As the financial markets become increasingly accessible through online platforms, traders of all levels seek brokers that offer competitive pricing for option trading. Navigating this complex landscape requires a deep understanding of the various pricing models employed by these brokers. In this comprehensive guide, we’ll delve into the intricate world of online brokerage pricing for options, empowering you with the knowledge to make informed decisions.

Image: androidcure.com

Pricing Paradigms for Option Traders

Commission-Based Fees

Traditional brokers often charge a commission fee for each option contract traded. This fee varies based on the brokerage and the type of option being traded. Typically, commissions range from $0.10 to $5 per contract, with complex options, such as spreads, incurring higher fees.

Tiered Pricing Systems

Some brokers implement tiered pricing systems, which offer reduced commissions based on trading volume. As you trade more contracts, you may qualify for lower commission rates, incentivizing active traders. These tiered systems often include monthly or quarterly account fees, which can be advantageous for high-volume traders.

Flat-Rate Fees

In recent years, flat-rate brokerage models have gained popularity. These brokers charge a predetermined fee per trade, regardless of contract type or volume. Flat-rate fees typically range from $0.50 to $5 per trade, providing a cost-effective option for infrequent traders or those executing smaller trades.

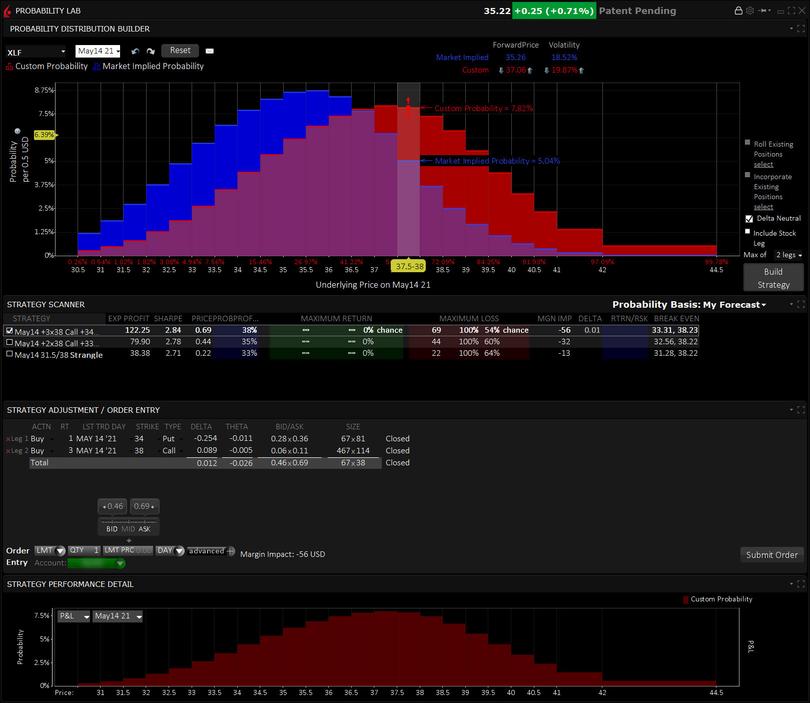

Image: www.interactivebrokers.com

Additional Considerations

Beyond the primary pricing models, several other factors can influence the overall cost of option trading:

- Account Minimums: Some brokers require a minimum account balance to open and maintain an account.

- Platform and Data Fees: Certain brokers may charge additional fees for access to advanced trading platforms or real-time market data.

- Regulatory Fees: Exchanges and regulatory bodies impose fees on all option trades, which brokers may pass on to their clients.

Expert Tips for Navigating Brokerage Pricing

Navigating the complex pricing landscape of online brokerages requires careful consideration. Here are some expert tips to help you make informed decisions:

- Determine Your Trading Style: Assess your trading frequency, contract types, and account size to determine the most suitable pricing model for your needs.

- Compare Brokerage Fees: Conduct thorough research to compare the pricing structures of different brokers. Consider not only the commission fees but also any additional charges or account minimums.

- Negotiate Commissions: For high-volume traders, consider negotiating lower commission rates with your broker based on your trading history and projected volume.

- Consider Bundled Services: Some brokers offer bundled packages that include discounted fees for multiple services, such as trading platform access and market data.

Frequently Asked Questions on Option Trading Pricing

Q: What is the average commission rate for option trading?

A: Commission rates can vary widely, depending on the broker, option type, and account volume. Typically, they range from $0.10 to $5 per contract.

Q: Which pricing model is most suitable for beginner traders?

A: Flat-rate brokerage models provide a cost-effective option for infrequent traders or those executing smaller trades.

Q: Do all brokers charge the same fees for options trading?

A: No, brokerage fees can vary significantly. It’s important to compare the pricing structures of different brokers to find the most competitive rates.

On Line Broakerage Companies There Prices For Option Trading

Image: www.slideshare.net

Conclusion

Navigating the online brokerage landscape for options trading requires a thorough understanding of the various pricing models. By carefully considering your trading style, researching broker fees, and utilizing expert advice, you can make informed decisions that optimize your option trading costs and maximize your potential returns. Remember, the key to successful trading is finding a broker that aligns with your specific needs and provides the pricing transparency and flexibility you require. Engage with the topic further by exploring our extensive resources on option trading strategies, market analysis, and brokerage reviews. Are you ready to embark on the path to informed option trading?