Options trading has gained prominence in recent years as a multifaceted tool for managing risk and enhancing returns. However, traders who delve into this realm must be fully cognizant of assignment risk, a potentially substantial liability that can arise when trading options contracts.

Image: steadyoptions.com

As such, it is imperative for traders to arm themselves with a comprehensive understanding of assignment risk, its implications, and the strategies employed to manage it effectively.

What is Assignment Risk?

Assignment risk is an inherent possibility in options trading where the seller of an option contract is legally bound to perform the contract’s terms, should the counterparty exercise their right to assign it. In other words, the option seller may be compelled to buy or sell the underlying asset at the predetermined price specified in the contract.

This obligation can materialize on the expiration date of the option, triggering potential financial repercussions for the seller if the underlying asset’s price has moved against their initial position.

Factors Influencing Assignment Risk

Several factors contribute to the level of assignment risk associated with an options contract. Understanding these factors empowers traders to make more informed decisions regarding their trading strategies:

- Expiration Date: The closer the option contract nears its expiration date, the greater the likelihood of assignment.

- Strike Price: Options that have a strike price close to the underlying asset’s current price possess a higher chance of assignment compared to those with distant strike prices.

- Market Conditions: Bullish markets, characterized by rising asset prices, elevate the probability of assignment for call options, while bearish markets, marked by falling asset prices, increase the likelihood of assignment for put options.

- Option Type: Long options (buyers) typically have no assignment risk, whereas short options (sellers) are inherently exposed to this risk.

Managing Assignment Risk

While assignment risk is an intrinsic component of options trading, traders can employ various techniques to mitigate its potential impact:

- Vertical Spreads: Employing vertical spreads, wherein an option is bought and sold simultaneously at different strike prices, can reduce the overall risk of assignment.

- Protective Collar: This strategy involves purchasing a protective put option and selling a call option to limit potential losses.

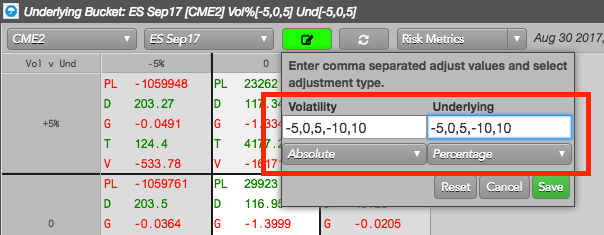

- Backtesting and Risk Simulation: Running simulations and conducting backtesting can help traders assess their strategies’ resilience against assignment risk in various market conditions.

- Closely Monitor Positions: Regular monitoring of option positions enables traders to make timely adjustments to their portfolio and manage assignment risk effectively.

Image: www.youtube.com

Frequently Asked Questions

Q: Can I avoid assignment risk entirely?

A: No, assignment risk is inherent to selling options contracts. However, employing prudent risk management strategies can minimize its impact.

Q: What happens if I’m assigned an option contract I don’t want?

A: You are obligated to fulfill the contract’s terms, which may involve buying or selling the underlying asset at the specified price.

Q: How can I determine the likelihood of assignment?

A: Consider factors such as time to expiration, strike price, market conditions, and option type to gauge the probability of assignment.

What Is Assignment Risk In Options Trading

Image: library.tradingtechnologies.com

Conclusion

Assignment risk is an integral aspect of options trading, posing both opportunities and risks to traders. By comprehending the nature of assignment risk, its influencing factors, and the available risk management techniques, traders can navigate the complexities of options trading with greater confidence. Embracing a proactive approach to risk management empowers traders to harness the potential rewards of options trading while mitigating the potential pitfalls.

We encourage you to delve deeper into the world of options trading and explore the wealth of resources available to expand your knowledge. Remember, a thorough understanding of the complexities of options trading, especially assignment risk, is essential for long-term success in this dynamic and rewarding arena.