Are you ready to embark on the exhilarating journey of option trading? Upstox, a trusted and renowned brokerage firm in India, offers a seamless and cost-effective platform for traders of all levels. In this exhaustive guide, we will delve into the intricacies of option trading charges on Upstox, empowering you with the knowledge to optimize your trading strategies and maximize your returns.

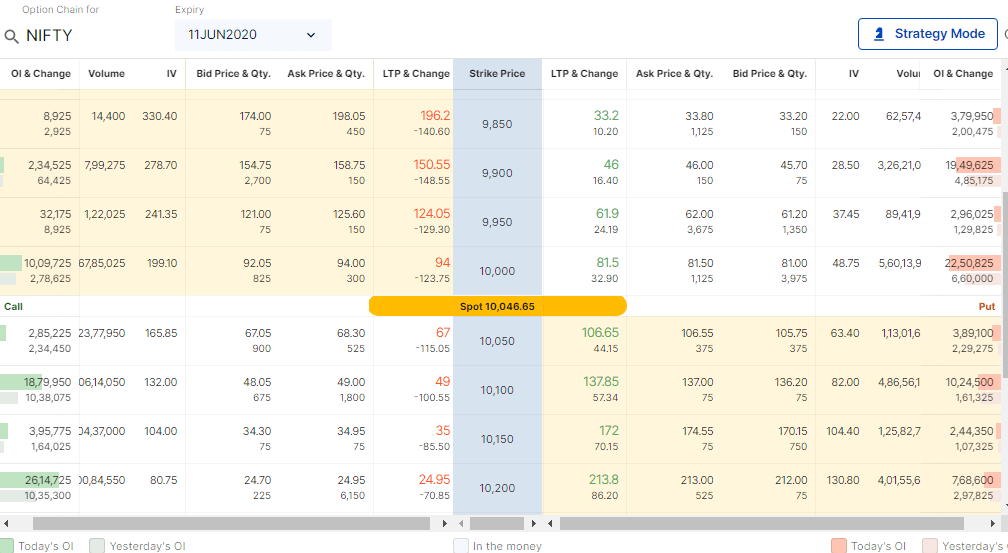

Image: www.cashoverflow.in

Demystifying Option Trading Charges

Understanding the charges associated with option trading is crucial for informed decision-making. Upstox has a transparent and competitive fee structure that ensures traders know exactly what they’re paying for. The key charges include:

-

Brokerage fees: A per-trade charge levied on all trades executed on Upstox’s platform.

-

Exchange fees: Fees charged by the stock exchanges where the trades are executed, such as the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE).

-

Transaction fees: Applicable to trades involving delivery-based options.

-

Clearing fees: Charged by the clearinghouse that facilitates the settlement of trades.

-

Stamp duty: A government-levied tax on option contracts.

Breaking Down Brokerage Fees

Upstox offers a flat brokerage fee of Rs. 20 per executed order, irrespective of the trade volume or contract size. This straightforward pricing structure provides clarity and predictability, allowing traders to focus on their trading strategies without worrying about escalating costs.

Understanding Exchange Fees

Exchange fees are charged by NSE and BSE to cover the infrastructure and regulatory costs associated with facilitating trades. Upstox passes these fees directly to traders, ensuring transparency and compliance. The exchange fees vary depending on the type of option contract and the exchange where the trade is executed.

Image: randomdimes.com

Navigating Transaction Fees

Transaction fees apply specifically to delivery-based options, which involve the physical delivery of underlying assets. Upstox charges a nominal transaction fee of 0.05% of the contract value, payable by both the buyer and seller of the option. This fee covers the administrative and logistical costs involved in the delivery process.

Clearing House Fees

Clearing fees are charged by the National Securities Clearing Corporation Limited (NSCCL), which acts as the central clearinghouse for option trades in India. These fees ensure the smooth and efficient settlement of trades, reducing counterparty risk and safeguarding the integrity of the market. Upstox includes clearing fees in its overall brokerage fee, simplifying the process for traders.

Stamp Duty: A Government Tax

Stamp duty is a state-levied tax on option contracts, payable to the relevant state government. The tax rate varies across different states in India. Upstox facilitates the payment of stamp duty on behalf of its clients, ensuring compliance with regulatory requirements.

Beyond Charges: Upstox’s Value Proposition

While understanding charges is important, it’s equally crucial to recognize the value proposition offered by Upstox. Here are some key benefits that make it a compelling choice for option traders:

-

Reliable and Secure Platform: Upstox employs advanced technology and security measures to safeguard user data and transactions.

-

Cutting-Edge Trading Tools: traders have access to state-of-the-art charting tools, technical indicators, and real-time market data to enhance their decision-making.

-

Dedicated Customer Support: Upstox provides round-the-clock customer support via phone, email, and chat to address any queries or concerns promptly.

-

Educational Resources: Upstox offers a comprehensive suite of educational resources, including webinars, tutorials, and market analysis reports, to empower traders at all levels.

Option Trading Charges Upstox

Image: demataccountopen.com

Conclusion

Embarking on option trading requires a thorough understanding of the associated charges and a reliable brokerage platform. Upstox, with its transparent fee structure, user-friendly platform, and unwavering commitment to customer satisfaction, provides the ideal environment for traders to navigate the intricacies of option trading. By leveraging the insights provided in this comprehensive guide, you can optimize your trading strategies, minimize costs, and confidently pursue your financial goals. As always, remember to trade responsibly and seek professional guidance when necessary.