As an aspiring options trader, I once found myself perplexed by the intricacies of Fidelity option trading costs. Determined to unravel this mystery, I delved into extensive research and sought advice from seasoned experts. This article shares my hard-earned insights, empowering you with the knowledge needed to make informed trading decisions.

Image: www.stockbrokers.com

Understanding Fidelity Option Trading Fees

Fidelity offers a range of options trading services, each with its associated costs. These fees primarily consist of:

- Option Fee: A flat fee charged per contract, regardless of the contract’s value or expiration date.

<li><strong>Commission:</strong> A percentage-based fee incurred when buying or selling options contracts. Fidelity offers three commission structures: tiered, flat, and Tiered Plus.</li>Factors Influencing Option Trading Costs

Besides Fidelity’s fee structure, several factors influence option trading costs:

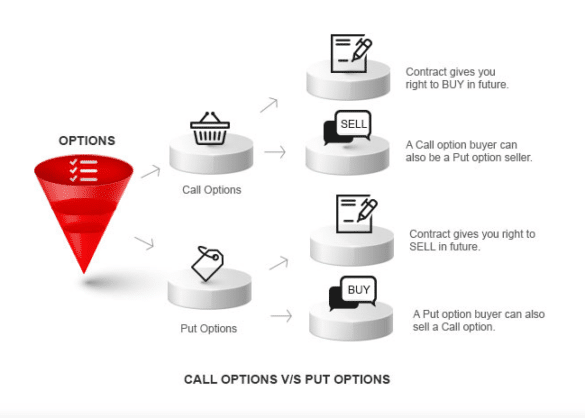

- Option Type: Equity options typically carry higher fees than index options due to their underlying risk.

<li><strong>Option Strike Price:</strong> Options closer to their strike prices tend to have higher fees due to increased volatility.</li>

<li><strong>Option Expiration Date:</strong> Options with shorter expirations usually have lower fees compared to those with longer expirations.</li>Minimizing Fidelity Option Trading Costs

To minimize trading costs, consider the following strategies:

- Maximize Contract Volume: Buying or selling multiple contracts in a single trade can reduce per-contract fees.

<li><strong>Consider Tiered Pricing:</strong> Fidelity's Tiered Pricing option offers lower commission rates for higher trading volumes.</li>

Image: www.fidelity.com

Expert Advice for Cost-Effective Trading

According to industry experts, here are additional tips for cost-effective options trading:

- Trade during Off-Peak Hours: Trading outside of peak market hours can lead to lower commissions.

<li><strong>Use Limit Orders:</strong> Placing limit orders instead of market orders can help control execution fees and avoid unfavorable pricing.</li>

<li><strong>Review Brokerage Fees:</strong> Compare fees offered by different brokerages to find the most cost-effective option for your trading needs.</li>FAQs on Fidelity Option Trading Costs

- Q: How do I calculate the total cost of an options trade?

<p><strong>A:</strong> Add the option fee to the commission, considering the number of contracts and the underlying value.</p> </li> <li><strong>Q: What is the difference between the Tiered and Tiered Plus commission structures?</strong> <p><strong>A:</strong> The Tiered Plus structure applies lower commissions to higher-priced trades, while the Tiered structure offers a single commission rate regardless of trade value.</p> </li>

Fidelity Option Trading Costs

Image: investgrail.com

Conclusion

Understanding option trading costs is crucial for making informed trades at Fidelity. By considering the fee structure, influencing factors, and cost-saving strategies, traders can effectively navigate the complexities and maximize their trading potential. Remember, the key lies in thorough research, expert advice, and continuous learning.

Are you eager to learn more about Fidelity option trading costs? Visit our dedicated resource hub today for in-depth information and valuable insights.