Are you ready to take your investment strategy to the next level? Option trading might be the game-changer you’ve been seeking. With its vast potential to enhance returns and mitigate risks, option trading has gained immense popularity among discerning XOM investors. In this in-depth guide, we’ll navigate the complexities of option trading, empowering you with the knowledge and strategies to capitalize on the opportunities presented by XOM’s stock performance.

Image: www.ultraalgo.com

What is Option Trading?

Option trading involves contracts that grant investors the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Call options provide investors with the potential for substantial upside in a rising market, while put options offer protection against downside risks in a falling market.

How Do Options Work?

To understand how options work, let’s consider an example. Suppose the current price of XOM stock is $50. You could purchase a call option with a strike price of $52.50 expiring in one month. This option would grant you the right to buy 100 shares of XOM at $52.50 per share on or before the expiration date. If the stock price rises above $52.50, you could exercise your option, buying the shares at the lower strike price and potentially profiting from the price difference. Conversely, if the stock price falls, you could let the option expire worthless, limiting your losses to the premium you paid for the option.

Benefits of Option Trading

Option trading offers a plethora of benefits for investors, including:

- Enhanced Returns: Options provide investors with the potential to generate outsized returns, particularly when the underlying asset experiences significant price movements.

- Risk Management: Put options serve as a valuable tool for hedging against potential losses in a declining market. By purchasing a put option, investors can lock in a minimum price for their XOM shares.

- Leverage: Options provide investors with leverage, allowing them to control a larger amount of shares than they could by purchasing the underlying stock outright. This can magnify potential returns, but also increases the risk involved.

Image: www.tradingview.com

Strategies for Option Trading XOM

Navigating the world of option trading requires a sound strategy tailored to your individual risk tolerance and investment goals. Some popular strategies include:

- Bullish Call Option: This strategy involves purchasing a call option when bullish on XOM’s stock. If the stock price rises, the investor can profit from the option’s appreciation.

- Covered Call: This strategy involves selling a call option against shares of XOM that you own. It generates income from the option premium while limiting your upside potential in exchange for downside protection.

- Put Option Spread: A put option spread involves purchasing a put option with a higher strike price and selling a put option with a lower strike price. This strategy provides protection against downside risks while capping potential gains.

Essential Considerations for Option Traders

Before embarking on option trading, it’s crucial to consider several important factors:

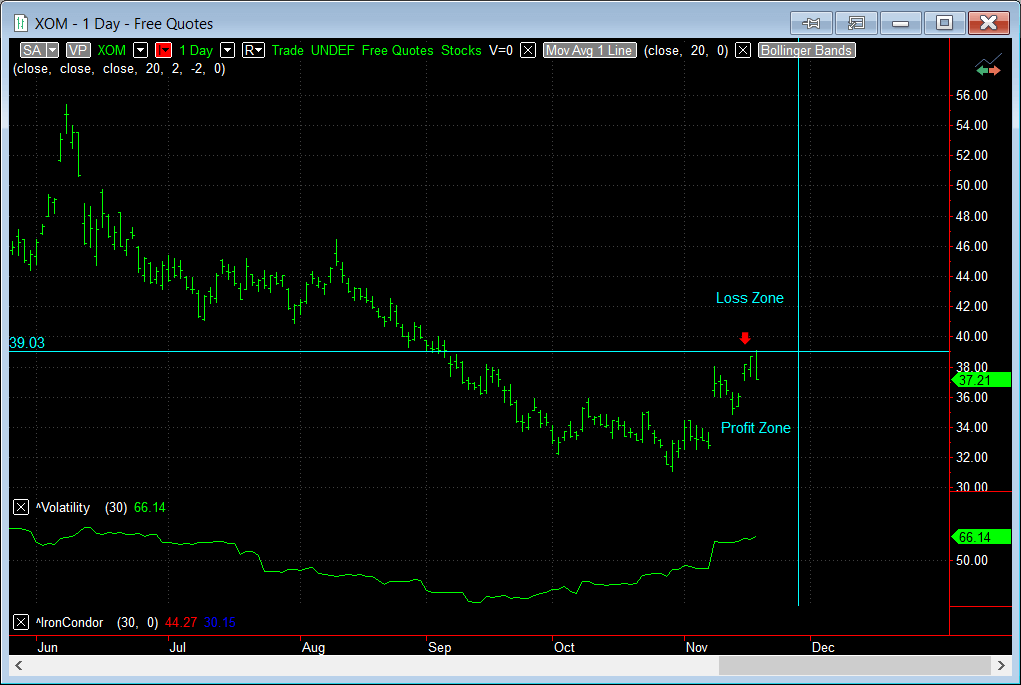

- Volatility: Volatility is a measure of how much the price of an asset fluctuates. Higher volatility can amplify potential returns but also magnify risks.

- Time Decay: Options lose value over time as the expiration date approaches. This is an inherent characteristic of options that investors must consider in their trading decisions.

- Liquidity: The liquidity of an option refers to how easily it can be bought or sold. Highly liquid options provide greater flexibility but may come at a higher premium.

Option Trading Xom

Image: www.optiontradingtips.com

Conclusion

Option trading can be a powerful tool for XOM investors, offering the potential for enhanced returns and risk management. By memahami the concepts, strategies, and considerations outlined in this guide, investors can make informed decisions and harness the opportunities presented by the complex but rewarding world of option trading. Remember to conduct thorough research, exercise caution, and seek the guidance of a qualified financial professional if needed. Embrace the excitement of option trading to unlock the full potential of your XOM investments.