout: A breakout occurs when the price moves decisively above a resistance level or below a support level. Breakouts often indicate a trend reversal and can provide significant trading opportunities.

Technical Indicators for Option Trading

In addition to chart patterns, technical analysts also employ a wide range of technical indicators to identify trading signals and confirm their analysis. These indicators are mathematical formulas that process historical price data to generate signals, such as:

- Moving Averages: Moving averages are trend-following indicators that smooth out price fluctuations by calculating the average price over a specified period.

- Relative Strength Index (RSI): The RSI measures the strength of a trend based on the magnitude and duration of price changes.

- Bollinger Bands: Bollinger Bands are volatility indicators that create an upper and lower band based on the standard deviation of the price.

:max_bytes(150000):strip_icc()/dotdash_final_The_Most_Important_Technical_Indicators_For_Binary_Options_Dec_2020-01-c9d67ed0703c4661932ce96fcfa0573b.jpg)

Image: www.investopedia.com

Technical Analysis Of Option Trading

https://youtube.com/watch?v=-HnMeQnV4h8

Conclusion

Technical analysis of option trading is a powerful technique that can equip traders with the insights and tools they need to navigate the complex and often unpredictable world of finance. By studying historical price data, identifying chart patterns, and using technical indicators, traders can uncover potential trading opportunities, manage risk, and maximize their returns. It is important to note that technical analysis is not foolproof, and traders should always exercise caution and combine technical analysis with other investment strategies.

As the field of option trading continues to evolve, so too will the techniques and strategies used by technical analysts. By staying abreast of the latest advancements and incorporating new tools into their analysis framework, traders can enhance their understanding of the market and continue to reap the benefits of this powerful investment approach.