Trading options can be a lucrative pursuit for savvy investors seeking to enhance their returns. However, choosing the ideal brokerage account is crucial for optimizing your options trading experience. This comprehensive guide will delve into the intricacies of selecting the best brokerage account for your specific needs, empowering you to make informed decisions and maximize your trading potential.

Image: www.wallible.com

Deciphering Options Trading and Its Enticing Benefits

Options trading involves the buying or selling of options contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. This versatile instrument offers investors myriad opportunities, such as hedging against market downturns, speculating on price movements, and generating income through option premiums. By understanding the dynamics of options trading, you can effectively harness its potential to amplify your investment returns.

Unraveling the Key Attributes of an Optimal Options Trading Brokerage Account

Choosing the best brokerage account for options trading necessitates careful consideration of several key factors:

- Low Trading Fees: Opt for a brokerage that charges minimal fees per trade, as these can accumulate over time and significantly impact your overall profitability.

- Advanced Trading Platforms: Seek a platform with robust charting tools, real-time market data, and customizable options chains to facilitate informed decision-making.

- Margin Trading Capabilities: If you plan to leverage margin trading, select a brokerage that offers competitive margin rates and flexible margin policies tailored to your risk appetite.

- Account Minimums: Consider brokerages with no account minimums or low account minimums to avoid prohibitive barriers to entry.

- Customer Support: Excellent customer support is paramount in resolving any queries or issues you may encounter while trading options.

Navigating the Options Trading Landscape: A Comprehensive Overview

Options trading entails numerous strategies, each with its unique risk and reward profile. Common approaches include:

- Covered Calls: Selling a call option against a stock you own to generate income while potentially limiting your upside potential.

- Cash-Secured Puts: Selling a put option while holding cash reserves to potentially acquire an asset at a discounted price.

- Iron Condor: Combining a bullish and a bearish spread to profit from a relatively stable market within a defined range.

- Butterfly Spread: A neutral strategy involving the simultaneous purchase and sale of options at various strike prices to capitalize on a specific market bias.

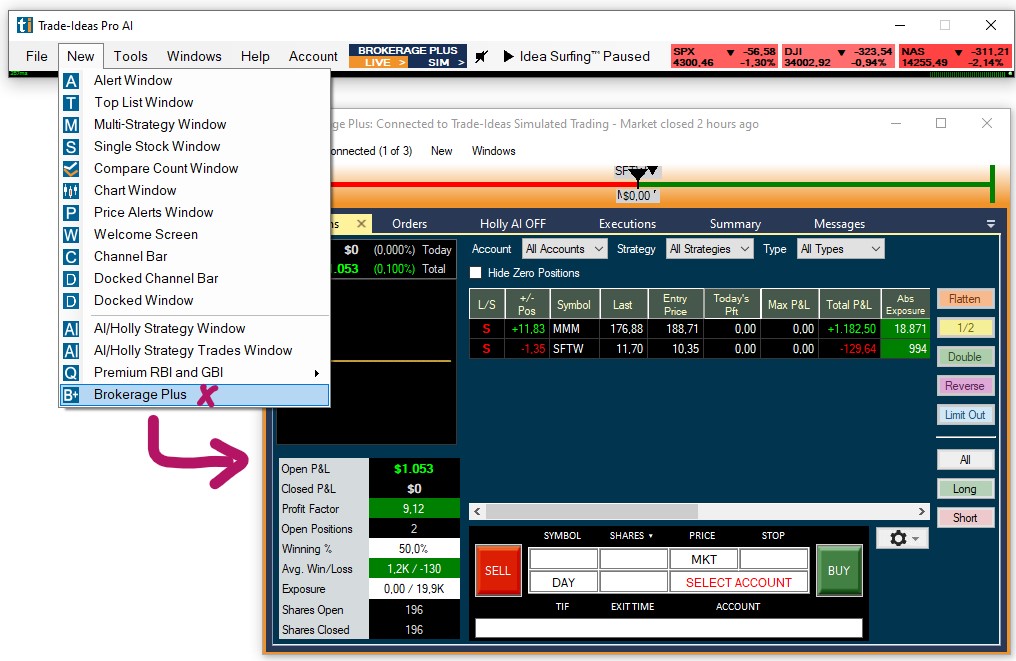

Image: www.trade-ideas.com

Essential Considerations for Selecting the Best Options Trading Brokerage Account

Your individual trading style and objectives should heavily influence your choice of brokerage account. If you are a frequent options trader seeking access to sophisticated trading tools, consider brokerages like Interactive Brokers or tastyworks. For those prioritizing low fees and ease of use, TD Ameritrade or Fidelity may be suitable options. Research and compare different brokerages based on their trading fees, platform capabilities, margin policies, and customer support to identify the best fit for your needs.

Best Brokerage Account For Trading Options

https://youtube.com/watch?v=eEIoP9mfGhY

Conclusion: Empowering Options Traders with Knowledge and Choice

By understanding the key features of options trading and the nuances of selecting a brokerage account, you can confidently embark on your options trading journey. Remember to carefully evaluate brokerages based on your unique requirements and embrace a continuous learning mindset to stay abreast of the latest trends and developments in the options trading landscape. With the right knowledge and brokerage account, you can unlock the full potential of options trading and potentially attain substantial financial gains.