Introduction

In the world of investing, options trading provides a versatile strategy for maximizing profits and mitigating risks. Fidelity, a leading financial services provider, offers a comprehensive options trading platform with competitive pricing. Understanding the pricing structure of Fidelity options trading is crucial for investors seeking to optimize their returns. In this article, we will delve into the various components of Fidelity options trading pricing, providing a comprehensive guide for informed decision-making.

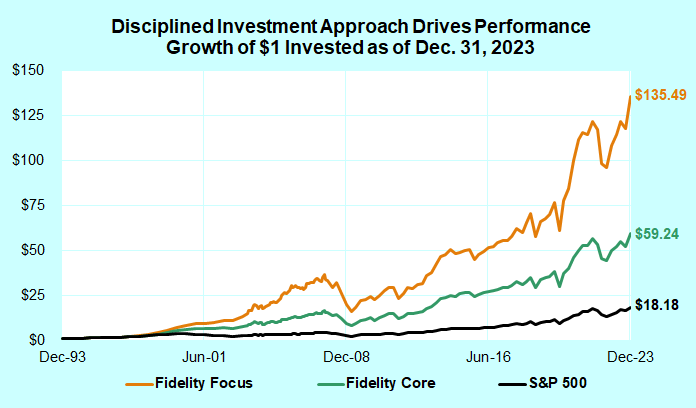

Image: www.alphaprofit.com

Understanding Fidelity Options Trading Pricing

Fidelity options trading pricing consists of two main components: commissions and option premiums. Commissions are the fees charged by Fidelity for executing trades on your behalf, while option premiums represent the cost of purchasing or selling an options contract.

Commissions:

Fidelity offers tiered pricing for its options trading commissions, based on trading volume. The higher your trading volume, the lower your commissions become. For individual investors trading less than 50 contracts per month, the base commission rate is $0.65 per contract. For more active traders, the commission rates can be negotiated directly with Fidelity.

Option Premiums:

Option premiums are determined by various factors, including the underlying asset, strike price, expiration date, and market volatility. The closer an option is to expiring ITM, the higher its premium will typically be. Conversely, options that are further OTM will have lower premiums.

Breaking Down Option Premiums

Underlying Asset: The price of the underlying asset directly affects the premium of an options contract. The more valuable the underlying asset, the higher the premium.

Strike Price: The strike price represents the price at which the option contract can be exercised. Options with strike prices close to the current market price of the underlying asset will have higher premiums than options with strike prices far from the current market price.

Expiration Date: The time until the option contract expires also influences its premium. Options with longer expirations typically have higher premiums than options with shorter expirations.

Volatility: Market volatility measures the extent to which the price of an asset fluctuates. Higher volatility leads to higher option premiums since there is a greater chance that the option will end up ITM.

Fidelity’s Competitive Pricing

Compared to other options trading platforms, Fidelity offers competitive pricing and several advantages for investors. Some of these advantages include:

Tiered Commission Structure: Fidelity’s tiered commission structure allows active traders to benefit from reduced fees, making it a cost-effective option for frequent traders.

Proprietary Pricing Model: Fidelity’s proprietary pricing model ensures that options prices are competitive and reflective of market conditions.

Image: www.stockbrokers.com

Fidelity Option Trading Pricing

Image: joaphiadicasenoldesemev.blogspot.com

Conclusion

Understanding the pricing structure of Fidelity options trading is essential for investors to make informed decisions and maximize their trading returns. Fidelity’s flexible pricing options, coupled with its competitive fees and proprietary pricing model, make it a compelling choice for both individual and active traders. By leveraging this knowledge, investors can optimize their options trading strategies, mitigate risks, and achieve their financial goals.