Understanding the Fidelity Trading Cost Structure

Navigating the world of investing requires a deep understanding of the fees associated with various trading platforms. Fidelity Investments is a prominent brokerage firm that offers a range of investment options, and its trading fees play a crucial role in determining the cost-effectiveness of investing with them. This article delves into the intricacies of Fidelity’s trading fees, guiding investors towards informed decisions that maximize their returns. Fidelity’s fee structure is designed to balance the costs of executing trades while providing competitive rates to its clients.

Image: www.forexfees.com

Key Considerations for Fidelity Trading Fees

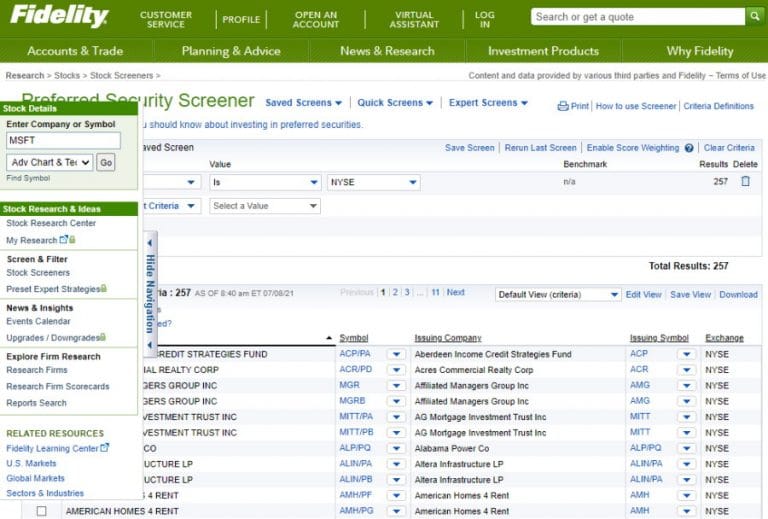

Fidelity offers various account types, each with tailored fee schedules. The type of account you choose, the frequency of your trading activity, and the assets you trade will all impact your trading costs. Some accounts charge a flat fee per trade, while others implement a commission-based structure. Here’s a breakdown of key fee components to be aware of:

-

Trade Commissions: Fidelity charges a commission for each trade you make, which can vary depending on the account type and asset class being traded. For example, the standard commission for stock trades is set at $0.0045 per share, with a minimum of $0.01 and a maximum of $0.0055.

-

Account Maintenance Fees: Certain account types at Fidelity may incur an account maintenance fee if the balance falls below a specified threshold or if there is a lack of trading activity. These fees can range from $0 to $100 per month, depending on the specific account.

-

Data and News Charges: Fidelity offers a range of data and news services that provide traders with real-time information about the markets. These services come with subscription fees, and the cost can vary based on the level of coverage required.

-

Other Fees: Additional fees may apply for specific trading activities, such as options trading or margin trading. These fees can vary depending on the complexity of the trade and the underlying asset.

Assessing the Impact of Trading Fees on Investment Returns

The cumulative impact of trading fees can significantly affect your investment returns over time, particularly for active traders. A higher trading cost will erode your profits, while a lower cost will allow you to retain a greater portion of your gains. Contextualizing the trading fees against your expected profits is critical for evaluating the cost-effectiveness of a particular investment strategy.

Fidelity Trading Fee Structure: Advantages and Drawbacks

Fidelity’s trading fee structure offers both advantages and drawbacks. The comprehensive range of account types allows investors to choose the option that best suits their trading style and financial goals. For infrequent traders, accounts with no-transaction fees and low maintenance fees may be more cost-effective. However, active traders may prefer accounts with lower per-trade commissions.

One potential drawback of Fidelity’s fee structure is that it can be complex, with different pricing scenarios for various account types and asset classes. This complexity can make it difficult for investors to accurately calculate their total trading costs upfront. Additionally, some account types may have higher maintenance fees, which can become a significant expense if the account balance is low or the trading activity is limited.

Image: tradingplatforms.com

Minimizing Trading Fees for Optimal Returns

Investors seeking to minimize trading fees with Fidelity should consider the following strategies:

-

Choose the Right Account Type: Review the fee schedules for different account types and select the one that aligns best with your trading habits and investment goals.

-

Consolidate Trades: Instead of placing multiple small trades, consider grouping them into larger orders to reduce per-trade commissions.

-

Utilize No-Fee Trading Options: Fidelity offers commission-free trading for select ETFs and index funds. These options can help reduce trading costs for long-term investors who prefer passive investment strategies.

-

Negotiate Trading Fees: Active traders with substantial account balances may be able to negotiate lower trading fees with Fidelity.

Fidelity Trading Fees Options

Image: tradingplatforms.com

Conclusion: Informed Trading Decisions through Transparency and Cost Optimization

Understanding and optimizing trading fees are crucial for maximizing investment returns. Fidelity’s comprehensive trading fee structure provides flexibility and options for investors with varying trading styles. By carefully assessing the fee implications, investors can make informed decisions that minimize trading costs and maximize their financial success. Whether you’re a novice investor or a seasoned trader, Fidelity’s commitment to transparency and cost optimization empowers individuals to achieve their investment goals.