Introduction:

The world of financial trading is an ever-evolving landscape, where traders constantly seek innovative techniques to maximize their profits. Among the plethora of trading methodologies, Bollinger Bands has emerged as a formidable tool, empowering traders with unique insights into the market’s volatility and potential price movements. In this article, we delve into the realm of Bollinger Band option trading, unveiling the secrets behind this powerful strategy.

Image: palgojournals.org

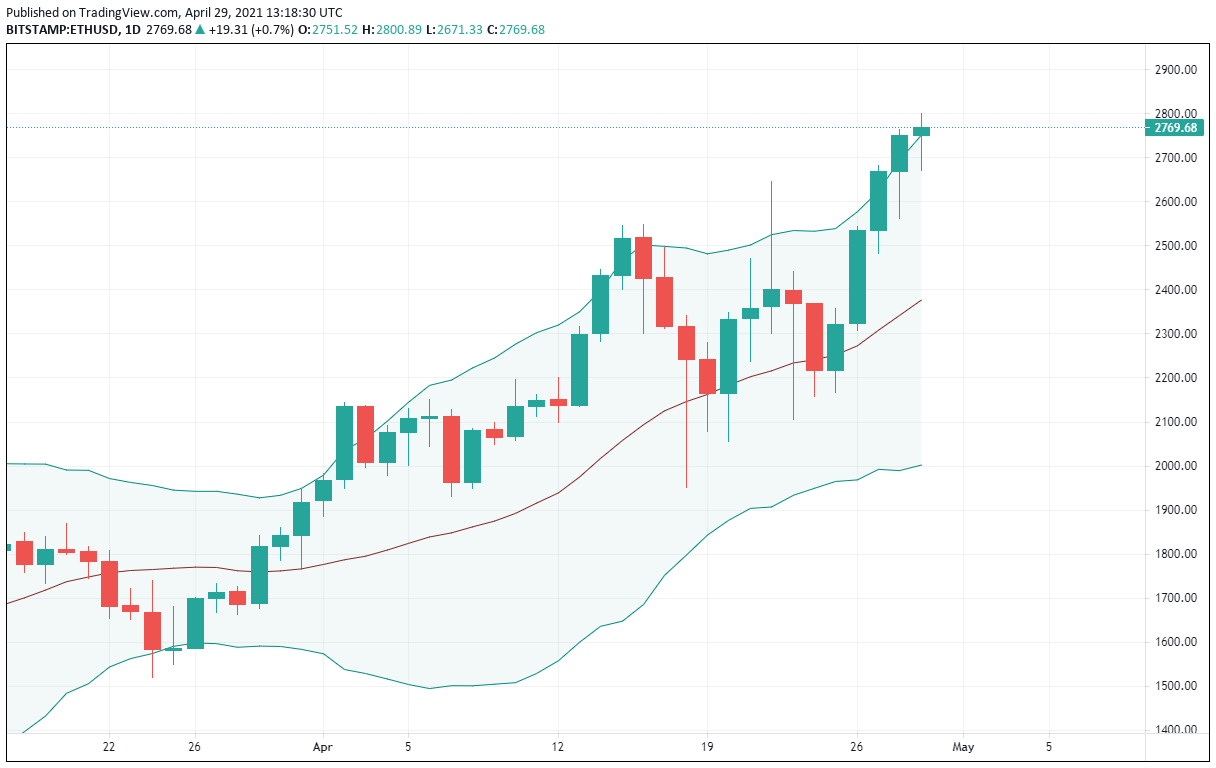

Bollinger Bands are a technical analysis tool that graphically depicts the standard deviation of an asset’s price over a specified period. They are constructed using three lines: a moving average (MA) and two standard deviation bands above and below the MA. The standard deviation measures the dispersion of data points from the mean, indicating the market’s volatility.

Unveiling Bollinger Band Option Trading:

The application of Bollinger Bands in option trading offers traders a comprehensive framework for evaluating market trends, identifying potential trading opportunities, and managing risk. By understanding the interplay between price and volatility, traders can formulate informed decisions, enhancing their chances of success.

When the asset’s price remains within the Bollinger Bands, it suggests a state of equilibrium. However, when the price breaks out of the bands, it signifies a potential trend reversal. Traders can capitalize on these breakouts by employing options strategies tailored to their risk appetite and market outlook.

-

Long Options: When the price breaks out above the upper Bollinger Band, traders may consider purchasing call options, speculating on further price appreciation.

-

Short Options: Conversely, if the price breaks below the lower Bollinger Band, traders may opt for put options, anticipating a decline in the underlying asset’s value.

-

Straddles or Strangles: For a more neutral stance, traders can consider straddles or strangles, which involve buying both call and put options at different strike prices.

Expert Insights:

“Bollinger Bands provide an invaluable lens into market volatility, enabling traders to make discerning decisions,” says renowned trader Mark Douglas. “By comprehending the dynamics of Bollinger Bands, traders can navigate the markets with greater confidence and clarity.”

“The key to successful Bollinger Band option trading lies in identifying breakouts with high conviction,” adds trading expert Kathy Lien. “Traders should seek confirmation from other technical indicators or fundamental analysis before committing to a position.”

Actionable Tips:

-

Choose the Right Markets: Bollinger Bands are most effective in trending markets with moderate to high volatility.

-

Set Realistic Parameters: Determine appropriate standard deviation levels for your Bollinger Bands based on the market’s historical volatility.

-

Monitor Volume: Always consider trading volume alongside Bollinger Band signals. High volume breakouts are typically more reliable than low volume moves.

Image: admiralmarkets.com

Impact on Your Trading:

The integration of Bollinger Bands into your option trading strategy can revolutionize your approach to the markets. By recognizing and leveraging market volatility, you gain a competitive edge in identifying trading opportunities and maximizing your returns. Bollinger Bands empower you to:

- Enhance Risk Management: Bollinger Bands aid in identifying potential support and resistance levels, guiding you in setting stop-loss orders and managing risk.

- Optimize Option Selection: Bollinger Bands assist in pinpointing optimal strike prices and expiration dates for your option trades.

- Capture Trending Moves: By identifying breakouts from Bollinger Bands, you can capitalize on market momentum and ride trending moves.

Bollinger Band Option Trading

Conclusion:

Bollinger Band option trading is a powerful technique that empowers traders with a dynamic understanding of market volatility. By grasping the intricacies of Bollinger Bands, traders can unlock exceptional opportunities, navigate market fluctuations with aplomb, and amplify their trading profits. Remember, knowledge is the key to success, so continue to delve into the nuances of Bollinger Bands, master the art of reading market signals, and unleash the full potential of this invaluable trading tool.