Millions of investors are pursuing financial freedom through trading options, and one of the most exciting and versatile strategies involves call options. Whether you’re a seasoned trader or just starting to explore the world of options, understanding call options and how to utilize them effectively can open up a world of opportunities in the financial markets.

Image: www.onlinefinancialmarkets.com

What are Call Options?

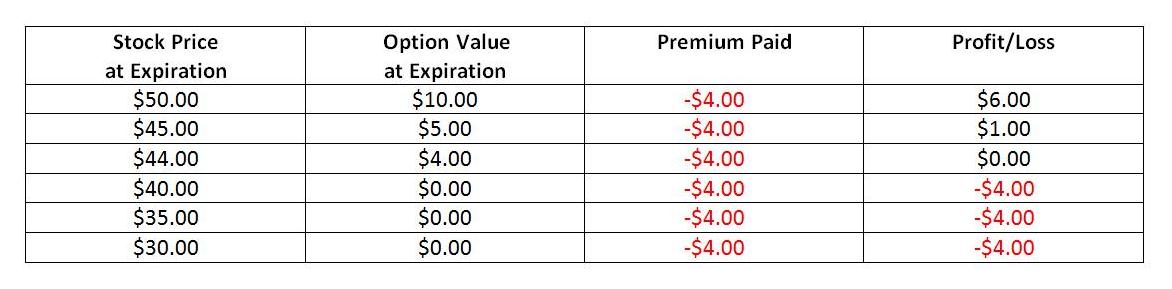

A call option is a derivative contract that gives the holder the right, but not the obligation, to buy an underlying asset at a specified price (the strike price) on or before a particular date (the expiration date). In other words, it’s like having a voucher that allows you to purchase an asset at a fixed price, regardless of its actual market value.

Why Call Options Matter

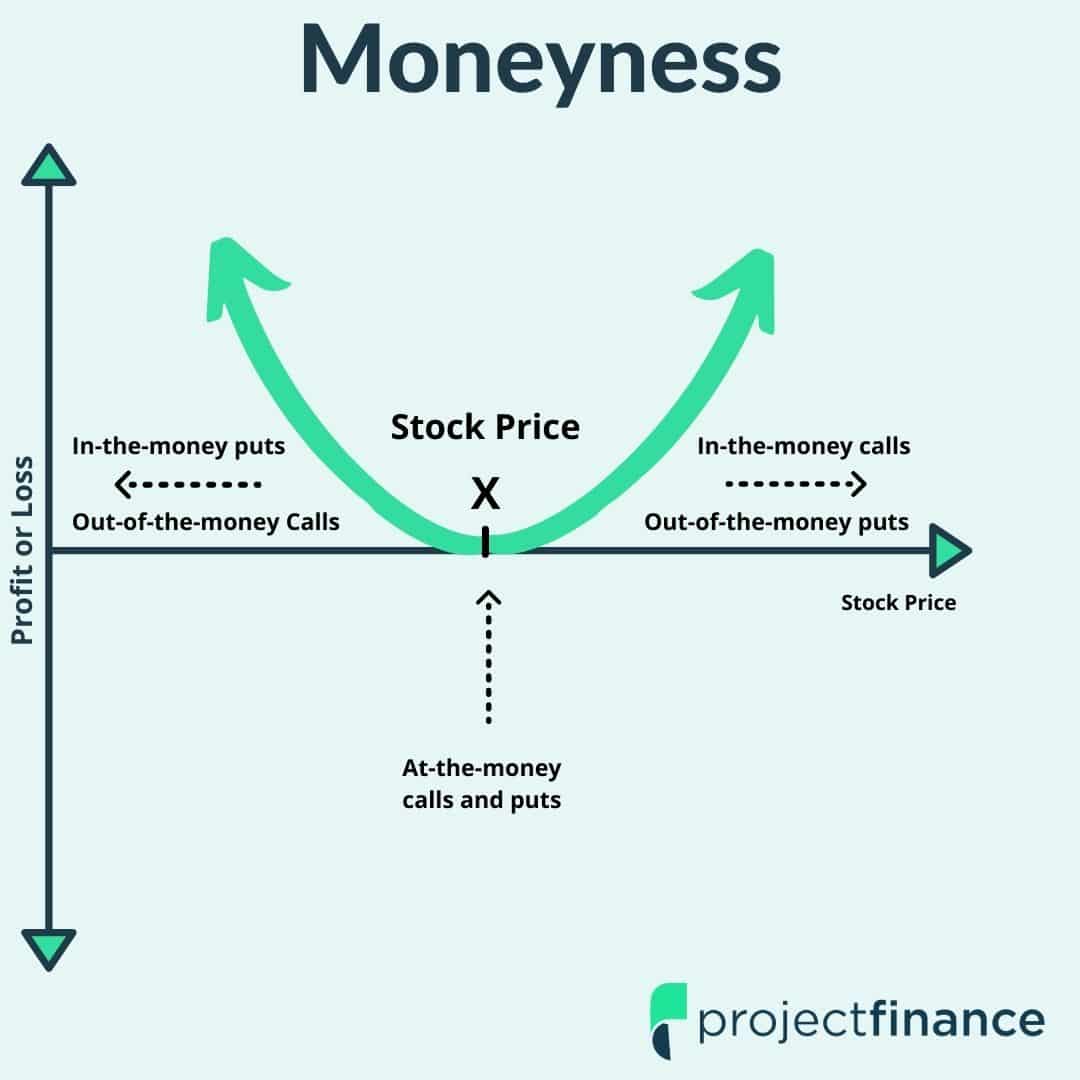

Call options provide traders with a powerful tool for profiting from rising asset prices. If the underlying asset increases in value above the strike price, the call option will appreciate in value, potentially yielding significant profits for the option holder. This makes call options ideal for investors who are bullish on a particular stock, commodity, or index.

Empowering Traders with Flexibility

The beauty of call options lies in their inherent flexibility. Traders can leverage various strategies to tailor their option positions to their risk appetite and investment goals. From simple buy-and-hold strategies to sophisticated multi-leg trades, the possibilities are endless. This empowers traders to customize their investment approaches and maximize their potential returns.

Image: www.projectfinance.com

Trading Call Options: A Step-by-Step Guide

To trade call options successfully, understanding the following key steps is crucial:

- Identify the Underlying Asset: Determine the asset you want to speculate on, whether it’s a stock, ETF, or commodity.

- Choose an Expiration Date: Decide the time frame within which you expect the underlying asset to appreciate in value.

- Select a Strike Price: Determine the price at which you would like to buy the underlying asset.

- Calculate the Premium: Determine the cost of purchasing the call option, known as the premium.

- Monitor the Position: Regularly track the performance of your option position and make adjustments as necessary.

Understanding the Risks

While call options offer significant upside potential, they also come with inherent risks. It’s essential to remember that just like any investment, there’s the potential for losses. Traders should carefully consider their risk tolerance and only invest an amount they are willing to lose.

Unveiling the Power of Call Options in Real-World Applications

Call options are widely used in various trading strategies, including:

- Bullish Bets: Buying a call option allows traders to profit from rising asset prices, providing a leveraged way to capitalize on market gains.

- Hedging Strategies: Call options can be used to hedge against potential losses in underlying assets, protecting investors from market downturns.

- Income Generation: Selling covered call options, a strategy involving selling call options while owning the underlying asset, can generate income while maintaining long-term exposure.

Trading Options Call

Image: corporatefinanceinstitute.com

Conclusion: Empowering Investors with Call Options

Trading call options unlocks a world of opportunities for investors seeking to profit from rising asset prices. By understanding the fundamentals of call options and embracing a disciplined trading approach, investors can harness the power of derivatives to enhance their investment returns. Whether you’re a novice trader or a seasoned investor, the versatile nature of call options empowers you to navigate the financial markets strategically and maximize your financial potential.