Introduction

In the labyrinthine world of finance, futures and options trading stand as potent instruments with the potential to both magnify gains and amplify risks. For those seeking a deeper understanding of these sophisticated derivatives, India presents a vibrant and lucrative market. With this comprehensive guide, we embark on a journey to decode the intricacies of futures and options trading in the Indian context, empowering you to make informed decisions and harness their transformative power.

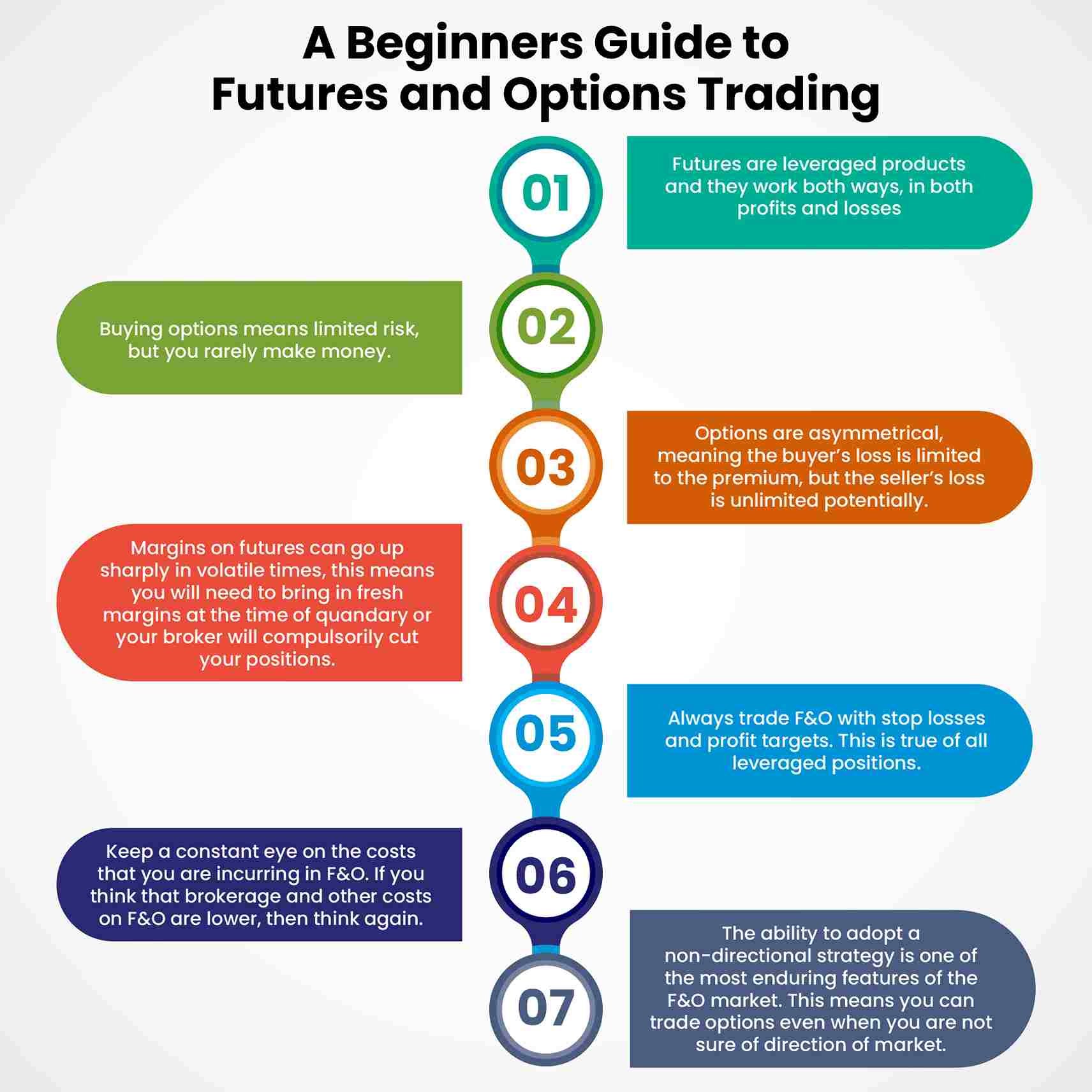

Image: db-excel.com

Understanding Futures and Options

Futures contracts are standardized agreements to buy or sell a specific asset at a predetermined price on a future date. They act as hedges against price fluctuations, allowing traders to mitigate risks and secure future prices. Options, on the other hand, provide the right, but not the obligation, to buy or sell an asset at a certain price within a specified time frame. With options, traders can potentially profit from price movements without the full commitment of buying or selling the underlying asset.

The Indian Market Landscape

India’s futures and options market has witnessed a remarkable surge in recent years, attracting both domestic and international participants. The country’s esteemed stock exchanges, including the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), offer a wide range of futures and options contracts on various asset classes, including equity indices, commodities, currencies, and interest rates. This diverse landscape provides ample opportunities for traders to diversify their portfolios and explore a multitude of trading strategies.

Getting Started

Venturing into futures and options trading requires a thorough understanding of the underlying concepts and a disciplined approach. Before placing any trades, aspiring traders must equip themselves with knowledge of market dynamics, risk management techniques, and trading platforms. Reputable brokerage firms and educational resources offer invaluable guidance and support for those embarking on this challenging but potentially rewarding endeavor.

Image: marketsandfinanceacademy.com

Essential Tips for Success

To thrive in the competitive arena of futures and options trading, several key principles should be meticulously adhered to. Managing risk is paramount, and traders should always employ stop-loss orders to limit potential losses. Disciplined trade execution and adherence to predefined trading plans are crucial for long-term success. Continuous learning and staying abreast of market developments through research and analysis are essential for making informed trading decisions.

Trading Strategies

A vast array of trading strategies can be employed in futures and options trading, each catering to specific market conditions and trader preferences. From scalping to day trading, swing trading, and arbitrage, traders can tailor their strategies to align with their risk tolerance and return objectives. Careful consideration of market trends, technical analysis, and fundamental factors is essential when developing and executing any trading strategy.

Expert Insights and Case Studies

Learning from the experiences of seasoned traders can provide invaluable insights into the intricacies of futures and options trading. Seeking mentorship from successful traders and studying case studies of profitable trades can accelerate your learning curve and enhance your trading acumen. By studying the strategies and methodologies of those who have mastered this craft, aspiring traders can gain valuable knowledge and develop their own unique approaches.

How To Do Futures And Options Trading In India

Image: www.setindiabiz.com

Conclusion

With dedication, discipline, and a comprehensive understanding of the markets, futures and options trading can be a captivating and lucrative endeavor in the Indian financial landscape. By embracing the principles outlined in this guide, aspiring traders can navigate the complexities of these derivatives, make informed decisions, and harness their full potential. Remember, trading involves inherent risks, and it’s imperative to proceed with caution and seek professional guidance when necessary. As you embark on this exciting journey, we encourage you to wholeheartedly embrace the transformative power of knowledge and stay committed to continuous learning. May your trading journey be filled with calculated risks, strategic decisions, and substantial rewards.