Navigating the Complex World of Options Trading: A Brokerage Account Comparison Guide

Options trading, a multifaceted investment strategy involving the purchase and sale of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date, presents both immense opportunities and potential risks for investors. Finding the right brokerage account that caters to your specific options trading needs is paramount to maximizing your returns while minimizing losses.

Image: voxt.ru

Choose a Brokerage Tailored to Your Options Trading Journey

Navigating through the ocean of brokerage accounts can be a daunting task, particularly for options traders. To steer your decision-making process in the right direction, consider the following parameters:

Essential Factors to Consider:

- Commission structure: Pay attention to the brokerage’s commission fees for options trades, which can vary widely.

- Trading platforms: Check the user-friendliness, capabilities, and research tools offered by different platforms.

- Account minimum: Determine if the brokerage’s minimum account balance meets your financial capabilities.

- Regulatory compliance: Ensure the brokerage is regulated by a reputable financial authority.

- Options trading features: Evaluate the availability of key features like advanced order types and margin trading.

Top Brokerage Options for Options Traders: A Comparative Analysis

1. Interactive Brokers: Known for its low commissions, powerful trading platform, and wide range of options trading features. Suitable for experienced traders.

2. TD Ameritrade: Offers a user-friendly platform with educational resources and a comprehensive suite of options trading tools. Ideal for both novice and experienced traders.

3. Fidelity: Provides a well-rounded platform with robust research and customer support. Suitable for a broad spectrum of traders, including options enthusiasts.

4. tastyworks: Geared towards active options traders, offering low commissions, an intuitive platform, and exceptional trading tools.

*5. ETrade**: Known for its user-friendly platform and educational materials, making it an accessible choice for beginner options traders.

Navigating the Nuances of Options Trading: Specialized Features to Know

Once you have identified a brokerage that fits your needs, delve deeper into the specialized features that empower options traders:

- Advanced order types: Enhance trade execution with limit orders, stop orders, and other complex order types.

- Margin trading: Access leverage to amplify potential profits, but understand the associated risks.

- Options chains: View the entire range of available options contracts for an underlying asset.

- Real-time data: Stay informed with up-to-the-minute market data and news.

- Option analytics: Analyze options contracts using Greeks and other metrics to make informed decisions.

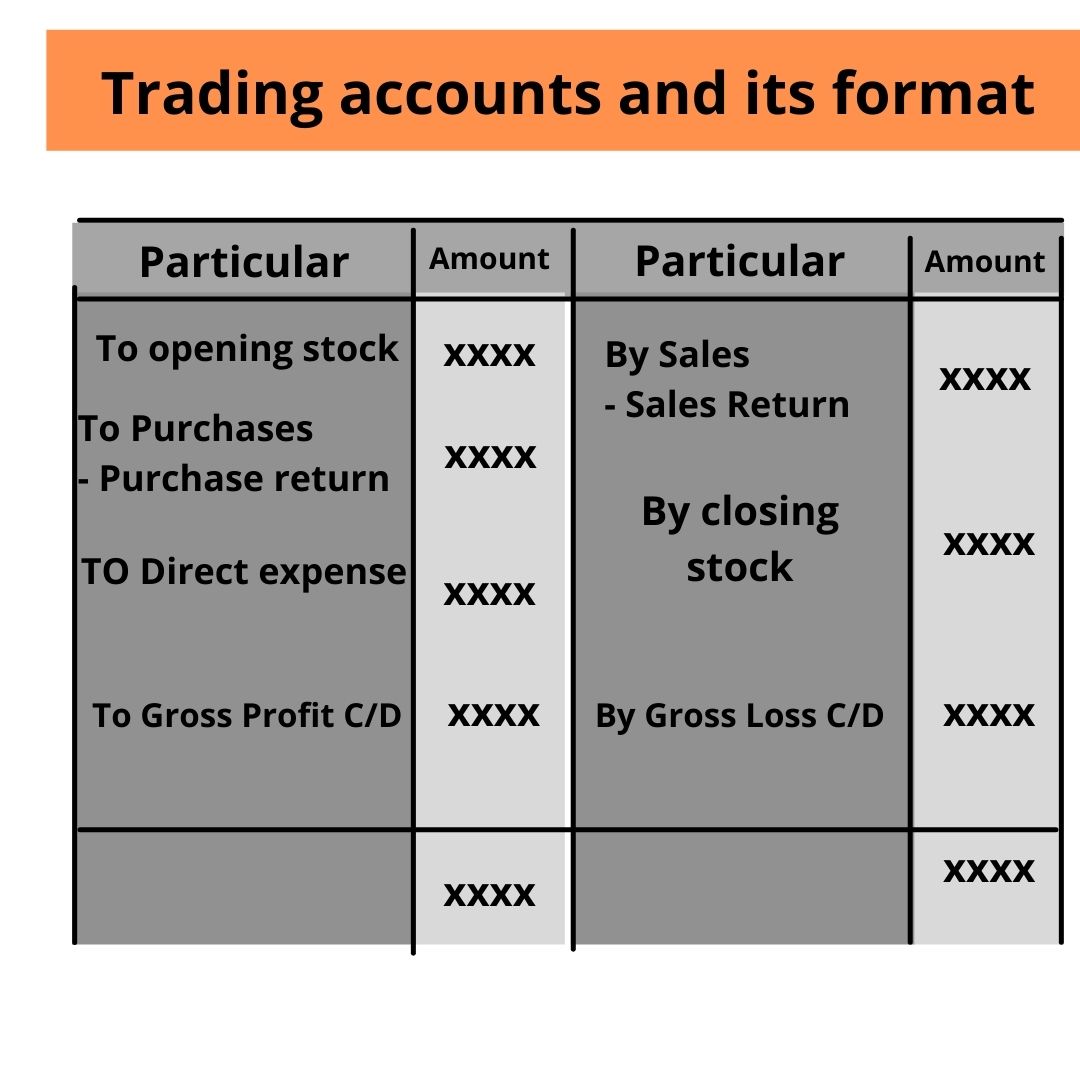

Image: www.thevistaacademy.com

Unveiling the Power of Options Trading: Strategies and Techniques

With the right brokerage account and features at your fingertips, embark on the journey of options trading with these strategies in mind:

- Covered calls: Sell covered calls against stocks you own to generate income while limiting downside risk.

- Cash-secured puts: Sell cash-secured puts to collect premium with the obligation to buy the underlying asset if assigned.

- Iron condors: Combine multiple options strategies to create defined risk profiles with potential return.

- Butterfly spreads: Capitalize on neutral to bullish market movements with a combination of options contracts.

- Trading options: Buy or sell options directly to speculate on price movements or hedge against risk.

Embrace Education and Risk Management: A Path to Success in Options Trading

As you navigate the intricacies of options trading, prioritize education and risk management:

- Ongoing learning: Stay informed about market trends, strategies, and trading techniques.

- Paper trading: Practice options trading in a simulated environment to gain experience without risking capital.

- Risk management: Manage your risk tolerance through diversification, position sizing, and stop-loss orders.

- Stop-loss orders: Execute automatic trade exits at predefined price levels to limit losses.

- Backtesting: Evaluate trading strategies historically to assess their effectiveness and potential risk-reward profiles.

Brokerage Account That Do Options Trading

Image: www.youtube.com

Conclusion: Unlocking the Potential of Options Trading with the Right Brokerage

Discovering the right brokerage account is the first step towards a successful options trading journey. By considering essential factors, comparing reputable platforms, and mastering specialized features, you can empower yourself to navigate market complexities and seize profit-making opportunities while managing risk. Remember, patience, discipline, and a continuous pursuit of knowledge are key to unlocking the full potential of options trading.