In the realm of financial markets, call options emerge as a fascinating instrument with the power to amplify your investment returns. This in-depth guide will delve into the captivating world of call options, empowering you with the knowledge and confidence to navigate this dynamic arena.

Image: tradewithmarketmoves.com

What Are Call Options?

A call option grants you the right, but not the obligation, to buy an underlying asset at a predetermined strike price on or before a specified expiration date. Think of it as a contract that gives you the option to purchase an asset at a specific price, even if the market value fluctuates wildly.

The Advantages of Call Options

Call options offer a myriad of advantages that make them an intriguing investment tool:

-

Leverage: Call options allow you to control a significant amount of the underlying asset with a relatively small investment. This leverage can magnify your potential returns.

-

Asymmetry: Unlike traditional stock purchases, call options reward you even if the underlying asset experiences a modest uptick. This asymmetry provides opportunities for profit even in volatile markets.

-

Hedging: Call options can serve as a risk management strategy. By purchasing call options on assets you already own, you can protect your portfolio from potential downturns.

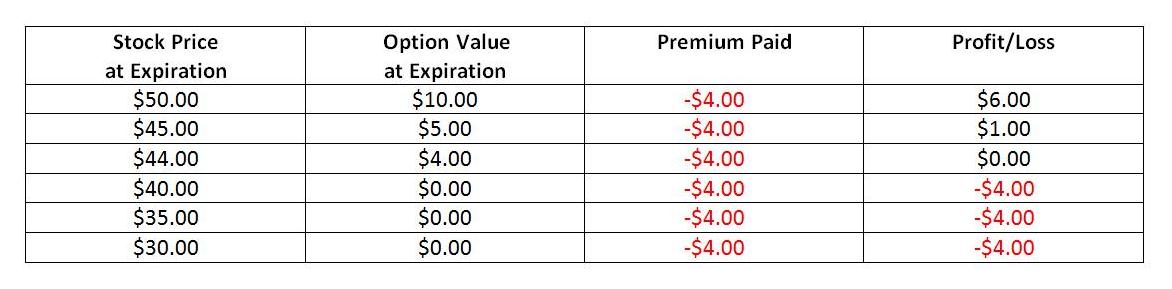

Understanding the Call Option’s Components

To master the art of call options trading, it’s essential to grasp the key components:

-

Strike Price: The predetermined price at which you can buy the underlying asset.

-

Expiration Date: The date on which the option contract expires. After this date, the option loses its value.

-

Premium: The price you pay to acquire the call option contract.

Image: www.youtube.com

Trading Call Options: Strategies and Tactics

Call options trading involves a range of strategies to optimize your returns. Some popular techniques include:

-

Covered Calls: Selling call options against underlying assets you own, generating income while limiting downside risk.

-

Buying Call Options: Acquiring call options with the anticipation that the underlying asset will appreciate in value.

-

Bull Call Spread: A combination of buying and selling call options with different strike prices to capture upside potential while limiting risk.

Call Options Trading Explained

Image: www.onlinefinancialmarkets.com

Expert Insights: Wisdom from the Masters

Seasoned traders and analysts emphasize the importance of:

-

Research and Due Diligence: Thoroughly studying the underlying asset, market trends, and option pricing models is crucial.

-

Risk Management: Understanding and managing your risk tolerance is paramount. Never invest more than you can afford to lose.

-

Discipline and Patience: Options trading requires patience and discipline. Avoid making impulsive trades and focus on long-term strategies.

In conclusion, call options trading presents a compelling opportunity to amplify your investment returns. By understanding the mechanics, advantages, and strategies involved, you can harness the power of call options to maximize your financial potential. Remember, as with any investment, thoroughly research and manage your risks, and always seek guidance from qualified professionals if needed.