Imagine making well-informed predictions about the future direction of stock prices and reaping the potential financial rewards. Options trading, a sophisticated financial instrument, provides this exciting opportunity to savvy investors. But before you dive into this complex world, it is crucial to establish a reliable foundation by opening an options trading account. This comprehensive guide will navigate you through the process, empowering you to take the first step towards financial success.

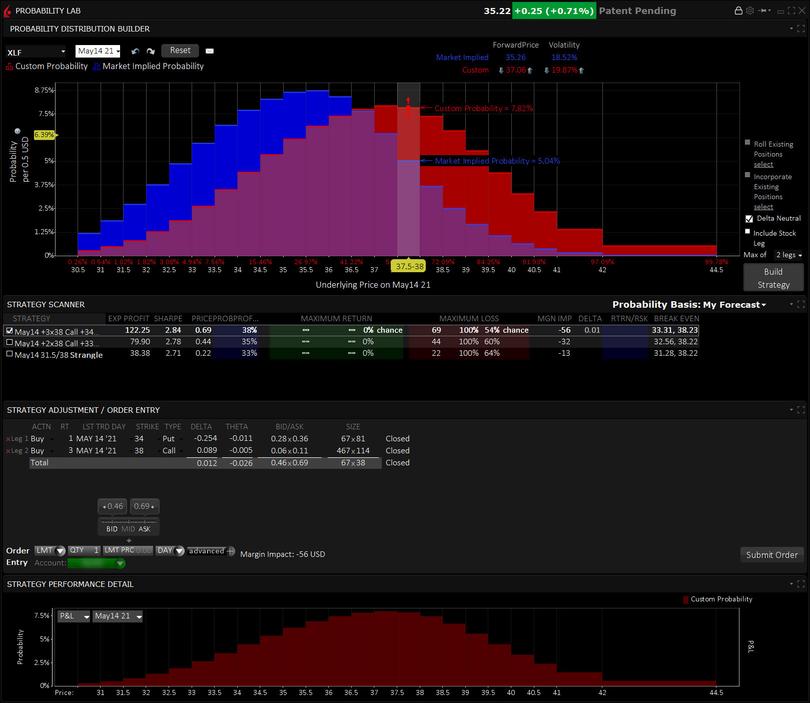

Image: www.interactivebrokers.com

Navigating the Options Trading Landscape: The What and the Why

Options trading involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset (such as a stock) at a predetermined price (the strike price) on or before a specific date (the expiration date). These contracts, known as options, offer a unique combination of flexibility and potential return, making them an attractive tool for both experienced traders and those seeking to diversify their investment portfolio.

Opening an options trading account is the gateway to accessing this financial arena. It provides the necessary framework for trading options, holding positions, executing transactions, and managing your overall account activity. As with any financial decision, it is essential to understand the nuances of options trading before venturing into this dynamic market.

Laying the Groundwork: Choosing the Right Brokerage

Finding a reputable brokerage firm is the cornerstone of successful options trading. Brokers act as intermediaries between you and the options exchanges, providing the platform for executing trades, clearing transactions, and holding your account balance. Selecting a brokerage involves evaluating several key factors:

-

Regulatory Compliance: Verify that the brokerage is regulated by reputable financial authorities such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). This ensures adherence to industry standards and investor protection.

-

Trading Platform: Assess the user-friendliness, functionality, and reliability of the brokerage’s trading platform. Determine if it aligns with your trading style, provides the necessary tools, and offers a seamless user experience.

-

Fees and Commissions: Understand the fee structure of the brokerage, including trading commissions, account maintenance fees, and any other associated costs. Choose a brokerage that offers competitive pricing without compromising on quality of service.

Preparing for Launch: Essential Account Requirements

Before opening an options trading account, you will need to fulfill certain eligibility criteria and gather the necessary documentation. These requirements may vary among brokerages, but typically include:

-

Age and Residency: You must meet the minimum age requirement, typically 18 years, and be a U.S. citizen or resident to open an options trading account. Some brokerages may have additional residency restrictions.

-

Risk Tolerance Assessment: Brokerages are required to assess your risk tolerance before approving you for options trading. This assessment involves evaluating your investment goals, financial situation, and understanding of options trading risks.

-

Identification and Verification: You will need to provide personal identification and proof of address to establish your identity and meet regulatory compliance requirements.

Image: learn.financestrategists.com

Understanding the Account Types: Selecting the Ideal Option

Depending on your investment objectives and trading strategies, you can choose from various types of options trading accounts:

-

Individual Account: Best suited for individual traders, this account is held in your own name and provides you with complete control over your trading decisions.

-

Joint Account: Allows you to share ownership of an account with another individual, jointly making trading decisions and sharing account responsibilities.

-

Managed Account: Entrusts a professional money manager to make trading decisions on your behalf. This option is ideal for investors who prefer a passive approach or lack extensive trading experience.

Activating Your Trading Account: A Step-by-Step Guide

Opening an options trading account typically involves these steps:

-

Research and Broker Selection: Diligently research and select a brokerage that aligns with your needs and offers competitive terms.

-

Account Application: Complete the online or paper-based account application, providing accurate personal and financial information.

-

Funding the Account: Transfer funds into your account using supported payment methods, such as wire transfers, electronic fund transfers, or checks.

-

Trading Platform Access: Once your account is approved, you will receive access to the brokerage’s trading platform.

Options Trading Account Open

Image: businessfirstfamily.com

Embark on Your Options Trading Journey

With your options trading account established, you are now poised to embark on the exciting world of options trading. Remember to approach this endeavor with a measured and informed mindset. Continuous learning, prudent risk management, and diligent market analysis will serve as your compass on this financial adventure. May your options trading pursuits yield substantial returns and fulfill your investment aspirations.