Welcome to the fascinating world of call options trading, where the potential for financial gain can be tantalizing. Imagine being able to leverage market dynamics to amplify your return on investment. Call options provide just that opportunity, empowering you to capitalize on rising stock prices. In this comprehensive article, we will embark on an informative journey, unraveling the intricacies of call options trading through real-world examples and expert insights.

Image: www.onlinefinancialmarkets.com

Understanding Call Options: A Gateway to Profits

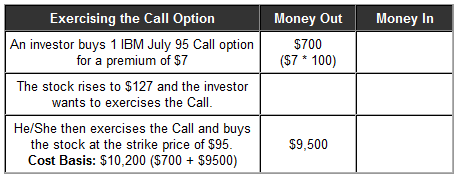

At their core, call options are financial contracts that bestow upon the holder the right, but not the obligation, to purchase a specific number of shares of a particular underlying asset at a predetermined price on or before a specified expiration date. By acquiring a call option, you gain the privilege to capitalize on a potential increase in the underlying asset’s price while being protected from significant losses if the price trend falters.

To comprehend the mechanics of call options, let’s consider a practical example. Imagine you anticipate a surge in the stock price of Apple Inc. Instead of purchasing the shares outright, you could opt to buy a call option that entitles you to buy 100 Apple shares at a strike price of $100 within the next two months. If during this period the stock price rises to $120, you can exercise your option to buy the shares at the strike price of $100 and immediately sell them at the prevailing market price, reaping a tidy profit.

Navigating the Nuances of Call Option Premiums

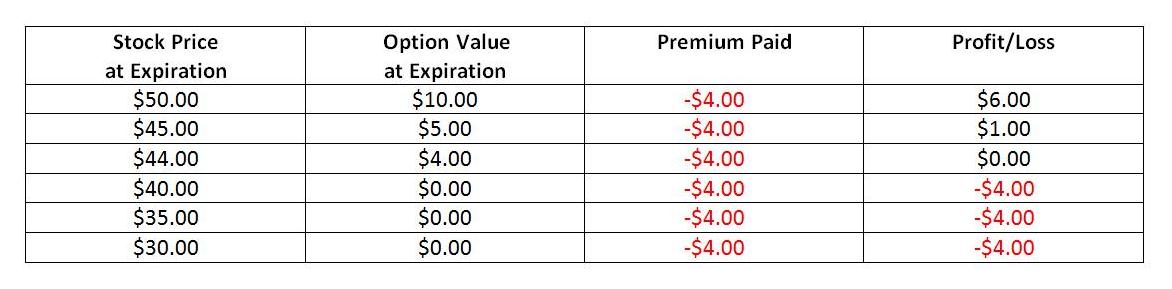

When purchasing a call option, you need to pay a premium, which represents the price for acquiring the contract. This premium is influenced by various factors, including the underlying asset’s price, time to expiration, volatility, and prevailing interest rates. The relationship between these factors is delicate, and understanding their dynamics is essential for informed decision-making.

Consider the impact of time decay on the premium of a call option. As the expiration date draws near, the intrinsic value of the option diminishes, resulting in a decline in the premium. Consequently, it is crucial to carefully select the expiration date, considering the potential for the underlying asset’s price to appreciate within that time frame.

Selecting the Right Strike Price: A Delicate Balance

Choosing the appropriate strike price for your call option is another critical aspect of successful trading. The strike price determines the price at which you can buy the underlying asset if you decide to exercise the option. A strike price that is too high may significantly reduce your chances of profitability, while a price that is too low can limit your potential gains. Understanding the underlying asset’s price history and volatility can help you make an informed decision when selecting the strike price.

Image: www.learn-stock-options-trading.com

Risk Management in Call Option Trading: Protecting Your Capital

While call options offer the allure of substantial profits, it is essential to be cognizant of the potential risks involved. Fluctuations in the underlying asset’s price can result in losses if the price moves against your predictions. Proper risk management strategies are paramount to mitigate these risks and safeguard your capital. Be sure to diversify your investments across multiple call options, set stop-loss orders, and monitor market conditions closely to make timely adjustments to your trading strategy as needed.

Unveiling the Advantages of Call Option Trading

The benefits of engaging in call option trading can be compelling. Here are some key advantages:

-

Leverage: Call options provide an opportunity to multiply your profits by leveraging the potential price movements of the underlying asset. Small increases in the asset’s price can translate into substantial gains for the option holder.

-

Limited Risk: Unlike purchasing the underlying asset outright, call options limit your risk to the premium paid. Even if the underlying asset’s price plummets, you won’t lose more than the premium you invested.

-

Flexibility: Call options offer flexibility in terms of timing and execution. You can exercise your option at any time before the expiration date or choose not to exercise it at all if the market conditions are unfavorable.

-

Speculation and Income Generation: Call options enable you to speculate on the future price movements of an underlying asset, providing opportunities for both capital appreciation and income generation through the sale of options premiums.

Trading Call Options Example

https://youtube.com/watch?v=lhXYSb45UMs

Embarking on the Call Option Trading Journey: A Path to Financial Growth

Now that you possess a comprehensive understanding of call options and their intricacies, you can confidently embark on your trading journey. With careful planning, prudent risk management, and a deep understanding of market dynamics, you can leverage call options to pursue financial growth and achieve your investment goals. Remember to research thoroughly, stay abreast of market trends, and consult with financial professionals if necessary to make informed trading decisions.

The world of call options trading is a vibrant and dynamic landscape, presenting both opportunities and challenges. By embracing a thoughtful and strategic approach, you can harness the potential of call options to enhance your financial well-being. May this article serve as a valuable guide on your path to success.