Introduction

Options trading has emerged as a powerful tool for investors seeking to navigate the ever-changing financial markets. However, understanding the complexities of options trading can be daunting, particularly for beginners. Enter technical analysis, a cornerstone technique that empowers traders with actionable insights into market trends and price movements. In this article, we delve into the invaluable world of option trading technical analysis, providing you with a comprehensive guide to unlock market insights for informed decisions.

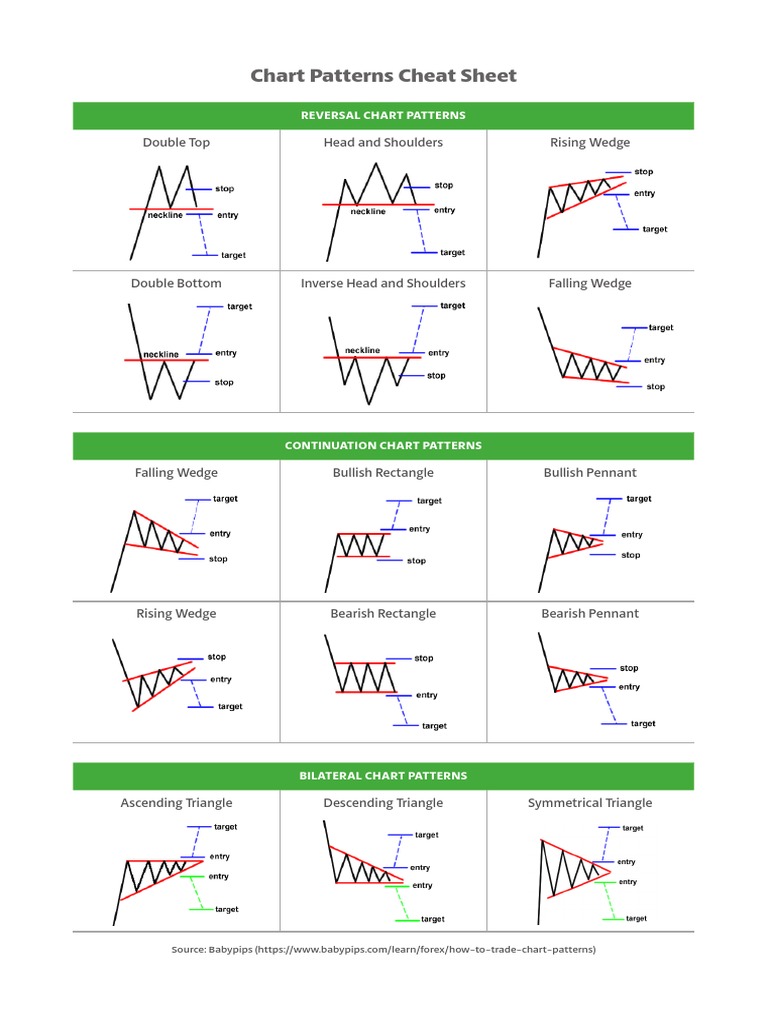

Image: resortyoshimasa.com

Unveiling Option Trading Technical Analysis

Technical analysis involves studying historical market data, including price charts and volume, to identify patterns and make predictions about future price movements. By scrutinizing these patterns, traders can gain a deeper understanding of market sentiment, support and resistance levels, and trend reversals. This knowledge equips traders with an invaluable advantage in assessing market conditions and making calculated trading decisions.

Essential Elements of Technical Analysis for Option Trading

- Trend Analysis: Technical analysis helps traders identify market trends, whether bullish or bearish. Understanding trend direction is crucial in determining the overall market sentiment and making informed decisions about entry and exit points.

- Support and Resistance Levels: Technical analysis allows traders to identify support and resistance levels, pivotal points where prices tend to bounce back or reverse. These levels provide critical information on potential market reversals and can inform strategic trading decisions.

- Volume Analysis: Volume, representing the number of trades executed during a specific period, offers valuable insights into market participation. High volume typically indicates increased market interest and volatility, while low volume may suggest a lack of conviction and potential trend reversals.

- Moving Averages: Moving averages smooth out price fluctuations over time, revealing underlying trends and potential turning points. Traders often use moving averages to determine market direction and identify possible entry and exit points.

- Momentum Indicators: Momentum indicators, such as the Relative Strength Index (RSI), measure the speed and strength of price movements. These indicators can help traders gauge market momentum and identify potential overbought or oversold conditions.

- Candlestick Charting: Candlestick charts provide a visually rich representation of price action, offering insights into market emotions and psychological factors. By analyzing candlestick patterns, traders can gain insights into market sentiment and predict potential price reversals.

Real-World Applications in Option Trading

Technical analysis plays a pivotal role in various aspects of option trading:

- Option Premium Valuation: Technical analysis enables traders to gauge option premium values and identify potential options trading opportunities.

- Implied Volatility Assessment: Technical analysis helps traders assess implied volatility, a critical factor in determining option prices.

- Greeks Management: By employing technical analysis, traders can monitor Greeks, key parameters influencing option pricing, and adjust accordingly.

Image: www.scribd.com

Option Trading Technical Analysis Pdf

https://youtube.com/watch?v=e4hr7IqEDaQ

Conclusion

Technical analysis remains an indispensable tool for option traders, providing them with valuable insights into market trends and price movements. By mastering this technique, traders can enhance their decision-making capabilities, optimize their option trading strategies, and ultimately maximize their chances of success in the ever-evolving financial markets. Embrace the power of technical analysis today and unlock the profound knowledge that will empower your option trading journey.