From the first whispers of a looming storm to the early signs of spring sunshine, the weather has a profound impact on our lives, shaping our day-to-day routines and influencing global economies. This interconnectedness extends to the realm of financial markets, where weather forecasts have emerged as valuable tools for options traders seeking to turn atmospheric conditions into profitable trades. In this comprehensive guide, we will delve into the fascinating world of options trading off of weather forecasts, providing an overview of this innovative approach, essential concepts, and valuable tips to enhance your trading strategies.

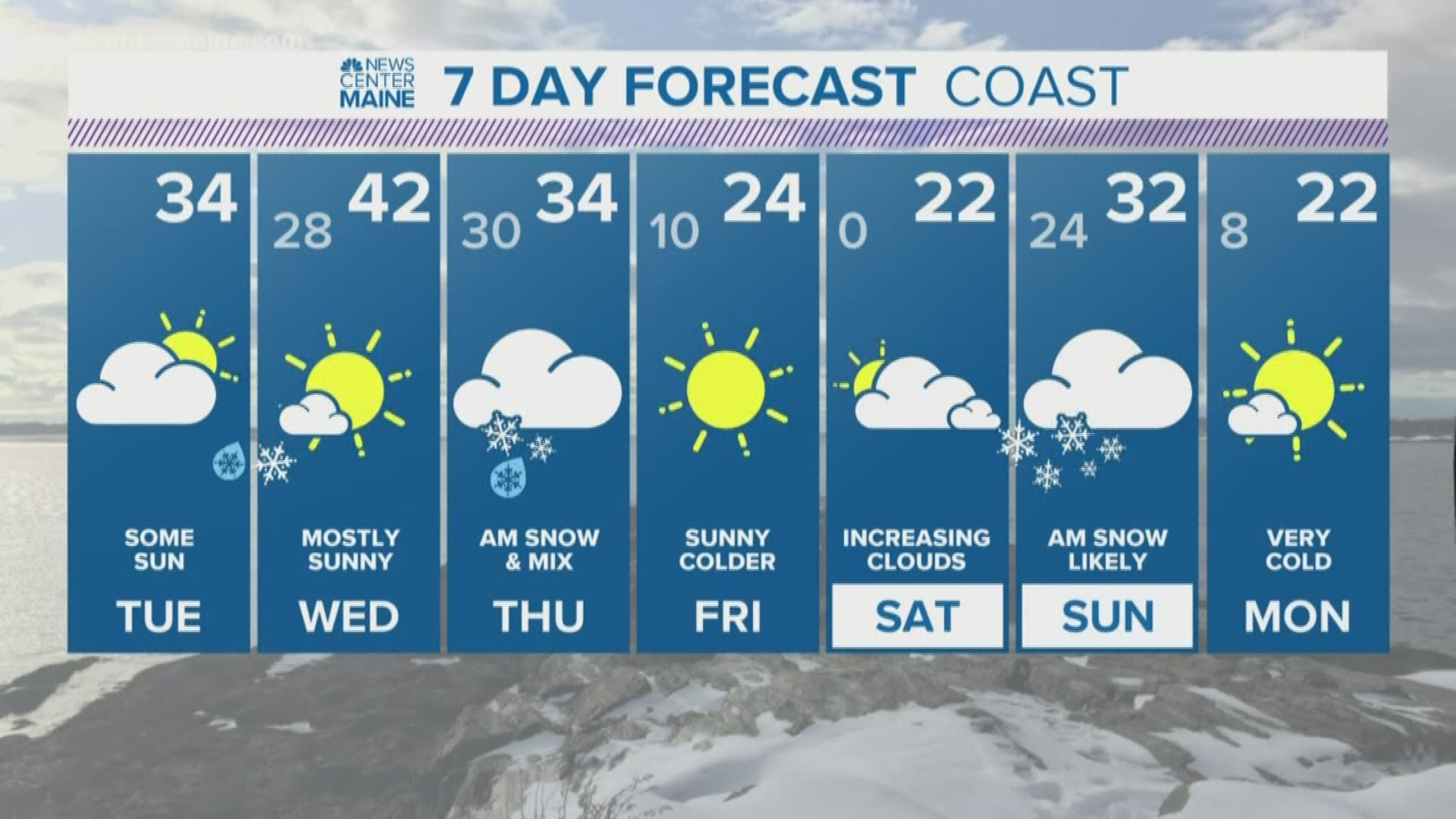

Image: www.newscentermaine.com

Unveiling Options Trading: A Window to Weather Profits

Options trading, in essence, involves the buying and selling of contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and time. These versatile instruments offer a myriad of possibilities for traders, from hedging against portfolio fluctuations to speculating on future market movements. In the realm of weather-based options trading, the underlying asset is a weather index, which encapsulates data on various weather parameters such as temperature, precipitation, snowfall, and wind speed. By meticulously analyzing weather forecasts and understanding the impact of meteorological conditions on the market, traders can identify lucrative opportunities to capitalize on the ebb and flow of the weather.

Decoding Weather Forecast Options: A Lexicon of Key Concepts

Before embarking on the journey of weather forecast options, a firm grasp of fundamental concepts is crucial. Weather-based index options, as previously mentioned, mirror weather parameters such as temperature or rainfall. These options contracts are standardized, ensuring uniformity in terms of the underlying index, contract period, and settlement methodology. Settlement prices for these options are derived from publicly available weather data, providing transparency and minimizing potential disputes. It’s important to note that weather forecasts serve as a foundational guide for traders, indicating potential weather conditions that may impact the value of the underlying index. However, it’s crucial to recognize that weather forecasts are inherently probabilistic, and actual weather conditions may diverge from predicted outcomes, underscoring the inherent risk associated with this type of trading.

Spotting Opportunities: Leveraging Weather Forecasts for Smart Trades

The ability to decipher weather forecasts and interpret their implications on various markets is what sets successful weather forecast options traders apart. By monitoring seasonal trends, historical weather patterns, and real-time updates from credible weather sources, traders can identify periods when weather conditions are likely to deviate from the norm, creating potential trading opportunities. For instance, a trader anticipating a colder-than-normal winter could purchase a call option on a heating oil futures contract, speculating that colder temperatures will drive up demand for heating oil and, in turn, the value of the futures contract. Conversely, a trader anticipating a milder-than-normal summer could sell a put option on a natural gas futures contract, betting that reduced cooling demand will lower natural gas prices.

Image: www.cottongrower.com

Seeking Shelter: Hedging Strategies for Risk Management

While options trading offers the potential for substantial rewards, it’s essential to acknowledge that all trading endeavors, including weather forecast options, inherently carry a degree of risk. To mitigate potential losses and safeguard their financial interests, traders employ hedging strategies to offset the risks associated with unforeseen meteorological conditions. Hedging involves entering into additional trades that aim to counterbalance the risk exposure of the initial trade. For instance, a farmer concerned about the impact of an impending heatwave on their projected crop yield could purchase a put option on a corn futures contract, ensuring a minimum price for their crop in case of adverse weather conditions.

Navigating the Market Landscape: A Survey of Weather Forecast Trading Platforms

With the advent of technology, a multitude of online platforms have emerged, facilitating weather forecast options trading from the convenience of your computer or mobile device. These platforms provide real-time weather data, advanced charting tools, and intuitive trading interfaces, allowing traders to monitor market trends, analyze historical data, and execute trades with just a few clicks. Some popular weather forecast trading platforms include DTN, Weather Source, and Climate Forecast Applications Network. When selecting a platform, it’s crucial to consider factors such as platform reliability, data accuracy, and the range of weather indices and options contracts offered.

Harvesting Wisdom: Tips for Enhanced Weather Forecast Trading

As with any trading discipline, honing your weather forecast options trading skills requires continuous learning, adaptability, and the incorporation of effective strategies. Here are a few invaluable tips to bolster your trading prowess:

-

Diligent Research: A Foundation of Knowledge: Delve into the intricacies of weather patterns, historical data analysis, and the impact of weather conditions on various markets. A comprehensive understanding of these factors will serve as a cornerstone for making informed trading decisions.

-

Meteorological Expertise: Unlocking Weather Wisdom: Develop a keen eye for interpreting weather forecasts, considering both probabilistic outcomes and potential for deviations from predicted conditions. A thorough grasp of weather dynamics and an ability to discern actionable insights from complex weather data will elevate your trading strategies.

-

Risk Management: A Prudent Approach: As previously emphasized, risk management is paramount in weather forecast options trading. Implement robust hedging strategies to mitigate potential losses, ensuring the preservation of your financial well-being.

-

Disciplined Execution: A Path to Consistency: Once you have identified a trading opportunity, execute your trades with discipline and precision. Avoid impulsive decisions and adhere to your predetermined trading plan, as emotions can often lead to unwise choices.

-

Continuous Learning: An Ongoing Quest for Knowledge: Financial markets, including weather forecast options trading, are constantly evolving. Diligently follow market news, industry updates, and research reports to stay abreast of the latest developments and refine your trading strategies accordingly.

Options Trading Off Of Weather Forecast

Image: www.pinterest.com

Conclusion: Embracing the Symphony of Weather and Market Rhythms

Options trading off of weather forecasts presents a unique and captivating opportunity for traders to leverage their understanding of meteorology to generate profitable trades. By meticulously analyzing weather forecasts, identifying market inefficiencies, and employing sound risk management strategies, traders can navigate the dynamic interplay between weather and market conditions, reaping the rewards of successful options trading. Remember, ongoing learning, adaptability, and a disciplined approach are the cornerstones of successful weather forecast options trading. Embrace the interconnectedness of weather and financial markets, and unlock the potential for profitable trades amidst the ever-changing elements.