In the ever-evolving world of financial markets, the Bollinger Bands trading strategy stands out as a beacon of reliability and precision. Like a seasoned navigator, Bollinger Bands guide traders through the treacherous waters of binary options trading, providing clarity and insight amidst the market’s volatility.

Image: www.forexstrategiesresources.com

Understanding Bollinger Bands

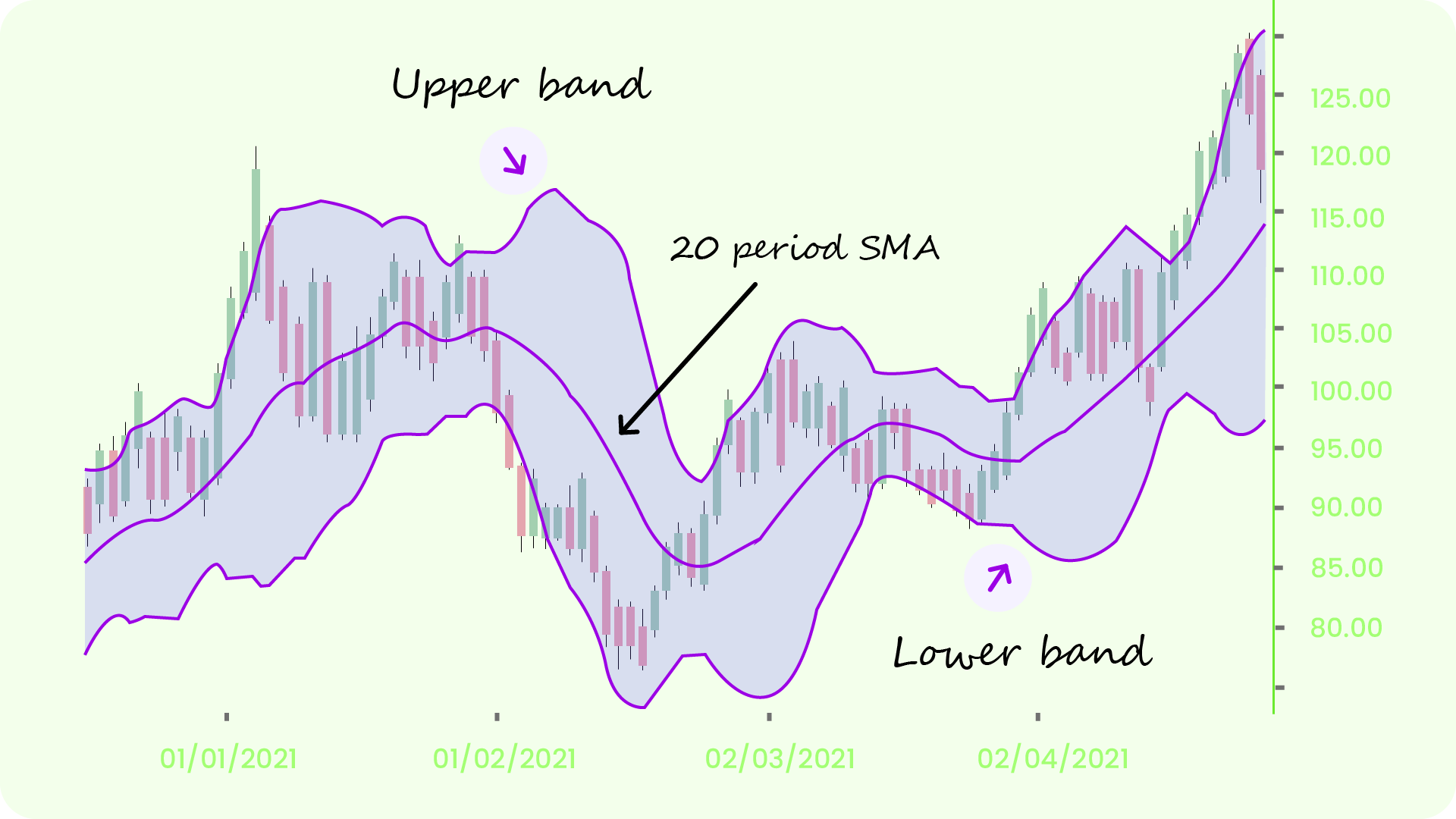

Coined by legendary trader John Bollinger in the 1980s, Bollinger Bands are a technical analysis tool that encapsulate price movements within a set of three lines:

- The central line: A simple moving average (SMA) of the stock price over a specified period.

- The upper Bollinger Band (UBB): The SMA plus twice the standard deviation of the price.

- The lower Bollinger Band (LBB): The SMA minus twice the standard deviation.

These bands create a dynamic envelope that defines the current trading range. When the price is near the UBB, it suggests overbought conditions, while a price near the LBB indicates oversold territory.

Binary Options Trading with Bollinger Bands

Binary options offer a high-risk, high-reward trading mechanism that allows investors to predict whether an asset’s price will rise or fall within a specific timeframe. Bollinger Bands play a pivotal role in binary options trading by providing valuable insights into price behavior:

- Breakouts: When the price breaks above the UBB, it’s often interpreted as a buy signal. Conversely, a break below the LBB signals a potential sell opportunity.

- Squeezes: When Bollinger Bands narrow, it indicates low volatility. This is often followed by a sharp price move in one direction or the other.

- Touch and Retrace: When the price touches the UBB or LBB and then pulls back, it can suggest a possible trend reversal.

Expert Insights and Actionable Strategies

“Bollinger Bands are like a roadmap for the price action,” says renowned trader Tom DeMark. “They help identify trading ranges, potential breakouts, and even overbought or oversold conditions.”

1. Impulse Trading: When the price breaks out of Bollinger Bands, it often continues in that direction with momentum. Traders can enter trades in the direction of the breakout, targeting profit within the expected trading range.

2. Range Trading: As Bollinger Bands narrow, forming a “squeeze,” it indicates a period of low volatility. Traders can enter trades on the assumption that a breakout is imminent, targeting profits beyond the breakout point.

3. Reversal Trading: When the price bounces off the LBB or UBB and moves in the opposite direction, it may signal a potential trend reversal. Traders can enter trades in the direction of the trend reversal, looking to capture short-term profits.

Conclusion

The Bollinger Bands trading strategy is an indispensable tool for binary options traders, offering insights into price behavior and providing opportunities for profitable trading. By comprehending the concepts and implementing the strategies outlined in this article, traders can navigate market uncertainty with greater confidence. Remember, Bollinger Bands are not a crystal ball but rather a powerful tool that, when combined with sound risk management, can help improve trading outcomes. Embrace the Bollinger Bands as your trusted companion in the binary options trading arena.

Image: blog.streak.tech

Bollinger Bands Trading Strategy Binary Options

Image: indicatorchart.com