In the realm of options trading, where market dynamics constantly fluctuate, mastering the art of identifying optimal trading opportunities is crucial. This is where Bollinger Bands, a versatile technical analysis tool, come into play. By harnessing the power of Bollinger Bands, traders can gauge market volatility, pinpoint potential trend reversals, and make informed decisions to maximize their trading success.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Bollinger_Bands_to_Gauge_Trends_Oct_2020-01-73f4b5749a6e445585bc2751d6e39d34.jpg)

Image: alexgroup.vn

Unveiling Bollinger Bands: A Guiding Light in Market Volatility

Conceived by renowned trader John Bollinger in the 1980s, Bollinger Bands are statistical tools that visually encapsulate price movements within a specified number of standard deviations from a moving average. These bands, plotted on a price chart, provide a clear representation of market volatility and help traders discern price patterns.

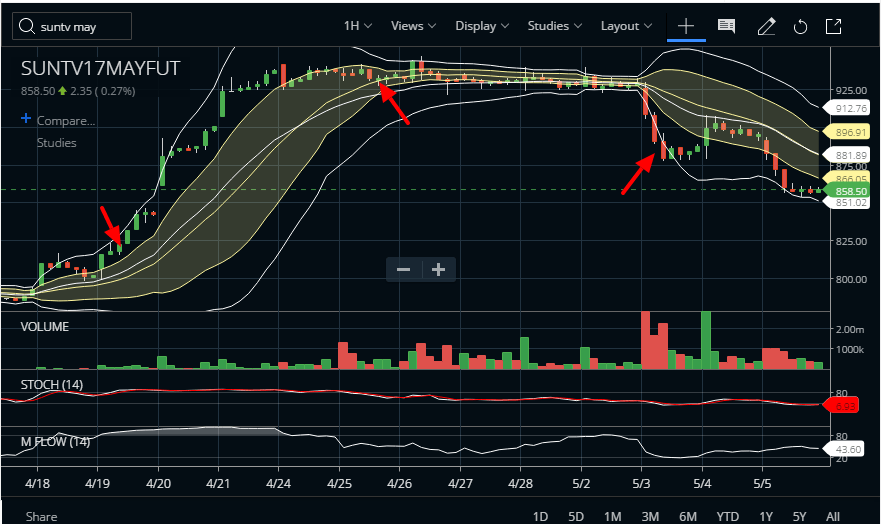

At the core of Bollinger Bands lies a simple but powerful concept. When the bands are wide, it signifies elevated market volatility, indicating potential price fluctuations. Conversely, when the bands constrict, it suggests reduced volatility and a potentially compressed trading range.

Navigating Market Volatility with Bollinger Bands

Bollinger Bands offer valuable insights into market volatility, enabling traders to make calculated decisions. When the bands are wide, it signals a period of heightened volatility, often accompanied by impulsive price movements. This environment presents both opportunities and risks, requiring traders to exercise caution and implement risk management strategies.

On the other hand, when the bands narrow, indicating low volatility, traders may interpret this as a sign of consolidation or potential trend reversal. This can be a favorable time to position for breakouts or reversals, as the market is likely to experience increased volatility in the near future.

Identifying Trading Opportunities with Bollinger Bands

Bollinger Bands serve as a versatile tool for identifying potential trading opportunities. By observing the price action in relation to the bands, traders can uncover valuable insights.

When the price touches or breaches the upper Bollinger Band, it may indicate that the market is overbought and a potential sell signal is imminent. Conversely, a price touch or breach of the lower Bollinger Band suggests an oversold market, potentially presenting a buy opportunity.

Additionally, Bollinger Bands can assist in identifying potential trend reversals. When the price bounces off the upper band and closes below it, it may signal a trend reversal to the downside. Similarly, a bounce off the lower band and close above it could indicate a trend reversal to the upside.

Image: unofficed.com

Capitalizing on Bollinger Bands Strategies

To harness the full potential of Bollinger Bands, traders can employ various strategies tailored to their risk tolerance and trading style.

One popular strategy involves entering a long position when the price closes above the upper Bollinger Band, indicating a potential uptrend. Conversely, a short position can be initiated when the price closes below the lower Bollinger Band, suggesting a downtrend.

Another strategy focuses on exploiting Bollinger Band squeezes. When the Bollinger Bands constrict, signaling low volatility, traders anticipate a breakout or reversal. By positioning for a breakout or reversal, they aim to capitalize on the subsequent increase in volatility.

Expert Insights and Practical Tips

To further enhance your trading prowess, consider these insights from seasoned experts:

- Tom DeMark: “Bollinger Bands are an excellent tool for gauging market sentiment and identifying potential turning points.”

- John Bollinger: “Traders should use Bollinger Bands in conjunction with other technical indicators to confirm signals and improve accuracy.”

- Kathy Lien: “Bollinger Bands can be particularly effective in identifying overbought and oversold conditions, providing valuable entry and exit points.”

To maximize your trading performance, keep these practical tips in mind:

- Customize Bollinger Bands: Experiment with different settings for the moving average and standard deviations to optimize Bollinger Bands for your trading style.

- Consider Other Indicators: Combine Bollinger Bands with other technical indicators, such as moving averages or oscillators, to enhance signal confirmation.

- Manage Risk: Always implement proper risk management strategies, such as stop-loss orders, to mitigate potential losses.

Trading Options With Bollinger Bands

Image: www.binaryoptions.com

Empower Your Trading Journey

Mastering Bollinger Bands empowers you with the ability to navigate market volatility, pinpoint trading opportunities, and make informed decisions. By incorporating Bollinger Bands into your trading arsenal, you can elevate your trading strategy and strive towards consistent success.

Remember, the financial markets are constantly evolving, and adapting your knowledge and skills is paramount. Embrace the transformative power of Bollinger Bands and confidently trade options, unlocking the path to fulfilling your financial objectives.