Snow Options Trading: A New Arena for Financial Exploration

As the world becomes increasingly complex and interconnected, so do the opportunities for financial growth. Snow options trading has emerged as one such opportunity, offering investors a unique and potentially lucrative way to navigate the ever-changing market. In this comprehensive guide, we will dive deep into the world of snow options trading, providing you with a clear understanding of its intricacies, potential benefits, and strategic approach.

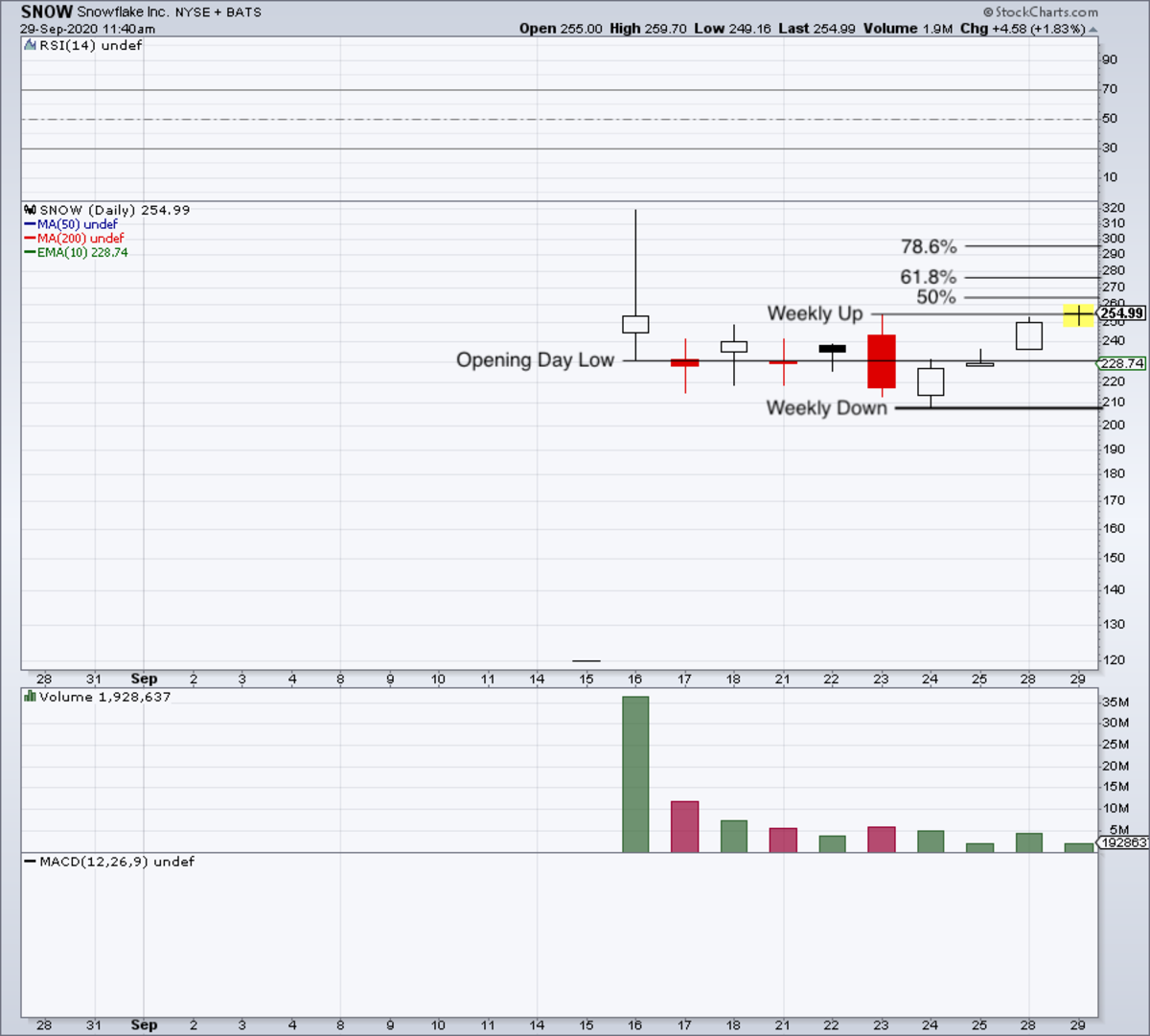

Image: www.tradingview.com

Snow options trading revolves around the concept of snowfall and its impact on various sectors. By speculating on the amount of snowfall in a particular region and time period, investors can capitalize on the fluctuations in the underlying price of snow-related assets and derivatives.

Historical Trends and Market Dynamics

The history of snow options trading can be traced back to the 1990s when weather derivatives emerged as a viable financial instrument. However, the market gained significant traction in the 2010s as advances in weather forecasting and data analytics made it possible to more accurately predict snowfall and its impact on businesses and industries.

Snow options trading is influenced by a wide range of factors, including weather patterns, climate change, and the performance of snow-dependent sectors such as tourism, transportation, and energy. Understanding these dynamics is crucial for investors to make informed decisions and mitigate potential risks.

Navigating the Intricacies of Snow Options Trading

Snow options trading involves the purchase or sale of contracts that give the holder the right to buy or sell a specific amount of snow at a predefined price and time. The underlying asset for snow options is typically a futures contract based on snowfall data collected at various weather stations.

Investors can choose from a variety of snow options contracts with different strike prices, expirations, and contract sizes. Understanding the nuances of each contract type is essential to developing a successful trading strategy. Additionally, factors such as the expected value, vega, and contango must be taken into account when making investment decisions.

Latest Trends and Emerging Opportunities

The snow options trading market is constantly evolving, with technological advancements and shifting market dynamics creating new opportunities and challenges. In recent years, the integration of artificial intelligence and machine learning has enhanced the accuracy of snowfall predictions, enabling investors to make more informed trading decisions.

Another notable trend is the growth of environmental, social, and governance (ESG) investing. Investors are increasingly seeking ways to align their portfolios with their values, and snow options trading offers a unique opportunity to invest in sustainable practices and support regions vulnerable to climate change.

Image: www.tradingview.com

Expert Tips for Successful Snow Options Trading

Successful snow options trading requires a combination of market knowledge, strategic planning, and risk management. Here are some expert tips to help you navigate this dynamic market:

- Conduct thorough research: Understand the historical snowfall patterns, weather dynamics, and economic impact of snow in the region you are interested in.

- Choose the right contract: Select snow options contracts that align with your investment goals, risk tolerance, and time horizon.

- Manage your risk: Utilize hedging strategies, such as purchasing put options or entering into futures contracts, to mitigate the potential for losses.

- Stay informed: Monitor weather forecasts, track market trends, and stay abreast of events that may impact snowfall and snow-related industries.

- Consult with professionals: If necessary, seek guidance from experienced snow options traders or financial advisors to enhance your decision-making.

By following these tips and continuously honing your trading skills, you can increase your chances of success and capitalize on the opportunities that snow options trading offers.

FAQ on Snow Options Trading

- Q: How do I start snow options trading?

A: To start snow options trading, you will need to open an account with a brokerage firm that offers this service. You will also need to educate yourself on the basics of snow options trading and develop a trading strategy. - Q: What is the minimum investment required to trade snow options?

A: The minimum investment required to trade snow options varies depending on the brokerage firm and the contract size. Typically, you can start with a small investment of a few hundred dollars. - Q: Is snow options trading profitable?

A: Snow options trading can be profitable if executed with a well-informed strategy and effective risk management. However, like any type of investment, there is always potential for losses. - Q: How do I limit my losses in snow options trading?

A: There are several strategies you can employ to limit your losses in snow options trading. These include setting stop-loss orders, using hedging techniques, and diversifying your portfolio.

Snow Options Trading

Image: www.thestreet.com

Conclusion

Snow options trading has opened up a new frontier for investors seeking diversification and innovative ways to capitalize on weather-related phenomena. By embracing the latest trends and developments, mastering the intricacies of snow options contracts, and implementing sound risk management practices, savvy investors can unlock the potential of this burgeoning market.

Call to action: If you are intrigued by the exciting world of snow options trading and eager to explore its potential, take the first step today. Consult with experienced traders or financial advisors, educate yourself on best practices, and embark on a journey that could significantly enhance your investment portfolio and deepen your understanding of the dynamic forces that shape our world.