Unlocking the Power of Options Trading: A Comprehensive Guide to the Long Strangle Strategy

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-07-d42b5b21cecb4979a299053479786a3f.png)

Image: www.investopedia.com

In the ever-evolving world of finance, options trading has emerged as a powerful tool for investors seeking to amplify their returns. Among the diverse options strategies, the long strangle stands out as a time-tested technique with the potential to generate substantial profits. In this article, we will delve into the intricacies of the long strangle strategy, exploring its history, key principles, and practical applications.

Understanding the Long Strangle Strategy

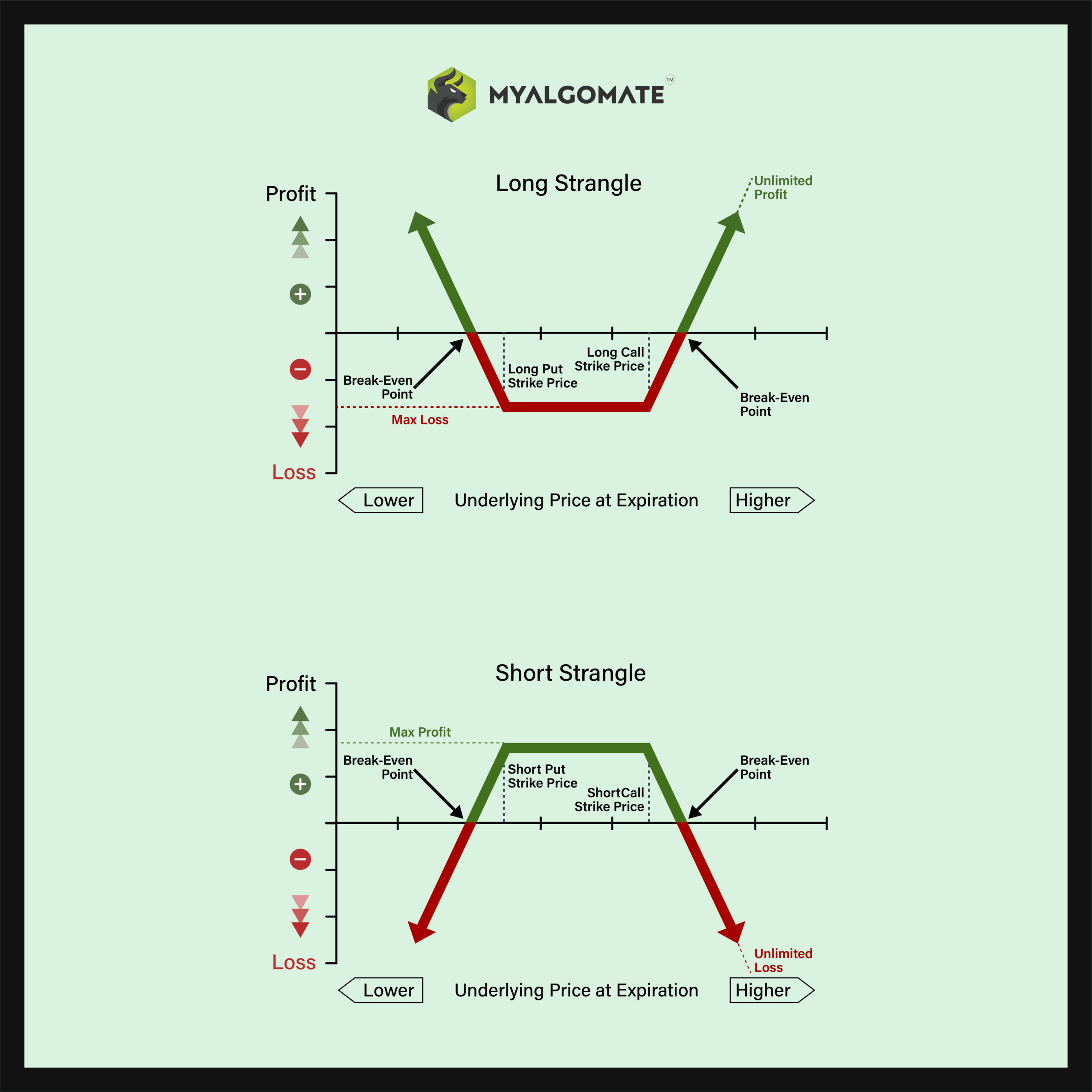

The long strangle is an options strategy that involves simultaneously purchasing an out-of-the-money (OTM) call option and an OTM put option with the same expiration date but different strike prices. The strike price of the call option is higher than the current market price, while the strike price of the put option is lower.

The key to success with the long strangle strategy lies in its ability to profit from large price movements in either direction. If the underlying asset’s price rises significantly, the call option’s value will increase, potentially offsetting the loss incurred on the put option. Conversely, if the underlying asset’s price falls sharply, the put option’s value will surge, compensating for the decline in the call option’s value.

Origins and Principles

The long strangle strategy has its roots in the early days of options trading, when it was developed by traders seeking a way to profit from unpredictable market movements. The strategy’s effectiveness stems from several fundamental principles:

- Controlled Risk: Buying both call and put options with different strike prices limits the potential loss to the premium paid for the options.

- Leverage Potential: The leverage provided by options can amplify potential profits even with small price movements.

- Time Decay: Both call and put options lose value over time, creating pressure to close the position before expiration.

- Volatility Sensitivity: The value of the long strangle is highly sensitive to implied volatility, the expected future volatility of the underlying asset.

Real-World Applications

The long strangle strategy can be applied in various market scenarios, including:

- Neutral Market: When the underlying asset’s price is expected to move within a specified range, the long strangle provides protection against unforeseen fluctuations.

- Trending Market: If the underlying asset is trending higher, a long strangle with a rising call strike price can capitalize on continued upward momentum.

- Volatile Market: In periods of high volatility, the long strangle can generate substantial profits due to the increased value of both call and put options.

Expert Insights and Actionable Tips

To optimize the success of a long strangle strategy, consider these insights from experts:

- Choose strike prices cautiously: The optimal strike prices depend on factors such as market volatility, risk tolerance, and holding period.

- Use technical analysis: Chart patterns and indicators can help identify potential price trends and entry points.

- Manage risk effectively: Utilize stop-loss orders to limit losses and adjust the position size based on available capital.

- Monitor the strategy regularly: Closely track the market movements and adjust the strategy as needed, especially as time decay approaches.

Conclusion

The long strangle strategy is a versatile options strategy that offers investors the opportunity to navigate complex market conditions and generate potentially significant profits. By understanding the foundational principles, real-world applications, and expert insights outlined in this article, you can unlock the power of this strategy. However, it’s crucial to exercise caution, conduct thorough research, and consult a financial professional before implementing the long strangle strategy in your investment portfolio.

Image: www.myalgomate.com

Options Trading Long Strangle Strategy

Image: www.youtube.com