Embarking on the exhilarating journey of options trading, it’s paramount to comprehend the associated fees that shape the profitability of your endeavors. Fidelity Investments, a renowned brokerage firm, presents a transparent fee structure that influences the execution of your trades.

Image: www.tffn.net

In this exhaustive guide, we delve into the intricacies of Fidelity’s options trading charges, empowering you with the knowledge to optimize your investment strategies. Dive in and discover the cost dynamics that will guide your trading decisions.

Fidelity’s Base Options Trading Fees

Fidelity charges a base rate for each options contract traded:

- Standard Commission: $0.65 per contract (minimum $1.00)

This fee is applicable for all options trades, regardless of the underlying security or strategy employed. However, exceptions and discounts may apply based on account type and trading volume.

Account-Based Discount Tiers

Fidelity offers tiered pricing for active traders:

- Select (50+ trades/30 days): 40% discount

- Preferred (120+ trades/30 days): 50% discount

- Private Client Group (200+ trades/30 days): 60% discount

Traders who meet these volume thresholds can significantly reduce their per-contract commission.

Additional Fees to Consider

Beyond the base commission, Fidelity may impose additional fees for certain types of trades:

- Options Assignment Fee: $20 per assignment

- Exercise Fee: $0.15 per contract

- Early Exercise Penalty Fee: Varies based on the contract’s time to expiration

Understanding these ancillary expenses is crucial for planning your trading strategy and managing your overall costs.

Image: www.tffn.net

Leveraging Fidelity’s Fee Structure for Smart Trading

By aligning your trading practices with Fidelity’s fee structure, you can maximize your profitability:

- Maximize Volume Discounts: Active traders should strive to meet higher volume thresholds to qualify for significant commission reductions.

- Bundle Options Trades: Combining multiple options trades into a single order can save on per-contract fees.

- Consider No-Load Options Funds: These funds provide a cost-effective way to access options strategies without individual contract commissions.

Expert Advice for Optimizing Costs

Seasoned traders recommend the following strategies to minimize options trading expenses:

- Negotiate with the Brokerage: High-volume traders can negotiate lower commission rates with Fidelity.

- Use Limit Orders: Placing limit orders instead of market orders can reduce slippage and potential additional costs.

- Monitor Account Activity: Keep track of your trading volume and fees to ensure you remain within the most advantageous tier or qualify for potential discounts.

FAQs on Fidelity Options Trading Costs

Q: What is the minimum commission I can pay per options contract?

A: $0.65 (minimum $1.00).

Q: Can I get discounts on options trading fees?

A: Yes, through account-based discount tiers and negotiated rates.

Q: How can I reduce my overall options trading costs?

A: Maximize volume discounts, bundle trades, use no-load options funds, negotiate with the brokerage, and monitor your account activity.

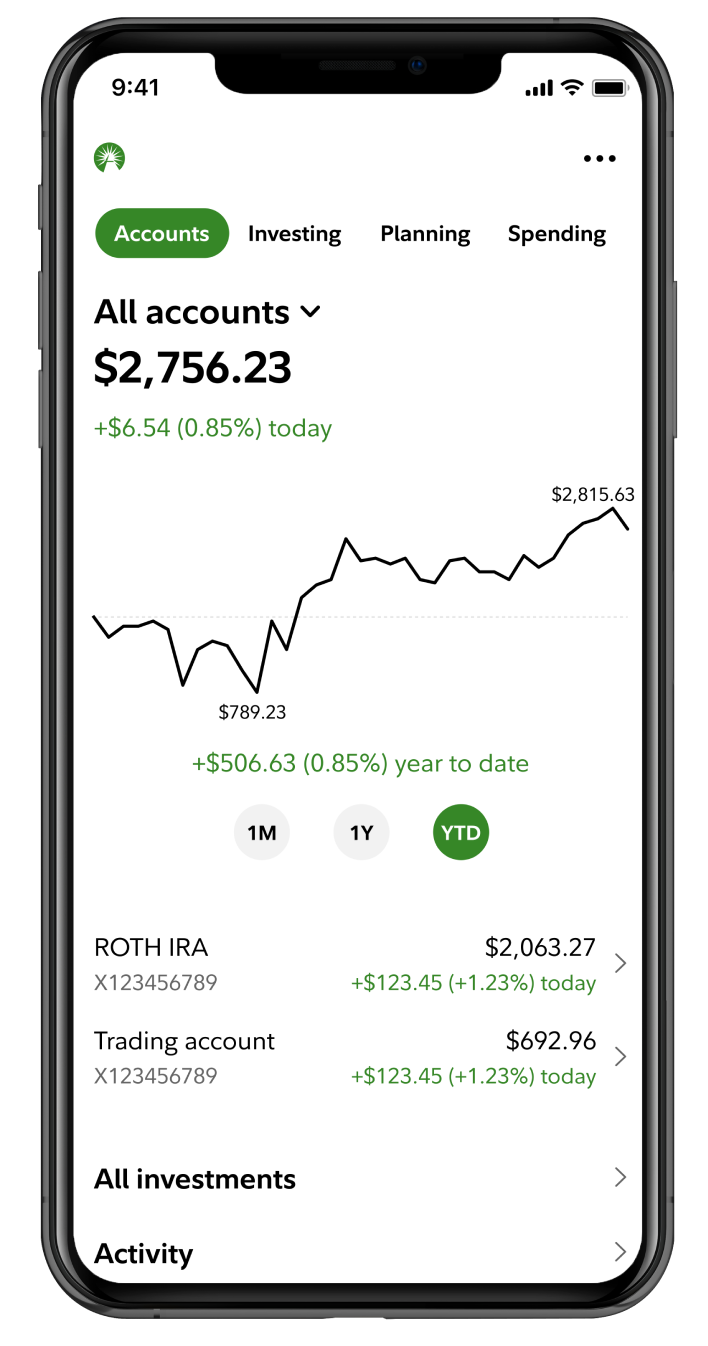

How Much Does Fidelity Charge For Options Trading

Image: www.fidelity.com

Conclusion

Mastering the nuances of Fidelity’s options trading charges is paramount for profitable ventures. By comprehending the base fees, account-based discounts, and additional costs, you can optimize your trading strategies and minimize expenses. Embrace the expert tips and leverage Fidelity’s pricing structure to maximize your success in the dynamic world of options trading.

Are you intrigued by the world of options trading and eager to refine your knowledge further? Explore other resources, consult with financial advisors, and continue to educate yourself to become a proficient and informed investor.