Have you ever wondered what it takes to navigate the complex world of commodity option trading? It’s a thrilling, yet demanding profession that requires an innate understanding of market dynamics, strategic thinking, and the courage to make bold decisions. If the thought of maneuvering the fluctuations of oil prices or betting on the future of soybean crops fuels your curiosity, read on to unravel the intricacies of commodity option trading jobs.

Image: fintrakk.com

Defining the Domain: Commodity Option Trading

Commodity options, in essence, are contracts that grant traders the right, but not the obligation, to buy (in the case of “call” options) or sell (in the case of “put” options) a specific quantity of a commodity at a predefined price within a specified time frame. These contracts provide traders with a flexible instrument to manage risk, hedge against portfolio losses, and potentially speculate on future price movements of commodities.

Delving into the Commodity Option Trading Ecosystem

The world of commodity option trading revolves around exchanges, brokers, and traders. Traders, the central players, analyze market trends, formulate trading strategies, and execute option contracts. Exchanges, such as the Chicago Mercantile Exchange (CME), provide a regulated platform where buyers and sellers converge to trade options. Brokers serve as intermediaries, facilitating trades between parties and offering advisory services.

Unveiling the Roles and Skills in Commodity Option Trading

Within the realm of commodity option trading, various roles offer distinct responsibilities and require specialized skills. Option traders, the core drivers of this profession, analyze market data, assess risk, and make trading decisions. They possess exceptional analytical abilities, a thorough understanding of financial markets, and the fortitude to manage high-stakes scenarios.

Commodity brokers, the intermediaries connecting traders to the market, provide personalized guidance and assistance. They leverage their market knowledge and trading experience to support traders in decision-making processes. To excel in this field, brokers must demonstrate excellent communication skills, a comprehensive understanding of option trading, and the ability to build strong relationships.

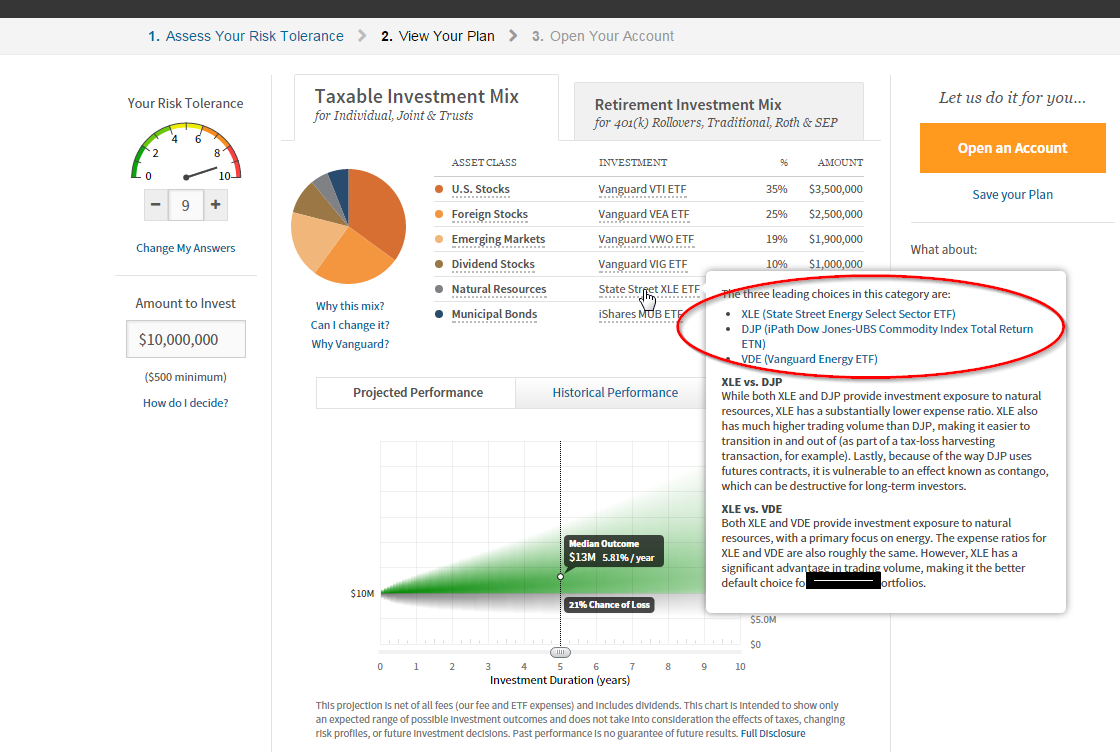

Image: blog.alphaarchitect.com

Deciphering the Variations of Commodity Option Trading

Commodity option trading encompasses different approaches, each with its unique nuances. Speculative trading involves buying and selling options with the primary goal of profiting from price fluctuations of the underlying commodity. Hedging, on the other hand, is a more defensive strategy employed by producers and consumers aiming to mitigate risk by offsetting the impact of unforeseen price shifts.

Navigating the Complexities of Commodity Option Trading

The intricacies of commodity option trading stem from the diverse factors influencing the underlying commodities, such as supply, demand, political dynamics, and weather conditions. Robust analytical abilities are crucial, as traders must continuously monitor market news, economic data, and geopolitical developments to discern the potential triggers of price fluctuations.

Advantages of Commodity Option Trading Jobs

For individuals driven by financial markets and enticed by high-stakes environments, commodity option trading jobs offer numerous advantages. High earning potential, intellectual stimulation, and the potential for significant portfolio growth make this profession particularly lucrative. The dynamic nature of the market provides constant challenges and rewards, fueling professional fulfillment and growth.

Challenges in Commodity Option Trading

Counterbalancing the allure of commodity option trading is a panorama of challenges that only the most resilient and agile professionals can conquer. High risk is an inevitable component of this realm, requiring traders to tread cautiously and manage their positions diligently. The ever-evolving nature of markets demands perpetual learning and adaptation, making stagnation an unaffordable luxury.

Commodity Option Trading Jobs

Image: www.careerharvest.com.au

Conclusion

Commodity option trading jobs present an exhilarating and demanding avenue for individuals who thrive in intellectually stimulating, high-stakes environments. While substantial rewards await those who navigate the complexities of this profession successfully, it is essential to acknowledge the inherent risks and the relentless demands of continuous learning and market vigilance. If you possess an unyielding desire to decipher the complexities of financial markets and the audacity to navigate its inherent risks, a career in commodity option trading may well be your ideal professional canvas.