Introduction

Options trading, a powerful investment strategy, enables traders to enhance their portfolios with calculated risks. Fidelity, renowned for its comprehensive financial services, provides a platform for options trading. However, understanding the associated costs is essential for informed decision-making.

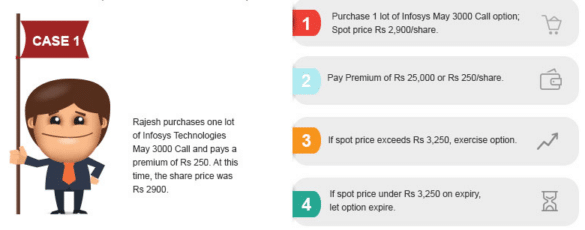

Image: arunkearns.blogspot.com

This article aims to provide a comprehensive overview of Fidelity’s options trading costs, unraveling their complexities and guiding you towards successful trading.

Fidelity Options Commissions

Commission Structure

Fidelity employs a tiered commission structure based on trade volume. The following table summarizes the per-contract commissions:

| Trading Volume | Commission Per Contract |

|---|---|

| 0-999 | $0.65 |

| 1,000-9,999 | $0.55 |

| 10,000+ | $0.45 |

Note that these commissions apply to both stock options and index options.

Additional Fees

- Exchange Fees: Fidelity does not charge exchange fees for options trades. However, exchanges may impose their own fees, which are typically included in the trade execution price.

- SEC Fees: A $0.000054 per-contract fee is charged by the SEC for all option trades.

- Regulatory Transaction Fee (RTF): A $0.000079 per-contract fee is charged by FINRA for all option trades.

- Order Entry Fee: Fidelity waives the order entry fee for trades executed online or via automated services.

Image: investgrail.com

Margin Fees

When trading options on margin, traders borrow funds from Fidelity to increase their buying power. Margin fees are charged based on the borrowed amount and duration.

Fidelity’s margin rates vary depending on the following factors:

- Account Type: Margin rates are typically lower for Individual Accounts and higher for Business Accounts.

- Account Balance: Margin rates decrease as account balances increase.

- Loan-to-Value Ratio: Margin rates are higher for higher loan-to-value ratios, which measure the proportion of borrowed funds relative to account value.

Account Minimums and Other Considerations

- Account Minimum: There is no minimum balance requirement for opening an options trading account with Fidelity.

- Trading Platform: Fidelity offers both a web-based and a downloadable trading platform. The platform you choose may affect your trading costs, as some platforms offer additional features such as real-time data feeds and advanced charting tools, which can require additional fees.

- Market Volatility: Options prices can fluctuate significantly during periods of market volatility. This can impact trading costs, as traders may need to adjust their strategies or pay higher premiums to secure desired positions.

Tips for Minimizing Options Trading Costs

To minimize your options trading costs, consider these tips:

Maximize Trading Volume: By increasing your trading volume, you can qualify for lower per-contract commissions under Fidelity’s tiered structure.

Utilize Limit Orders: Limit orders allow you to specify the maximum price you are willing to pay or receive for an option. This can help you avoid higher prices that may result from immediate market orders.

Seek Low Margin Rates: If you plan to trade options on margin, negotiate with Fidelity for lower margin rates based on your account balance and history.

Frequently Asked Questions about Fidelity Options Trading Costs

- Question: What is the minimum commission per option contract on Fidelity?

Answer: $0.65 for trades of 999 or fewer contracts.

- Question: Are there any additional fees besides commissions on Fidelity options trades?

Answer: Yes, there may be exchange fees, SEC fees, and Regulatory Transaction Fees.

- Question: How can I minimize my options trading costs with Fidelity?

Answer: By increasing trading volume, utilizing limit orders, and seeking low margin rates.

Fidelity Options Trading Cost

Image: www.warriortrading.com

Conclusion

Understanding Fidelity’s options trading costs is crucial for successful trading. By carefully considering the commission structure, additional fees, margin costs, and other factors, you can minimize expenses and maximize your returns. Remember, options trading involves risk, so consult with a financial advisor before making any investment decisions.

Are you interested in learning more about Fidelity options trading costs? Visit Fidelity’s website or contact their customer service team for additional information.