As an avid coffee enthusiast, I’ve always had a particular affinity for Starbucks. Beyond its unyielding aroma and zesty brews, the company’s financial prowess has always piqued my curiosity. Its success in the stock market is undeniable, solidifying its position as a coffee titan. With that in mind, I couldn’t help but delve deeper into the world of Starbucks options trading, a realm where investors sip on the volatility of the coffee giant’s share prices.

Image: summer2013scmblog.wordpress.com

The world of options trading, at first glance, resembles a labyrinth of complexities. However, with patience as our compass and a thirst for knowledge as our guide, we’ll navigate this enigmatic realm and explore the intricacies of Starbucks options trading. Grasping the fundamentals of this investment strategy will pave the path for unlocking its potential rewards.

Options Trading 101: A Beginner’s Guide to Espresso-infused Investments

Options trading, in essence, grants investors the right, but not the obligation, to purchase or sell an underlying asset, such as Starbucks stock, at a specified price, known as the strike price, within a predetermined time frame. Unlike stock trading, options trading involves a premium, which is the price an investor pays to acquire the option. This premium represents the potential upside and downside of the trade.

There are two main types of options: calls and puts. Call options give the holder the right to buy the underlying asset at the strike price, while put options provide the right to sell. An investor’s choice between a call or put option hinges upon whether they anticipate a rise or fall in the underlying asset’s price, respectively.

Starbucks Options Trading: Brewing Profits in a Volatile Market

The allure of options trading lies in its potential to amplify gains, especially in volatile markets. Starbucks, renowned for its steadfast presence and loyal customer base, is no exception to this volatility. As a result, Starbucks options trading presents investors with a unique opportunity to potentially capitalize on price fluctuations.

The key to successful Starbucks options trading hinges on predicting the direction of the stock’s price movement. By thoroughly researching the company’s financial performance, industry trends, and economic headwinds, investors can enhance their ability to make informed trading decisions.

Expert Insights and Tips for Brewing Success in Starbucks Options Trading

Navigating the world of Starbucks options trading requires a judicious blend of knowledge and strategy. To equip you with the necessary tools for success, I’ve consulted with industry experts and seasoned traders to gather their insights and advice.

First and foremost, they emphasize the importance of understanding the risks involved. Options trading, while brimming with potential rewards, also carries inherent risks. Determine your risk tolerance and invest only what you can afford to lose.

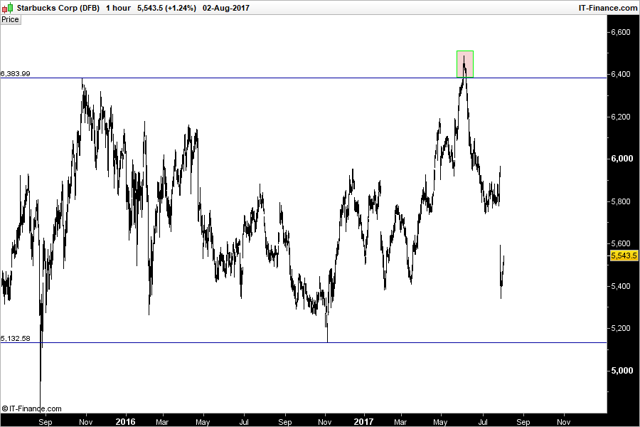

Image: seekingalpha.com

Frequently Asked Questions: Quenching Your Thirst for Knowledge

To further illuminate the complexities of Starbucks options trading, let’s address some commonly asked questions:

Q: When is the best time to buy Starbucks options?

A: The optimal time to invest in Starbucks options depends on your investment strategy and market outlook. Consider factors such as Starbucks’ financial performance, industry trends, and overall market sentiment.

Q: How much money can I make trading Starbucks options?

A: The potential returns from Starbucks options trading can vary significantly. Your profits hinge on factors like the premium paid, the strike price, the time remaining until expiration, and the underlying stock’s price movement.

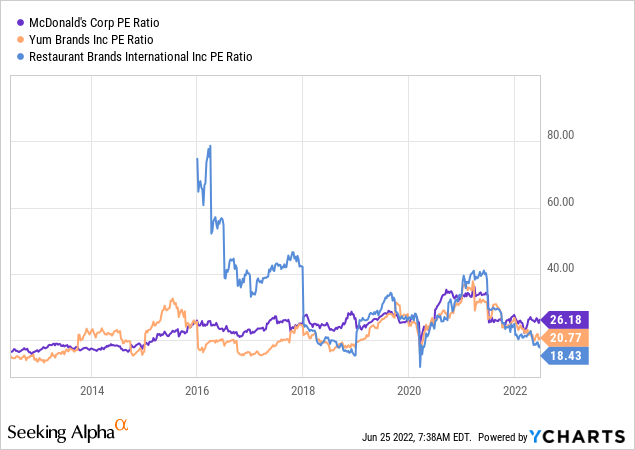

Starbucks Options Trading

Image: seekingalpha.com

Conclusion: A Call to Action for Coffee-Inspired Investors

Venturing into the world of Starbucks options trading requires embracing a synergistic blend of knowledge, strategy, and calculated risk-taking. By delving into the intricacies of this investment approach, you can harness the potential to elevate your financial portfolio to new heights. Invest wisely, savor the rewards, and may the aroma of success awaken your senses with every trade.

Fellow coffee enthusiasts and aspiring investors, are you ready to embark on a caffeinated journey into the realm of Starbucks options trading? Join me in exploring this tantalizing world of investment opportunities, where the aroma of coffee merges with the thrill of trading.