In the enigmatic labyrinth of options trading, the question of whether direction matters has been a subject of relentless debate. While some argue that direction plays a crucial role, others maintain that it’s merely a secondary consideration. To unravel this conundrum, we embark on an enlightening journey, exploring the intricacies of options trading and navigating the turbulent waters of market direction.

Image: www.reddit.com

**Defining the Direction in Options Trading**

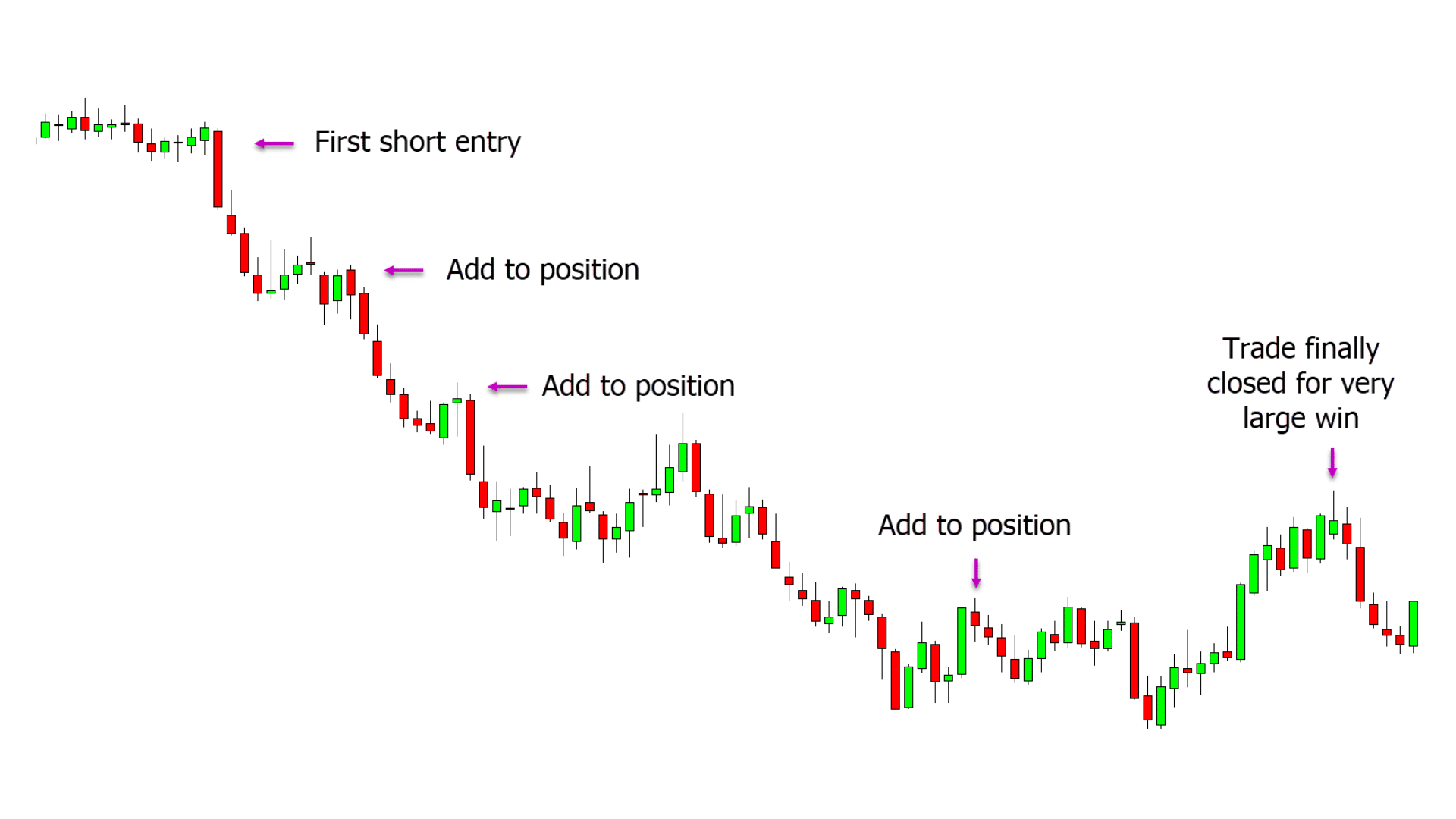

In options trading, direction refers to the perceived movement of an underlying asset. The direction can be upward (bullish) or downward (bearish). Bullish traders anticipate an increase in the asset’s price, whereas bearish traders wager on a decline.

Understanding the direction is essential for informed decision-making in options trading. By identifying the prevailing trend, traders can align their strategies accordingly, maximizing their potential for success. However, the market is inherently unpredictable, often defying expectations and rendering directionality a complex and uncertain pursuit.

**The Role of Direction in Options Strategies**

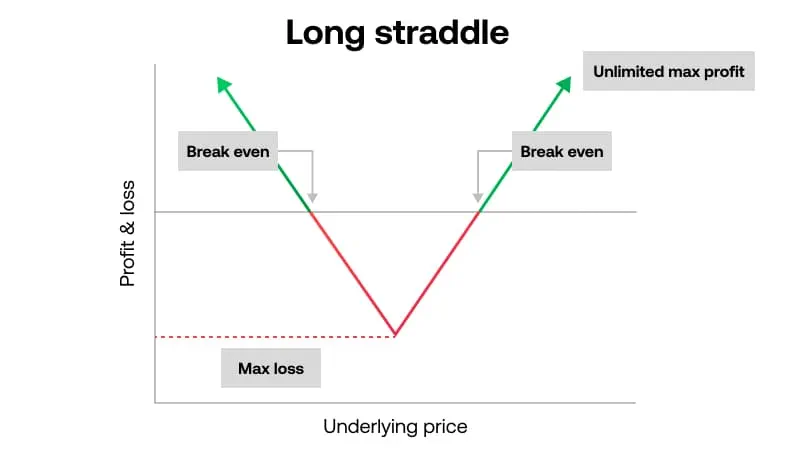

Options strategies can be designed to benefit from either an upward or downward movement in the underlying asset. Call options grant the right to buy an asset at a specified price (strike price), making them suitable for bullish strategies. Conversely, put options give the right to sell an asset at a strike price, aligning with bearish strategies.

The direction of the underlying asset determines the profitability of these strategies. For instance, if an asset’s price rises, call options may appreciate in value, potentially leading to substantial gains for bullish traders. Conversely, if the asset’s price falls, put options may become more valuable, rewarding bearish traders.

**Technical Indicators and Market Sentiment**

Traders leverage various technical indicators and market sentiment gauges to gauge the potential direction of an underlying asset. Technical indicators, such as moving averages, support, and resistance levels, provide insights into the historical behavior of the asset, helping traders identify possible trend reversals or continuations.

Market sentiment, reflected in surveys, news headlines, and social media trends, can also influence the perceived direction of an asset. Positive sentiment often indicates a bullish outlook, while negative sentiment may suggest bearish expectations.

Image: learnpriceaction.com

**Tips and Expert Advice**

To navigate the complexities of direction in options trading, consider the following tips and expert advice:

- Identify clear entry and exit points for your trades, defining the potential profit and loss scenarios.

- Avoid trading against the prevailing trend unless you have a strong conviction based on technical analysis or market sentiment.

- Choose options with a suitable time-to-expiration that aligns with your预期市场波动情况.

- Use stop-loss orders to protect your capital against significant losses in the event of adverse price movements.

**FAQs on Direction in Options Trading**

Q: Is it essential to predict the direction before trading options?

A: While predicting direction is not always possible, it’s crucial to consider the potential risks and rewards associated with different directions and tailor your strategies accordingly.

Q: What are the most common mistakes traders make regarding direction?

A: Some common mistakes include overtrading, failing to conduct thorough research, and ignoring market sentiment.

Q: How can I improve my understanding of direction in options trading?

A: Continuously educate yourself through books, courses, and webinars. Practice paper trading to test strategies and build confidence.

Does Direction Matter In Options Trading

Image: www.cityindex.com

**Conclusion**

In the ever-evolving realm of options trading, direction plays a multifaceted role, yet it remains an elusive concept. By embracing the latest tools and techniques, seeking expert guidance, and continuously refining your skills, you can master the art of directionality and harness its power to enhance your trading outcomes. So, ask yourself, are you ready to embark on this exhilarating journey and conquer the mysteries of direction in options trading?