Introduction

Have you ever gazed upon the vast expanse of the sky and wondered if there was more to it than meets the eye? In the realm of finance, the concept of “sky option trading” offers a fascinating opportunity to explore the realm of possibilities just beyond the horizon. Sky options, a powerful financial instrument, hold the potential to unlock hidden value and enhance your investment strategies.

Image: twitter.com

In this comprehensive guide, we will delve into the enigmatic world of sky option trading, uncovering its complexities and empowering you with the knowledge to harness its potential. Whether you are a seasoned investor seeking to expand your horizon or a newcomer venturing into the world of finance, this article will serve as your celestial compass, illuminating the path to financial success.

Defining Sky Option Trading

Sky option trading involves leveraging a type of financial contract known as a “sky option.” These options provide the buyer with the right, but not the obligation, to purchase or sell an underlying asset at a predetermined price on or before a specific date. The key distinguishing feature of sky options lies in the underlying asset: the sky itself.

Instead of stocks, bonds, or commodities, sky options trade on the value of atmospheric conditions such as cloud cover, temperature, and precipitation. This unique twist transforms the sky into a dynamic marketplace, opening up unprecedented avenues for financial gain.

Basic Concepts of Sky Option Trading

Sky options are categorized into two main types: “call” and “put” options.

- Call Options: Grant the buyer the right to purchase a specific volume of specified atmospheric conditions at a predetermined price. The buyer anticipates that the value of sky conditions will rise, providing the potential for profit.

- Put Options: Grant the buyer the right to sell a specific volume of specified atmospheric conditions at a predetermined price. The buyer anticipates that the value of sky conditions will fall, offering the potential for profit.

The underlying asset in sky option trading is typically measured in terms of “sky points.” Each sky point represents a particular set of atmospheric conditions (e.g., amount of cloud coverage, temperature range). The value of sky points fluctuates based on supply and demand, as well as factors such as weather forecasts and environmental trends.

Real-World Applications of Sky Option Trading

The applications of sky option trading extend beyond mere financial speculation, providing valuable insights into real-world industries.

- Agriculture: Farmers and agricultural businesses can use sky options to hedge against adverse weather conditions that could impact crop yields. By purchasing call options on favorable conditions, they can lock in prices and protect their revenue.

- Tourism: Businesses in the tourism sector can utilize sky options to manage risk associated with weather-dependent activities such as outdoor concerts and festivals. By purchasing put options on unfavorable conditions, they can mitigate potential losses.

- Energy: Renewable energy companies involved in solar or wind power generation can utilize sky options to hedge against fluctuations in weather patterns that affect their production. By trading sky options, they can enhance revenue predictability.

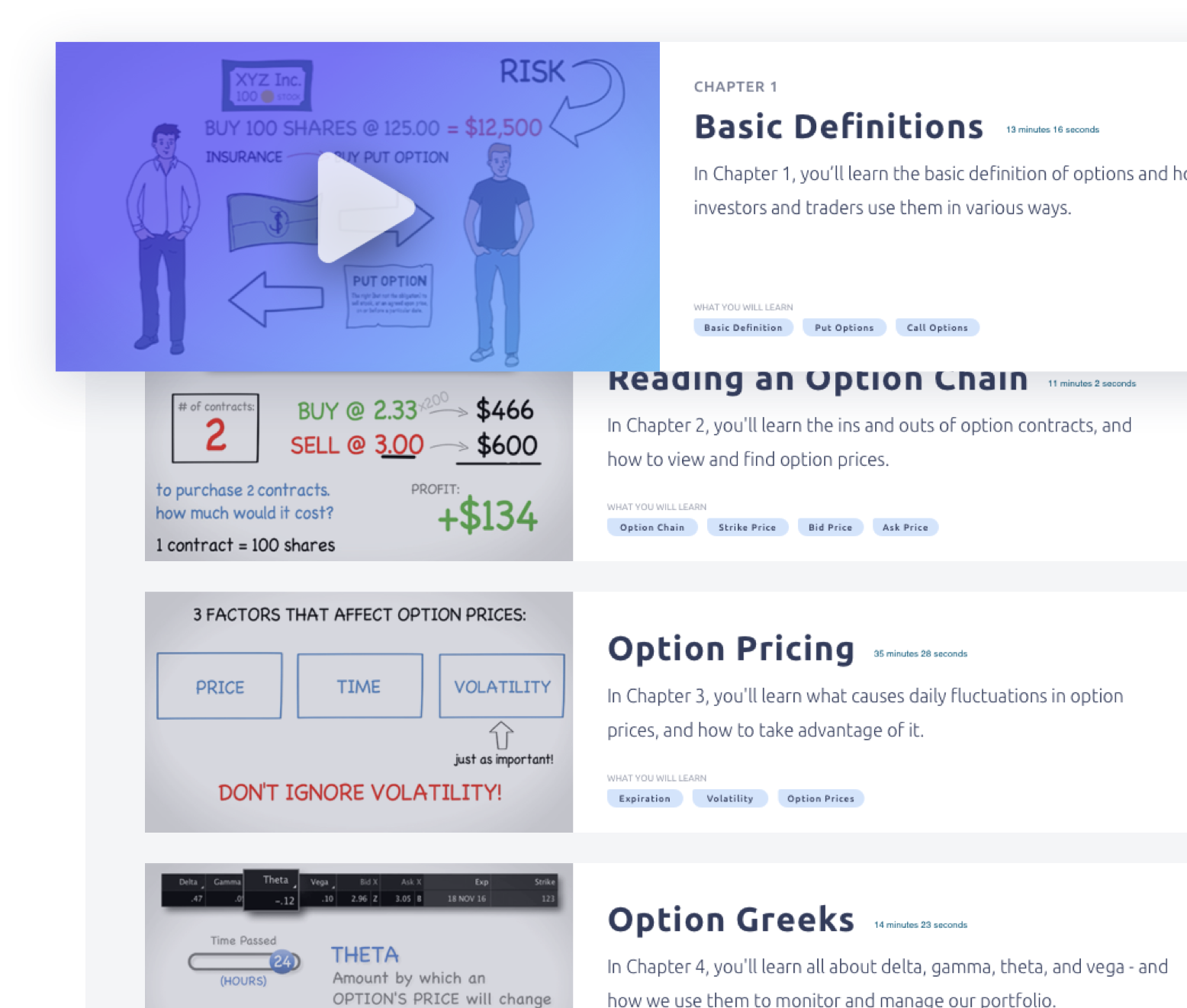

Image: skyoptiontrading.com

Strategies for Sky Option Trading

Successful sky option trading requires a well-defined strategy and a thorough understanding of the market dynamics.

- Long Calls: Buying a call option with the intent of holding it until its expiration or selling it at a higher price. This strategy is employed when the trader anticipates a rise in the value of sky conditions.

- Short Puts: Selling a put option with the intention of purchasing it back at a lower price or letting it expire worthless. This strategy is adopted when the trader expects a decline in the value of sky conditions.

- Pairs Trading: Involves buying and selling options simultaneously to exploit price inefficiencies between related contracts. This strategy aims to generate profits regardless of the direction of the market.

Sky Option Trading

Image: skyviewtrading.com

Conclusion

Sky option trading presents a captivating opportunity to explore a novel and dynamic financial landscape. With a clear understanding of the fundamentals, strategic thinking, and a keen eye for market opportunities, investors can harness the potential of sky options to enhance returns, manage risk, and gain a deeper appreciation for the intricacies of our atmospheric environment.

As you venture into the realm of sky option trading, remember to conduct thorough research, embrace innovative strategies, and seek guidance from experienced professionals to maximize your chances of success. Let the celestial tapestry become your guide as you soar to new heights of financial achievement.