In the fast-paced world of finance, the dynamic arena of options trading presents intriguing opportunities for savvy investors. As I embarked on my own journey into this realm, I discovered the intricacies of assignment options trading, a strategy that allows traders to delve deeper into the market’s fluctuations.

Image: www.borntosell.com

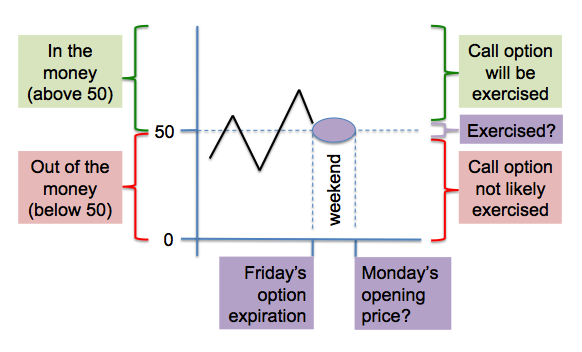

Assignment options trading empowers investors with the ability to acquire or sell the underlying asset of an options contract at a predetermined price upon its expiration date. Unlike standard options, which confer the option to execute the contract, assignment options obligate the holder to follow through with the trade.

**The Significance of Assignment Options Trading**

Assignment options trading adds an additional layer of complexity and potential profitability to the options market. It enables investors to capitalize on significant price movements by locking in a price that may be favorable at the time of expiration. By assuming the obligation of assignment, traders gain exposure to the underlying asset, which can amplify their potential gains.

However, it’s crucial to recognize that assignment options trading carries inherent risks. Traders must assess the volatility of the underlying asset and the market conditions carefully to minimize potential losses. Proper risk management strategies and a deep understanding of options dynamics are paramount for navigating this market successfully.

Definition and History

Assignment options trading involves obligating the buyer of a call option or the seller of a put option to buy or sell the underlying asset at the predetermined strike price. The history of assignment options trading dates back to the dawn of options contracts in the mid-19th century, serving as a fundamental market mechanism to facilitate asset transfers.

Scope and Nature

Assignment options trading encompasses a wide range of asset classes, including stocks, bonds, ETFs, and commodities. It enables investors to speculate on the future price movements of these assets and potentially generate substantial returns. Assignment options trading requires sophisticated market knowledge and an understanding of volatility, liquidity, and other market factors.

**Advantages and Disadvantages**

Advantages

- Potential for significant profit in favorable market conditions

- Ability to gain exposure to the underlying asset at a predetermined price

- Flexibility to buy or sell the asset at expiration with no additional premium

Disadvantages

- Higher risk due to the obligation of assignment

- Limited liquidity in certain markets, making it challenging to exit positions

- Potential for losses if the underlying asset price moves against the trader’s prediction

**Tips and Expert Advice**

Tips

- Conduct thorough research on the underlying asset and market conditions

- Use technical analysis and probability models to enhance decision-making

- Control risk by using stop-loss orders and managing position sizes.

Expert Advice

Assignment options trading requires patience and a comprehensive understanding of market dynamics. By utilizing sound risk management strategies and leveraging market insights, traders can navigate this market successfully and unlock its profit potential.

Image: aeromir.com

**FAQ**

Q: What are the key differences between assignment and standard options?

A: Standard options give the holder the right to buy or sell the underlying asset, while assignment options obligate the holder to do so.

Q: What are some potential risks associated with assignment options trading?

A: Risks include adverse price movements, low liquidity, and the obligation to acquire or sell the underlying asset.

Q: Can assignment options trading be profitable?

A: Yes, assignment options trading offers the potential for significant profits but requires careful analysis and risk management.

Assignment Options Trading

**Conclusion**

Assignment options trading presents an intriguing avenue for experienced traders seeking to amplify their returns. By mastering the intricacies of this market, investors can capitalize on the potential for substantial gains while managing inherent risks. Whether you are a seasoned trader or just getting started in the world of options, I encourage you to explore the world of assignment options trading with thoughtful consideration and due diligence.

For those fascinated by the dynamic interplay of market forces and seeking to delve deeper into the intricacies of assignment options trading, I would love to connect and share my experiences and insights.