Introduction

Image: www.makeupera.com

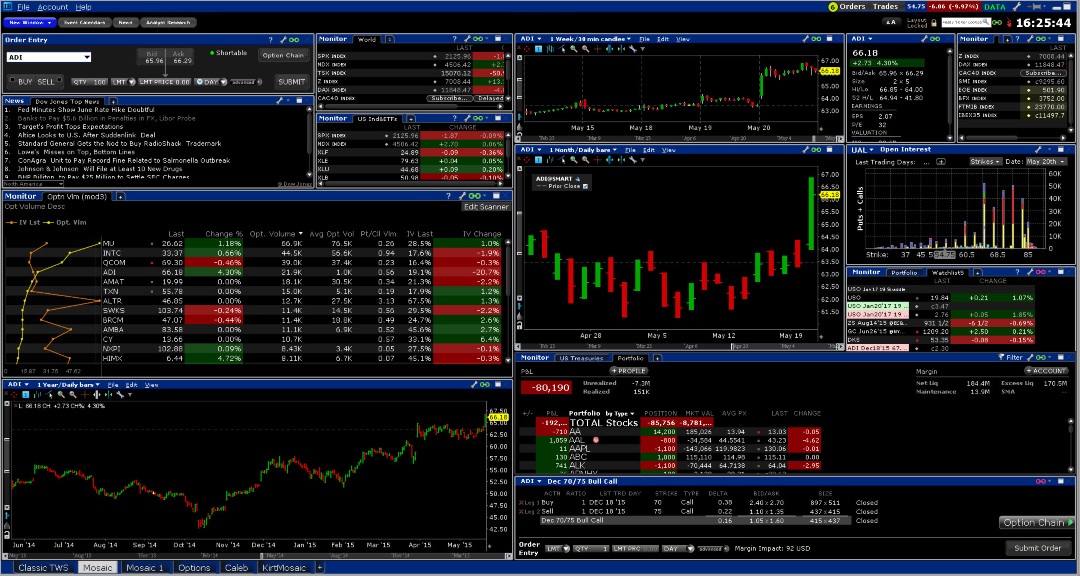

In the fast-paced world of financial trading, speed is of the essence. Lightspeed Trading, a leading provider of electronic trading platforms, offers a popular solution for options traders seeking lightning-fast execution. However, it’s important to understand the associated fees to make informed decisions. This article delves into the complexities of Lightspeed Trading options fees, providing a comprehensive guide to its structure, calculation, and impact on trading strategies.

Understanding Lightspeed Trading Options Fees

Lightspeed Trading charges a tiered pricing model based on the number of contracts traded per month. Each tier offers varying discounts, effectively lowering the per-contract fee as trading volume increases. The fee structure is designed to cater to the needs of different traders, from occasional options buyers to high-volume institutional players.

The minimum fee for a single options contract is $0.50, with discounts ranging from 10% to 50% depending on the tier reached. As trading volume surpasses certain thresholds, such as 1,000 or 5,000 contracts per month, traders qualify for lower per-contract fees. This fee structure incentivizes traders to consolidate their trading activity on Lightspeed’s platform to maximize savings.

Calculating Options Fees on Lightspeed Trading

Calculating options fees on Lightspeed Trading is straightforward. The total fee is determined by multiplying the number of contracts traded by the per-contract fee applicable to the trader’s tier. For instance, a trader in the second tier trading 200 contracts in a month would pay a total fee of $0.45 x 200 = $90.

Lightspeed Trading provides a convenient fee calculator on its website, allowing traders to estimate their potential fees based on their anticipated trading volume. This tool helps traders make informed decisions about platform fees and plan their trading strategies accordingly.

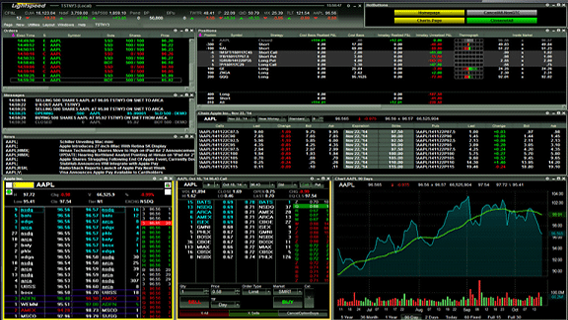

Impact of Fees on Trading Strategies

While speed and efficiency are essential for options traders, fees can significantly impact overall trading profitability. High fees can erode returns, especially for short-term traders or those who trade large volumes. Traders should carefully consider the fee structure of their trading platform in relation to their trading style and profit targets.

For traders with low to moderate trading volume, Lightspeed Trading’s tiered pricing model can provide competitive fee rates. However, traders with very high trading volume may find it more cost-effective to negotiate customized fee arrangements with Lightspeed Trading or consider alternative platforms with lower per-contract fees.

Image: j2t.com

Lightspeed Trading Options Fees

Image: daytradereview.com

Conclusion

Understanding Lightspeed Trading options fees is crucial for traders seeking the best execution platform for their needs. Lightspeed’s tiered pricing model offers flexibility and cost savings for different trading volumes. By leveraging the fee calculator and carefully considering the impact of fees on their strategies, traders can optimize their trading performance and maximize profitability.